5 – Project experience

The NPD has held a number of meetings since 2014 with development operators. These sessions report on progress and cost trends as well as challenges, and how these are being tackled.

Lessons learnt and experience gained are summarised and applied in the NPD’s early-phase follow-up of projects to help licensees take account of important factors for achieving good execution.

Another key purpose is to share experience with the industry. This chapter therefore covers important experience and lessons from the developments. These are primarily based on meetings held by the NPD in 2014-19, but other studies dealing with the subject have also been referenced.

This chapter is divided into different topics which discuss and provide examples of experience and learning considered by the NPD to be important for successful project execution. However, the specific project examples in the chapter do not provide a complete explanation of why a project has been successful or less so. The PSA published a detailed review in 2019 covering three of the developments in the period covered by this report /5/

5.1 Detailed planning before the PDO

The planning phase precedes the investment decision and submission of the PDO. See figure 1. In the NPD’s 2013 report, several of the projects reviewed were found to have major deficiencies in this phase. Several were characterised right from the start by a much too ambitious execution plan.

Little time was thereby also allocated to early-phase work. Experience shows that projects which fall short in this area need to make extensive changes during the construction phase and to repeat work. The result is then often overruns and delays.

Various development concepts are matured up to the BOV, when the licensees choose one of them and decide whether to continue pursuing the project. Making integrated and detailed assessments and taking the right choices in the preceding phase reduce the risk of post-BOV changes. This assumes that the decision basis is sufficiently matured and that good cross-disciplinary interaction prevails in the project team so that concept changes are avoided at a late stage.

The concept should permit action to be taken if the sub-surface proves to differ from earlier assumptions – altering well locations, for example. Should many issues remain unclarified at the BOV, sticking to the plan may prove very resource-intensive and this could have consequences for project execution. The licensees should consider whether it might be better to postpone a BOV until basic uncertainties are clarified.

During the post-BOV phase, the chosen concept is matured to an investment decision and PDO. Sufficient time should be allowed for studies to ensure good-quality documentation for the execution phase. A good rule is to try as far as possible to avoid introducing significant changes in the concept after the BOV. If alterations have to be made, enough time must be allocated for maturing these to the right level before the project is sanctioned.

Goliat is an example where the decision base was inadequately matured at both BOV and PDO /5/. Experience from Martin Linge is rather similar.

The NPD finds that many projects developed in recent years or still in progress highlight good planning as the reason why execution has gone well. Operators report that they handle surprises effectively during the execution phase because of the preparation made at an early stage.

As described in section 3.2, greater attention is being paid to an early choice of concept. If this helps the operator to allow more time for maturing the chosen solution, it could improve the quality of the decision basis. However, a balance needs to be struck between making an early choice and maturing the alternatives sufficiently to ensure a good selection.

Project organisations appear to have learnt the lessons from a period with many examples of cost overruns. In addition, market changes have influenced the way companies plan their projects. Levels of activity and prices were high up to 2014. The oil price slump caused licensees to devote more attention to costs and cost efficiency – projects also had to be profitable at low oil prices. Certain licensee groupsdecided during this period to devote more time to planning to ensure profitability under the new conditions. The extra time was used to mature the project further and to make improvements before the execution phase.

Developments sanctioned since oil prices fell have often benefitted from greater availability of capacity at suppliers and higher priority at construction sites. Should the downturn lead todownsizing by suppliers, however, the consequences could be negative for capacity as well as for HSE and quality. In some cases, a risk has also existed that suppliers could go into liquidation.

Dvalin and Oda are two subsea developments where the operators have emphasised good planning as the reason why project execution has gone well.

Based on input from Equinor and Total:

Martin Linge

The development concept for Martin Linge is a fixed facility with processing and oil transfer to a floating storage and offloading (FSO) unit. The gas is exported to the St Fergus terminal. Wells are drilled by a separate jack-up rig, and power is supplied from shore.

Project status

Total was operator for project planning and development until its interests and the operatorship were transferred to Equinor in 2018. The latter now holds 70 per cent, while Petoro has 30 per cent.

In Proposition 1 S (2019-2020), Equinor reported that the cost estimate has risen by almost NOK 26 billion or 85 per cent since the PDO to NOK 56 billion. Production is now expected to start in the third quarter of 2020, compared with the PDO estimate of December 2016.

Project experience

The authorities were informed in October 2011 that the licensees had passed the BOV milestone, with the PDO submitted in January 2012.

Feed work had not been completed at the PDO. The concept of power from shore was introduced in 2011 and identified as an execution risk in the PDO, since design changes came late and the solution had not been studied in detail. Another risk was the weight of the process module in relation to the capacity of the crane vessels available at the time.

The jacket contract was awarded immediately after PDO submission. Contracts for the FSO, topsides andsubsea equipment/flowlines were placed in early 2013. According to the 2014 national budget (based on reporting to the MPE in August 2013), the investment estimate had risen by NOK 3.4 billion because of higher costs in a tight market, the subsea installations, more extensive engineering, a bigger project organisation than originally planned and power from shore.

When the PDO was submitted, plans called for the topsides to be installed as three modules – the quarters and utilities, the well and process module, and the flare boom. The quarters and utilities were built separately with the intention of hooking these up and testing the systems before offshore installation in a single lift. Estimates for the maximum permitted lifting capacity were reduced post-PDO.

