7 – Future developments on the NCS

On the basis of the discovery portfolio and projects being planned on producing fields, this chapter looks at what kinds of developments might be seen in the years to come.

This will change in line with ongoing project maturation, exploration activity, oil price trends and technology advances, but nevertheless gives a picture of what types of projects and associated challenges and opportunities are in prospect on the NCS.

Experience described in this report and the NPD’s 2013 study will also be relevant for future projects. It is important that licensees make active use of this and other experience in the work of pursuing developments on the NCS.

7.1 Discoveries

At 31 December 2018, the licensees of 85 discoveries on the NCS had yet to submit a PDO /4/. Resources in this portfolio break down into 360 million scm of liquids (oil, natural gas liquids and condensate) and 300 billion scm of gas. The total investment required to develop all the discoveries is estimated at NOK 400 billion in 2018 value.

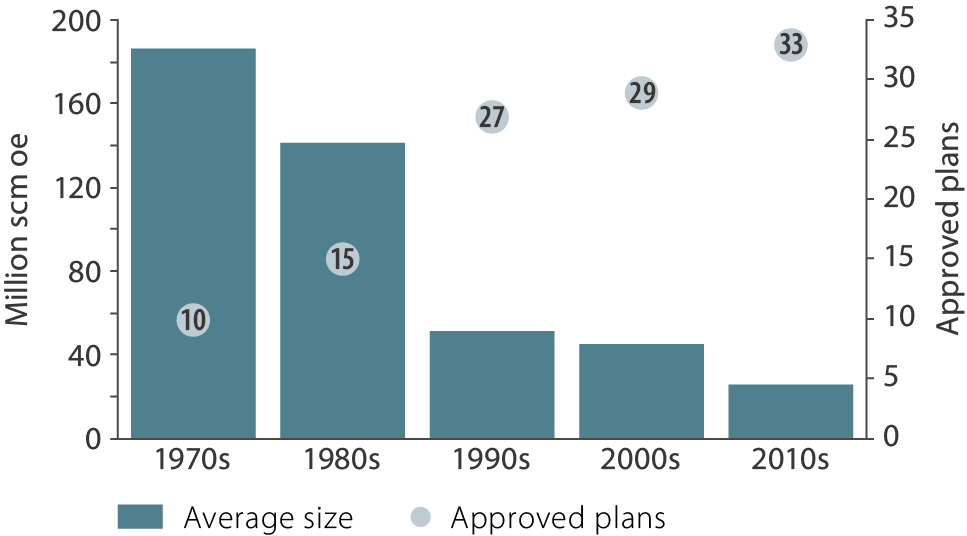

The number of discoveries in the portfolio at the end of 2018 was about the same as in 1999. However, their average size had declined from 20.8 to 7.8 million scm in recoverable oe over the same period. The biggest discoveries have been developed, while new ones are largely smaller than before.

Figure 16 Average size at first PDO and number of approved development plans /4/.