Combined with a weight increase, this contributed to a conclusion that quarters and utilities had to be installed separately. It was then discovered in 2012 that the process module exceeded lifting capacity and had to be split into a further module, which was connected to the flare boom. Topside structures also needed to be removed before lifting the modules.

These factors meant that integration work originally due to be done at the yard had to be carried out offshore. Weight challenges are therefore an important reason why hook-up and completion work offshore is taking significantly longer than with other developments.

Technip and Samsung Heavy Industries (SHI) were awarded a turnkey contract for the topsides, including transport to Norway and offshore hook-up/completion. Total also found, like many other operators, that the engineering hours needed were significantly above the estimate. Constructing the topsides in South Korea proved challenging, both because of engineering delays and because many competing projects at the yard made the resource position challenging.

The licensees decided to postpone the planned departure of the topside modules from the summer of 2016, initially by a year until the summer of 2017.

An audit of Martin Linge at SHI conducted by the PSA in March 2017 focused on technical safety, electrical facilities and maintenance management. Several breaches of the regulations were identified with the modules.

In addition to challenges caused by a big workload and quality shortcomings, construction work was temporarily halted by an accident at the yard on 1 May, when six people employed on the Martin Linge project died. Departure from SHI was postponed until the end of 2017.

The process and utility modules were positioned at the Rosenberg yard in Stavanger from March 2018 for inspection and verification before being taken offshore in July 2018.

Apply Leirvik was awarded the quarters contract as an SHI subcontractor. Lack of capacity meant that engineering and fabrication were moved from Stord to Apply Emtunga in Gothenburg. The quarters module was transported to Norway in 2018.

The FSO solution had not been determined in the PDO. Shipping company Knutsen was awarded the contract to convert tanker Hanne Knutsen for this role in Poland. The work was challenging and very delayed.

Delays related to the FSO and quarters never became critical for Martin Linge.

Photo: Equinor/Arne Wold/Bo B. Randulff

Offshore hook-up and completion, estimated in the PDO to last seven-eight months, could take about two years under current plans. The higher workload substantially increases the hours required.

This rise has occurred partly because the modules were incomplete when they left the Asian yard and because additional work has since been identified through systematic system reviews. Topsides design combined with weight challenges has also contributed to additional hours offshore by limiting opportunities for testing and hook-up on land. Efficiency on the field has also been lower than expected.

Based on input from Spirit Energy:

Oda

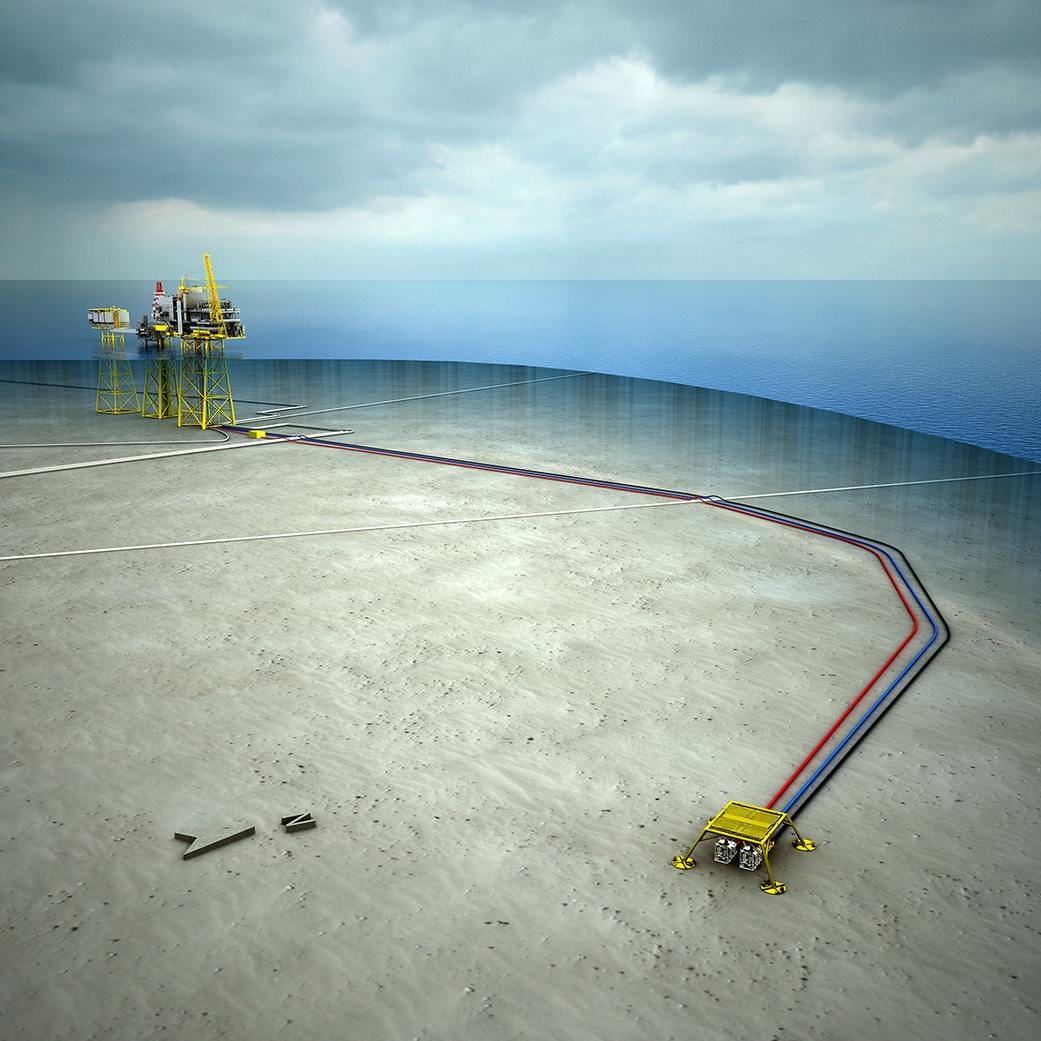

Oda is a subsea field in the North Sea comprising a seabed template with two production wells tied back to Ula and an injection well for pressure support. Spirit Energy (formerly Centrica) is the development operator. The PDO was approved in 2017.

This project is the operator’s first development on the NCS. Acquiring expertise and maturing through Feed have been important in the preparations. Spirit had meetings with other operators and industries in order to establish a best practice for project planning and execution. Alliances were entered into in 2015 with a few selected contractors.

This was prompted in part by a desire to involve the suppliers early in the planning phase, to give them greater ownership and involvement, and to ensure supplier continuity from Feed to detail engineering and construction. According to the operator, another consideration was that it would help its own organisation to be more easily adapted and scaled to the level of activity.

Low oil prices in 2016 meant that about six additional months were required before the Oda project was sanctioned internally and in the production licence. In addition to increased requirements for checking and maturity in the design work, all commercial agreements – such as tie-back to the Ula host platform – were to be in place before sanctioning. A high level of maturity in the Feed studies and using the same contractors from Feed to detail design meant no post-PDO changes were made.

The field came on stream in March 2019, five months ahead of schedule and NOK 500 million under the PDO cost estimate. Results from production drilling have shown that the reservoir is more complicated and less extensive than expected. This was a sensitivity in the PDO volumes. Reserves have been written down by 30 per cent. However, the Oda template has a spare well slot, and opportunities for increasing and/or accelerating reserves have been identified.

Illustration: Spirit Energy.

5.2 Project organisation with enough expertise, experience and capacity

Equinor is the largest development operator on the NCS and has pursued such activities for many years. The company has both large and small projects under way at any given time. It works actively to learn lessons from these developments and continues to refine working methods and governing documentation. The same applies to ConocoPhillips, which has had a portfolio of projects in the Ekofisk area over many years.

Other operators have pursued few NCS developments. In other words, companies making discoveries off Norway may have very different starting points when a project is to be planned and executed.