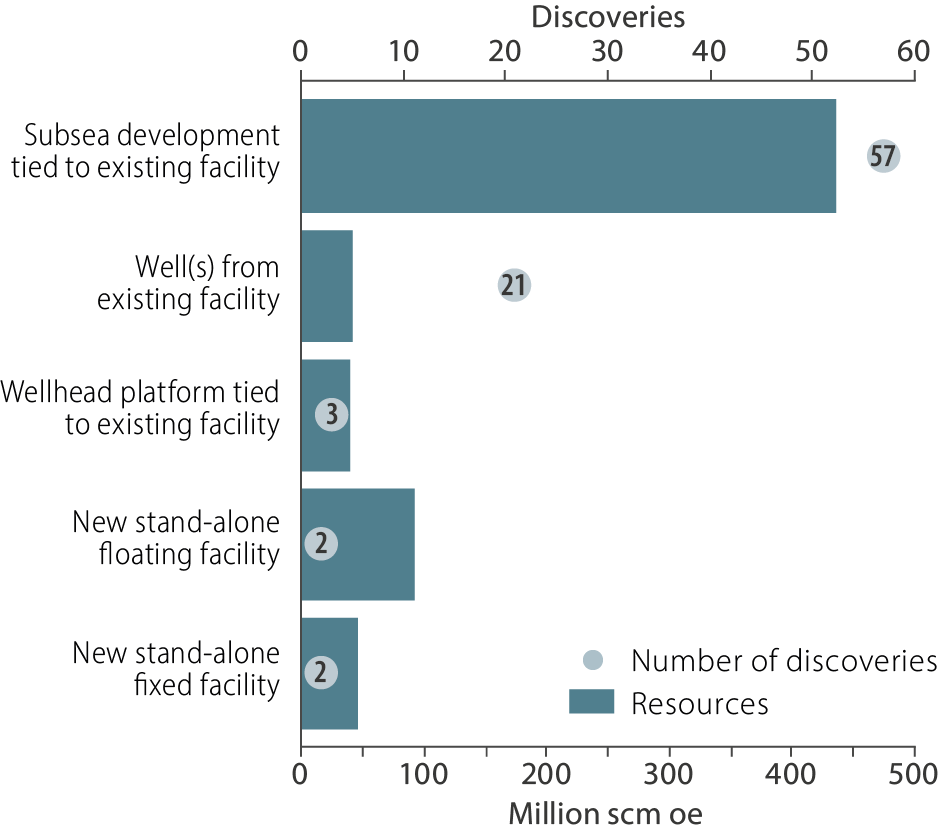

Phasing in to existing or future infrastructure makes it possible to exploit discoveries which are too small to be profitable as stand-alone developments. Under current plans, some 80 discoveries with about 500 million scm in recoverable oe could be developed in this way. See figure 17, which shows discoveries and resources in the portfolio by their most likely development concept.

Subsea facilities are relevant for a large majority of the discoveries, followed by wells drilled from existing facilities and wellhead platforms. Fixed facilities are being assessed in the North Sea for the area between Alvheim and Oseberg, and a floater in the Barents Sea on Wisting.

Experience from the NCS in 2007-18 is that subsea projects have almost always been implemented in accordance with the approved plans, regardless of the operator’s development experience.

About 75 per cent of the discoveries being considered for a tie-back have the same operator as the intended host facility. That will make it easier to understand the scope of work related to modification work on the latter, and provide greater incentives for the licensee group to come up with good solutions. This will also be positive in terms of coordinating the development with other activities on the facility.

Collaboration between the players to find good solutions is also important where different operators are involved. In such circumstances, dialogue and information flow between the two must be good. Technical assessments which form the basis for the execution phase should not be influenced by undeclared commercial considerations.

The review of reserve developments shows that, in many cases, the size of small fields has declined from the PDO estimate. This makes it important that the licensees have a good grasp of the resource base in order to reduce uncertainty. Flexibility in the development concept to deal with the uncertainty could have great value if the downside for resources materialises. A spare well slot on a subsea template, for example, could provide flexibility at a relatively low additional cost. Appraisal and data acquisition when drilling production wells – such as pilots – will also be important.

Figure 17 Discoveries and resources in the discovery portfolio by most likely development concept.

7.2 Fields

To maintain value creation on fields in operation, it is important that the licensees assess measures for improving the recovery of socio-economically profitable resources. Fields contain 85 per cent of remaining discovered petroleum resources on the NCS.