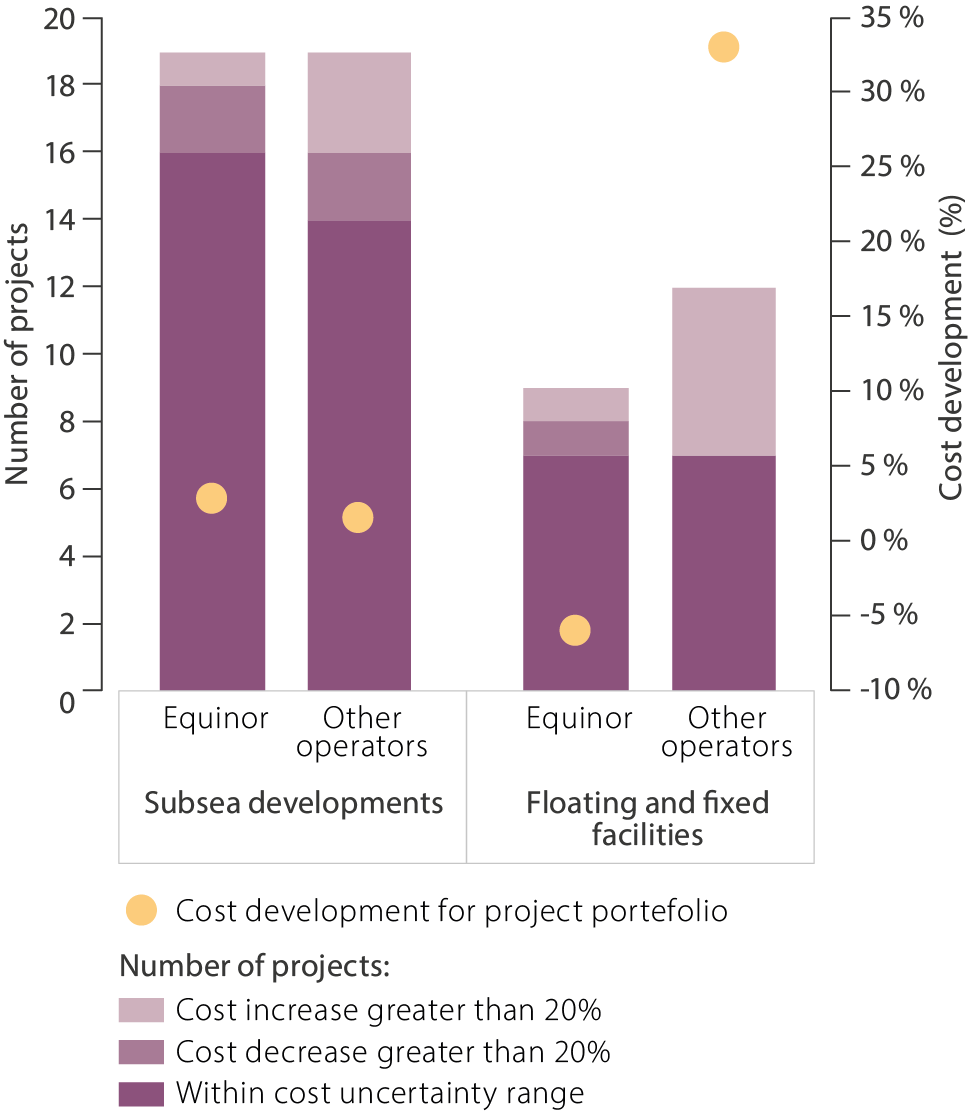

Figure 15 shows that Equinor has had few cost overruns on projects involving either subsea installations or fixed/floating facilities. Similarly, the remaining operators have been successful with subsea developments. Five of 12 projects based on fixed/floating facilities have ended up with overruns – Skarv, Goliat, Valhall Redevelopment, Martin Linge and Yme. Examples of projects without overruns are Ekofisk South, Eldfisk II, Edvard Grieg and Ivar Aasen.

Companies which have had few or no earlier developments must build up a project organisation, including possible governing documentation, while also pursuing planning work. Several of the project teams which the NPD has held meetings with emphasise the importance of inexperienced development operators building up an organisation with experienced project personnel. That applies particularly where a stand-alone field centre is involved. Such projects call for a big organisation with a number of disciplines, since they involve a number of interfaces requiring a large degree of involvement and management by the operator in both planning and execution phases.

When subsea developments have the same operator as the host facility, modification work on the latter is organised as an integrated part of the project. Where the operators are not the same, two project organisations are established with the operator of the host facility responsible for the necessary modifications.

Collaboration between two operators differs from relations between oil company and supplier. The operator developing the field has limited opportunities to manage the part of the work which lies on the host facility. This makes it important, when planning a project, for the players to establish good routines for interaction and exchanging information, so that a sound basis is created for planning, execution and operation. In the NPD’s view, this type of collaboration functions well on the NCS.

Figure 15 Projects and project results by operator (Equinor and “other”) and development concept (subsea installations or fixed/floating facilities).

In meetings with the NPD, several operators have emphasised the importance of good collaboration in the planning phase, independently of possible parallel commercial discussions. Some operators have found that collaboration has generally been more demanding before commercial agreements are in place than in the execution phase.

Based on input from Wintershall Dea:

Dvalin

Dvalin is a subsea development in the Norwegian Sea which comprises a seabed template with four gas producers tied back to the Heidrun platform. Gas is exported in a new pipeline to Polarled. The development operator at the PDO was DEA Norge, which merged in December 2019 with Wintershall Norge to form Wintershall Dea Norge.

This field represented DEA’s first development. It was important for the operator to prepare well for the execution phase. In the DEA case, this involved establishing necessary project management procedures and systems. Experience transfer from other operators formed an important part of these preparations.

Aker Solutions and IKM each performed Feed studies related to the subsea installations. A Dvalin PDO was postponed in 2014 because the project was not considered sufficiently profitable. It also took time for the operator to establish a tie-in agreement with the host facility. The PDO was submitted in 2016 and approved in 2017.

The operator utilised these two years to mature the project further and prepare for the execution phase. To create the best possible conditions for competitive tendering and the subsequent execution phase, the operator gave suppliers who had not conducted Feed the opportunity to acquaint themselves with the project.

Dvalin has a reservoir with high pressure and temperature. Only Aker Solutions was originally qualified to deliver subsea equipment for the higher temperature. The operator therefore used the two-year postponement to give FMC and OneSubsea the opportunity to qualify the necessary components. Tender evaluation was completed and the contract ready for signing at PDO submission. That helped to reduce uncertainty in the PDO cost estimates.

DEA emphasises that a close collaboration with the host facility is important for success. As Heidrun operator, Equinor contributed in the planning phase with quality assurance and suggestions on part of DEA’s work. Ahead of the investment decision, the parties established a collaboration procedure which defined areas for interaction and information flow between the projects.

Furthermore, DEA has been represented in the modification project which Equinor was responsible for. That helped to make DEA very familiar with the status of that part of the work.

The project is still in progress and on target to reach production start-up as planned in 2020.

Photo: Wintershall Dea/Screenstory

5.3 Including experience from project execution and operation in planning work

It is important that the project organisation understands lessons learned from other projects. That could relate, for example, to suppliers, project follow-up and contract strategies. Also important will be knowledge of Norwegian conditions and how these should be taken into account when establishing an execution strategy and timetable, when training personnel, when prequalifying and when evaluating contractor bids.

In meetings with the NPD, many operators have emphasised experience transfer from earlier and ongoing developments as an important part of project planning. That applies to both inexperienced and very experienced development operators. It seems to the NPD that licensees on the NCS are very willing to share experience. This represents an asset for Norway’s petroleum industry, and retaining it is important.

Devoting attention in an early phase to minimising offshore hook-up and testing is important. Solutions should be chosen and plans laid which permit as much testing and completion as possible to be done on land. Restrictions on personnel numbers (berths) are greater offshore and access is more difficult.

More work offshore as a result of faults and deficiencies which are not rectified before transfer to the field could also impose big extra costs and delays. The same applies if insufficient allowance has been made for possible weight increases during execution, so that modules originally intended for installation in a single lift have to be split up.

Operating experience should be incorporated in all stages of a project. During an early phase, it will be important to identify good operational and maintenance solutions. Establishing plans for delivering the facility in an appropriate way to the production organisation is important. Operations personnel must also participate in the project during completion and delivery in order to ensure an efficient hand-over, to become familiar with the facility, and to prepare for the production phase.

Where modification projects are concerned, input from the operations organisation on equipment experience and the condition of the facility is important in ensuring that the requirements for upgrading are adequately assessed and taken into account in the design. Inspections should be conducted where the condition is uncertain or unknown and to verify that the underlying drawings are updated. The scope of work in a number of modification projects has increased because the estimates failed to take sufficient account of the need to replace and update equipment.

5.4 Contract strategy tailored to expertise and capacity of operator and supplier

One of the recommendations in the NPD’s 2013 project report was the need for a clear contract strategy which helps to ensure quality and progress. The operator’s follow-up and prequalification of suppliers should be part of this strategy. Thorough supplier prequalification on the basis of earlier experience can reduce the risk of problems along the way and thereby the amount of follow-up required. The review showed that, in several cases, operators relied far too much on the ability of the contractor to deliver in line with the specified requirements.

The significance of ensuring continuity of main contractor(s) from Feed before the PDO to detail design afterwards has been highlighted by several development operators in meetings with the NPD. This helps to ensure that suppliers are familiar with the project when detail design starts and have ownership of the chosen solutions. If a supplier is changed, the schedule must provide time for the newcomer to become familiar with the project and have the opportunity to take ownership of earlier work. Changes will occur more often with a change of contractor, and time must be allowed to handle these.

To ensure continuity of suppliers and competition, operators have often opted for parallel Feed studies. One example is Fenja, a subsea development being tied back to the Njord facilities. The licensees chose parallel Feed studies for both subsea installations and pipelines. Fenja’s development concept involves building and installing a new type of heated pipeline.

The two suppliers could each offer their own variant of this concept, which both required technological qualification. Parallel studies increased the likelihood of success with such qualification while also securing competing tenders. Where the subsea installations were concerned, parallel Feed gave both suppliers good insight into the project and the best possible basis for a realistic bid.

Many parallel studies in each technical discipline increase costs, can be more demanding to follow up, and make big demands on expertise and capacity in the project organisation. Allocating time after the studies to ensure that sufficient quality has been achieved should be considered, particularly for large developments.

In the alliances which certain operators have established in recent years, the supplier is involved early in the planning phase. This form of contract ensures continuity from planning through execution. The operators report that they save time on competitive tendering processes as well as eliminating the risk associated with changing supplier along the way. The idea is also that interaction between the alliance partners over time can help to improve project planning and execution.

Many large developments have been pursued on the NCS since 2007. A lot of these have been awarded as turnkey contracts to yards in South Korea and Singapore. They are usually placed with a consortium comprising a European engineering contractor and a yard. The latter will historically have drawn most of its experience from building ships, which are less complex than offshore process platforms.

The work was made even more demanding by late delivery from the engineering contractor. In many cases, the operator also lacked sufficient understanding of the cultural and organisational differences between yards in this part of the world and familiar partners in Norway. These were underestimated when the licensees awarded contracts to Asian yards.

By allocating additional resources for follow-up, Equinor and Det Norske ensured that the topsides for Gina Krog and Ivar Aasen respectively were completed on schedule.

When choosing a construction site for Edvard Grieg, Lundin emphasised that the suppliers needed to have the right understanding of what was required and made its own estimates of how many hours would be needed to build the topsides.

The supplier whose estimate was in the same order of size as the operator’s was chosen, rather than the competitors who had tendered lower costs but with estimates for total work hours which the operator considered unrealistically low. According to Lundin, less follow-up was needed than would have been the case with an Asian yard. Since Edvard Grieg was sanctioned before several other large projects in a period characterised by a high level of activity, the company had greater freedom of choice over a yard than a number of other operators.

Turnkey assignments have been the most frequently used form of contract for building platforms on the NCS among the projects covered in this report. Equinor is the operator with the largest number of projects involving construction in Asia. Most have been EPC contracts. In recent years, contracts awarded to Norwegian suppliers have been EPCs, while those given to Asian yards have been for fabrication and construction (FC) with the EP parts going to a Norwegian supplier (see table 1 and the description of the Johan Sverdrup project).

A division into several contracts will make greater calls on the operator’s experience and resources. That could be demanding for an inexperienced project organisation. At the same time, experience shows that good interaction with and control of suppliers is also crucial when using turnkey contracts. These require close follow-up of progress and quality, a presence at the supplier, and being prepared to take control if a change of course is needed.

It is then important that satisfactory mechanisms for collaboration and control are established in the contract, rather than taking it for granted that the contractor will deliver in line with specifications and plans. When operators with limited project experience want to use turnkey contracts, selecting suppliers with a solid ability to implement such assignments will be important.

With Gjøa, the licensees agreed that Statoil would develop the discovery and Gaz de France Norge (GDF) would take over in the production phase. Similarly, the licensees for 7324/8-1 Wisting in production licence 537, where OMV is operator, recently agreed that Equinor would lead the development. As on Gjøa, OMV will take over the operatorship when the field comes on stream. This approach was used on the NCS in the 1980s, before Statoil acquired enough development expertise, and can also be a future model for demanding projects in production licences where the operator has limited development experience.

Contract formats vary significantly between subsea developments, from extensive splitting between different vendors to turnkey assignments. Operators with less development experience use the latter (EPC or EPCI), with possible alliance partners in addition. Equinor tailors its strategy to the individual project and has chosen both to award turnkey contracts and to utilise extensive separation of assignments.