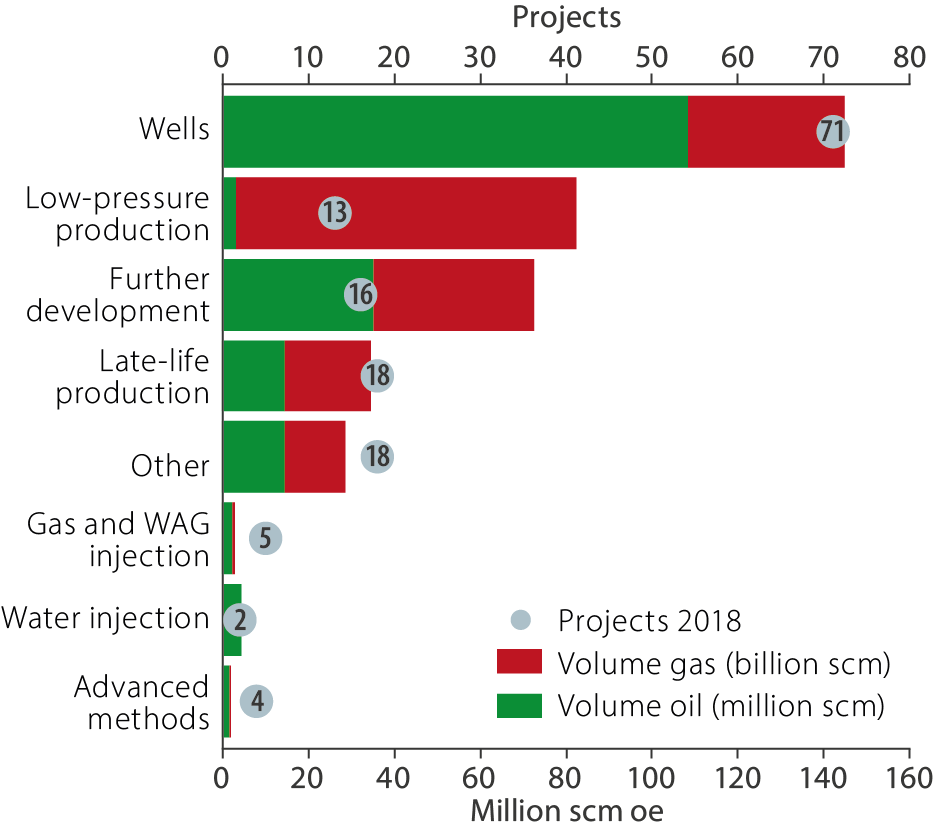

The companies reported about 150 specific projects for improving oil and gas production (resource classes 4 and 5) in 2018. In addition come possible but non-specific improved recovery measures (RC 7). A number of the projects on producing fields could involve the need to submit a PDO, as with many of the developments discussed earlier in this report. However, a lot will not require a PDO.

An overview of various types of specific but not sanctioned projects is presented in figure 18. Reported projects are dominated by new wells. Others which make a substantial contribution are further developments – particularly subsea projects – as well as improved recovery through low pressure production.

PDOs have been approved since 2013 for reopening two fields – Yme and Tor II (2019). At present, 10 projects reported to the NPD aim to recover additional resources from six abandoned fields.

Virtually all fields on the NCS produce for considerably longer than forecast in the PDO. Lower operating costs, improved recovery measures and a bigger resource base than expected extend producing life. Phasing into existing infrastructure is not only a precondition for developing today’s discovery portfolio but also an important contribution to extending the producing life of existing fields.

Maintaining good control of the condition of facilities and carrying out necessary maintenance and upgrades are important for safeguarding own production and regularity, and when planning tie-in projects with associated modifications to the facility.

A number of parallel activities are often under way on a field, limiting available berths. The licensees will aim to assign work which requires a production shutdown to planned maintenance turnarounds.

Good knowledge of a facility’s condition, updated drawings and good maintenance planning therefore represent important contributions to establishing a best-estimate decision base for modification projects.

A number of projects in recent years have assessed reuse rather than newbuilding. Njord Future involves upgrades and modifications to the Njord A production facility and the Njord B storage ship. Converting a tanker for storage instead of building a new vessel was chosen for both Gina Krog and Martin Linge. Experience from these projects is that modifications are demanding and pose the risk of surprises along the way.

Figure 18 Projects and estimated recoverable oil and gas volumes by project category.