Subsea developments are completed to a large extent within cost and schedule, and such projects appear to have opted for appropriate contract strategies based on the expertise of suppliers and operators.

Norwegian projects with contracts in South Korea

An MSc student at the University of Stavanger wrote a thesis on Managing the Efficiency of Foreign Engineering Contracts: a Study of a Norwegian and South Korean Project Interface /9/ in 2015.

This concluded that four principal factors add to challenges for Norwegian EPC projects in South Korea: cultural differences, industrial practices at the yard (shipbuilding), engineering design and quality control, and the EPC contract form.

Understanding the country’s culture is important, since it differs significantly from that in the west. Confucianism, a Chinese philosophical tradition, is strong. It influences the understanding of contracts, yard organisation, social relations, and communication both internally and with the client and suppliers.

The thesis noted that South Korean yards have traditionally concentrated on shipbuilding. They have also had many offshore projects, but mostly the fabrication of such structures as steel jackets for fixed facilities and hulls. When the 2008 financial crisis hit the shipyards, the big ones in particular wanted to take greater responsibility for large offshore projects. Transferring the Lean principle, which has helped the yards to achieve high shipbuilding productivity, to offshore production facilities is not entirely straightforward since these are more complex and largely custom-designed.

The yards achieve theirhigh productivity at the expense of flexibility. Handling change is challenging. Extensive use of contract labour represents another challenge. Although this helps the yards to be competitive, it gives them less control over resources and quality.

Cross-disciplinary engineering expertise, important for designing and building highly complex structures, is largely lacking at the yards. In addition, the thesis found that the Norsok standards and Norway’s performance-based regulations are difficult to understand, which means that users must have the experience and knowledge required to benefit from their advantages.

These considerations make it difficult for the yards to exercise turnkey responsibility in an EPC contract.

The thesis also found that, with shipbuilding, the yards normally secure contracts from a shipping company over a number of years. That helps to build longterm relations. Similarly, relationships are built up with sub-contractors. About 85 per cent of equipment and materials for shipbuilding are delivered by local suppliers. These share a common culture with the yard and an understanding of what is to be delivered and how.

Where offshore projects are concerned, the operator and the engineering contractor are in many cases new to the yard. A large part of the equipment and material will also be delivered by suppliers the yard is not used to collaborating with. In addition, Norwegian turnkey contracts are formulated differently from shipbuilding orders. This is highlighted as another challenge.

Based on input from Equinor:

Johan Sverdrup

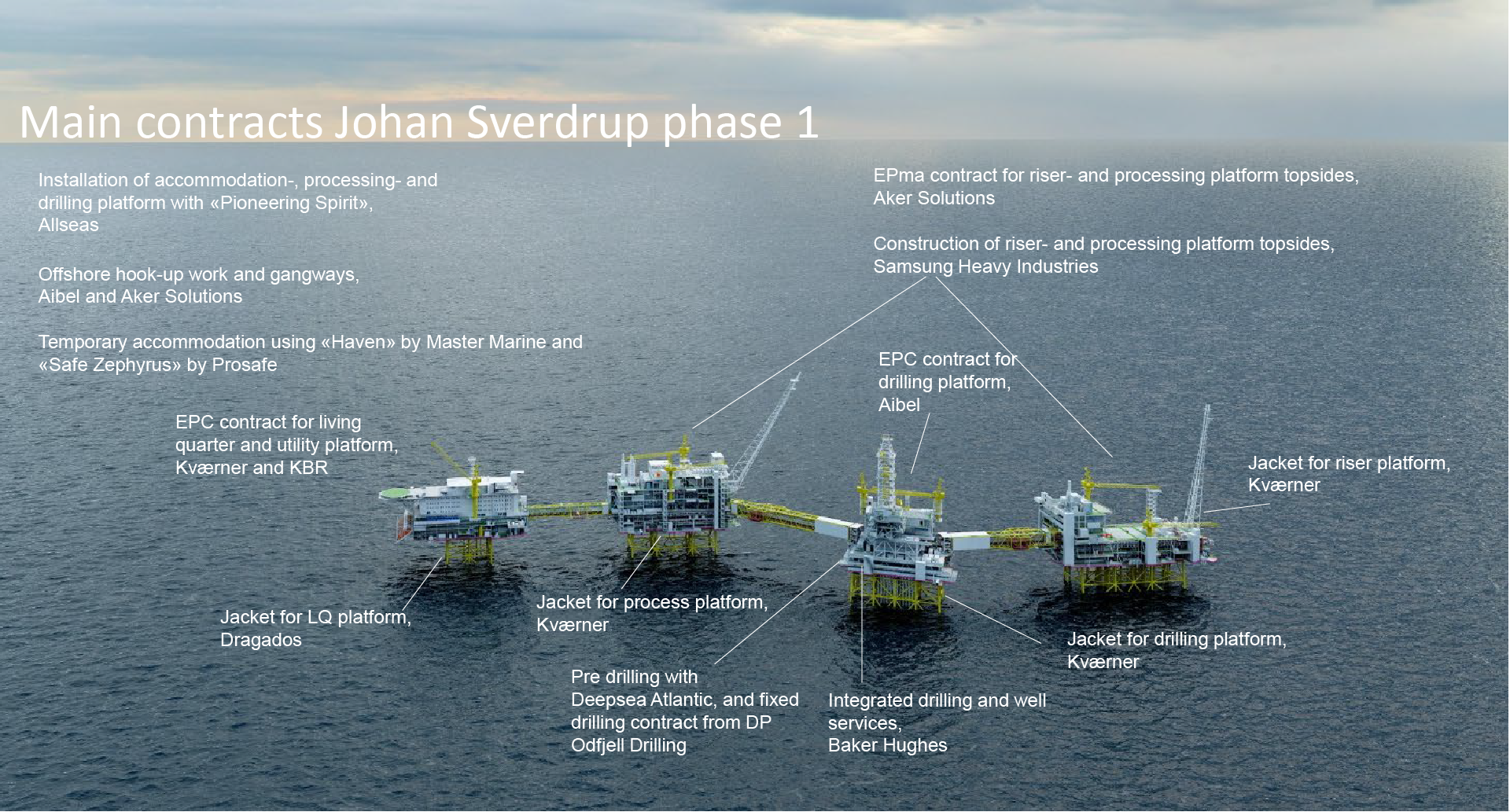

Phase 1 comprises four fixed platforms, for risers (RP), drilling (DP), processing (P1) and utilities and quarters (LQ) respectively. These have been designed and built with the aid of suppliers worldwide. Equinor is the operator, with Lundin, Aker BP, Total and Petoro as partners.

At the BOV, offshore installation was based on traditional crane vessels, which have a lifting capacity of roughly 10 000 tonnes. All the platforms were originally due to be built as several modules and installed by a crane vessel offshore. Pioneering Spirit, a new vessel with a lifting capacity up to 48 000 tonnes, was under construction and made topside installation as a single lift possible.

Feed studies of both modular and single-lift solutions were conducted in parallel. Midway through this process and before PDO submission, the decision was taken to adopt a single-lift strategy for the DP, P1 and LQ topsides (22 000, 26 000 and 18 000 tonnes respectively). This offered substantial savings in both workload and time for offshore hook-up and testing.

Equinor established a strategy for weight control of the platform topsides early in the planning phase to ensure that the modules were liftable. This included the establishment of margins for both operational weights and lifting capacity, which were followed up in Feed, the detail design phase and the construction contracts.

Equipment lists were followed up in detail and quality-assured through benchmarking and by securing experience from other projects. The steel jackets were also designed with robust weight margins, and strict change control was imposed from choice of concept/BOV.

Illustration: Equinor

Given the project size and market conditions, Equinor chose to tailor Johan Sverdrup contracts to the market by introducing a greater degree of separation compared with earlier developments. Where two of the platforms were concerned, the engineering contractor was given responsibility for engineering and procurement while construction went to Asian yards to take advantage of their spare capacity and experience from earlier projects.

In such a model, Equinor takes responsibility for handling the interface between engineering, equipment deliveries and fabrication, and influences execution in a managed way.

Aker Solutions carried out conceptual and Feed studies before receiving an EPMa contract covering detail design and procurement for the P1 and RP topsides, and an integrated responsibility for design and interface management covering overall construction. Building the P1 and RP topsides was awarded to Samsung Heavy Industries in South Korea under an FC contract.

Aibel secured an EPC contract for the DP topsides and carried out the engineering. The topsides comprise three modules. One was built at Aibel’s yard in Thailand, another in Haugesund and the third by Nymo in Grimstad. They were lifted by the Thialf crane ship onto a barge in the fjord outside Stord, and then hooked up on this vessel at the Aibel yard in Haugesund.

The LQ topsides were awarded as an EPC contract to a joint venture comprising Kværner and KBR. Engineering and procurement were handled by KBR’s London office. Construction took place in Poland and at Stord. Built in aluminium, the quarters were a fixed-price sub-delivery from Leirvik AS. The topsides were completed and tested at Stord before installation offshore.

Hook-up work for platforms and bridges on the field was awarded as two contracts to Aibel and Aker. Two parallel contracts were chosen in order to ensure sufficient capacity and flexibility in executing the complex work of completing the whole field centre. Testing both on land and offshore was planned and executed under Equinor’s leadership.

Three of the steel jackets were delivered by Kværner and built in Verdal, while the fourth came from Dragados in Spain. All were awarded as fixed-price EPC contracts.

Phase 2 of the Johan Sverdrup development comprises a new P2 processing platform, an equipment module for installation on RP, and integration work at the field centre. The following main contracts have been awarded for the project.

– Steel jacket for P2: EPC contract for Kværner Verda

– Topsides for P2: EPC contract for Aibel, with overall responsibility for engineering and interface control for phase 2 at the field centre. The main support frame will be built at Aibel’s Thai yard, the upper process modules at Haugesund and the HVDC module by sub-contractor Navantia in Spain. As in phase 1, the modules will be lifted together by a crane ship off Haugesund. Hook-up and testing will be done on a barge berthed in Haugesund before installation offshore as a single lift.

– RP utility module and integration work on the field: joint venture between Aker Solutions and Kværner responsible for engineering, procurement, construction and integration. A 5 000-tonne module will be built at Stord and installed offshore with a crane ship.

5.5 Good routines for quality assurance

Quality assurance is a significant part of early-phase work. Various forms of it are usually conducted during planning, and particularly at the project’s DGs. It is important that quality assurance is good enough to pick up possible deficiencies in the underlying material and that follow-up covers their rectification and, where necessary, revision of the plans to allow enough time for this work.

Day-to-day planning and execution of projects is done by the operator. At the same time, the see-toit duty requires the other licensees to help ensure good quality in the decision basis through participating in management committee meetings, sharing experience and project verifications, and conducting their own and external studies. See section 3.4.

A basic requirement for achieving the right project maturation is that the licensees have a goodinternal decision system which sets requirements for the level of engineering and cost estimation at the various DGs. One observation in the NPD’s 2013 review of the Yme project was that the operator had failed to implement such a solution.

Another key requirement is that the companies comply with governing documents and do not sanction projects which are insufficiently mature. Acona’s report /5/ concludes that the Goliat project failed to satisfy both Eni and Equinor’s requirements for project maturation at both BOV and BOG.

Estimating weights and work hours is important for large newbuild projects, and central to good cost estimating. The quality of estimates will generally improve as more detailed studies are conducted up to the PDO. Comparing the estimated figures with those from other projects (benchmarking) can provide increased assurance of their quality.

Equinor has a big project portfolio which can be used for benchmarking. The company also employs external consultants who have specialised in comparing projects.

Most development operators on the NCS have a relatively small project portfolio, and will therefore have few Norwegian projects to benchmark with. That makes it particularly important for these players to secure external benchmarking.

Many of these companies participate in the Performance Forum, a joint industry project (JIP) where the operators can benchmark their projects. The Forum for Exchange of Experience and Results from Modification Projects (Ferm) is a similar body, which Equinor, ConocoPhillips, Aker BP and Shell belong to.

When oil prices are experiencing big changes, the risk arises that experience data used for cost and planning estimates do not reflect market changes and improvement initiatives (such as drilling efficiency). Inviting tenders for important parts of a project pre-PDO could help to achieve greater assurance of estimate quality. The NPD understands that some companies have requirements in their governing documentation that bids for a

substantial proportion of the contracts must have been obtained by the investment DG.

As well as obtaining bids, awarding contracts can further improve the quality of cost and planning estimates. Contractual obligations cannot be entered into until a PDO is approved, unless the MPE consents. In order to receive such consent, the licensees must prove that the disadvantages of postponement are significant.

This consent does not represent any form of advance approval of the development plans, and the licensees act at their own risk. See the PDO/PIO guidelines for more information.

5.6 Continuous risk assessment, follow-up and implementation of measures during the execution phase

Project follow-up involves taking care of HSE, following up contractual aspects, ensuring good cost control and progress, managing and following up engineering and construction work, and handling procurement and quality assurance. The division of duties between operator and supplier can vary, and is regulated through the contract. Ultimate responsibility rests in any event with the operator on behalf of the licensees, who must make sure that the project is pursued in accordance with the regulations and approved plans.

Factors contributing to the operator’s success in executing the project include maintaining close follow-up from the start, identifying risk and adapting follow-up, as well as taking action if problem areas are identified.

Detail design is the first part of the execution phase, and involves preparing the final construction drawings. It is important that this stage has been completed before fabrication begins. Starting too early increases the risk of faults and of having to redo work.

The number of engineering hours has been underestimated in many large developments, resulting in a significant increase during detail design. That has created challenges related to the progress and quality of engineering and of equipment packages. This will be demanding in any project. In a meeting with the NPD, the operators have stated that Asian yards are efficient at construction when the drawings and equipment/materials are in place.

A high level of activity at yards with many simultaneous projects has contributed to further challenges. Resource shortages, combined with delays to equipment/drawings, made it difficult to stay on schedule. Operators had to fight to secure priority for their project, which was not beneficial for either costs or execution time. Incentive schemes which reward the supplier for progress have been attempted for many projects in a bid to secure resources for their contracts.

To avoid delays, many operators have posted more personnel than planned to the engineering companies and followed up equipment packages more closely through a presence at suppliers for the most critical deliveries.

Technical teams with experience of similar projects and Norsok expertise have been established for several developments to help the yards plan their work. Since taking decisions was demanding for the yards because of the challenges with design progress and quality, it has been important for operators to contribute to or manage this interface.

In meetings with the NPD, the operators have also emphasised that relationship-building at top management level is important in securing the necessary priority and communication with the yard. The NPD’s understanding is that it has been less demanding to build at yards where the operator is the only customer.

Plans may also have to be adjusted for some projects. Postponing departure from the yard could be relevant, for example. Since weather conditions mean that production facilities on the NCS must be installed in the summer season, a few weeks longer at the yard could mean delaying the start to production until the following season – roughly a year later. Postponements also impose additional costs related to contracts already awarded (crane ships, flotels, drilling rigs and transport vessels).

At the same time, efficiency offshore is significantly lower than on land. Completion work on the field should therefore be minimised to avoid increased costs, delays and the risk of HSE incidents.

When assessing whether plans should be amended, having a realistic picture of remaining work is therefore very important.

Acona writes that the Goliat facility was originally intended to spend time at a yard on the Norwegian coast for installation preparations. However, it was decided to go directly to the field. This decision was very likely to have been different if the project organisation had a better overview of outstanding work.

Close follow-up, on-going implementation of measures, assessing their effects and adjusting them along the way are important for any project. The scope of follow-up must naturally be tailored to the relevant development. Operators building at Asian yards, for example, have had from just over 100 to more than 300 of their own employees and contract personnel following up work there. When awarding fabrication contracts for big developments in Norway, experience from some projects indicates that fewer personnel have been necessary for follow-up.