3 – Undiscovered resources

The NPD’s estimate of undiscovered resources shows that large quantities of oil and gas remain to be found in all regions of the NCS.

At 3 910 million scm oe, the expectation volume represents almost half the remaining amount. About 40 per cent of the undiscovered resources lie in areas still not open for petroleum activities.

Resource estimate

The estimate for undiscovered resources is updated every other year, most recently by the end of 2019. The number of possible petroleum accumulations (prospects and leads) is an important factor in making this estimate. In recent years, mapped prospects and leads in the NPD’s database have risen sharply.

This increase is substantial in all parts of the NCS – the North, Norwegian and Barents Seas – and shows that new opportunities for future exploration are constantly being identified. Access to acreage, more and better data, and learning from exploration wells are probably important reasons for this.

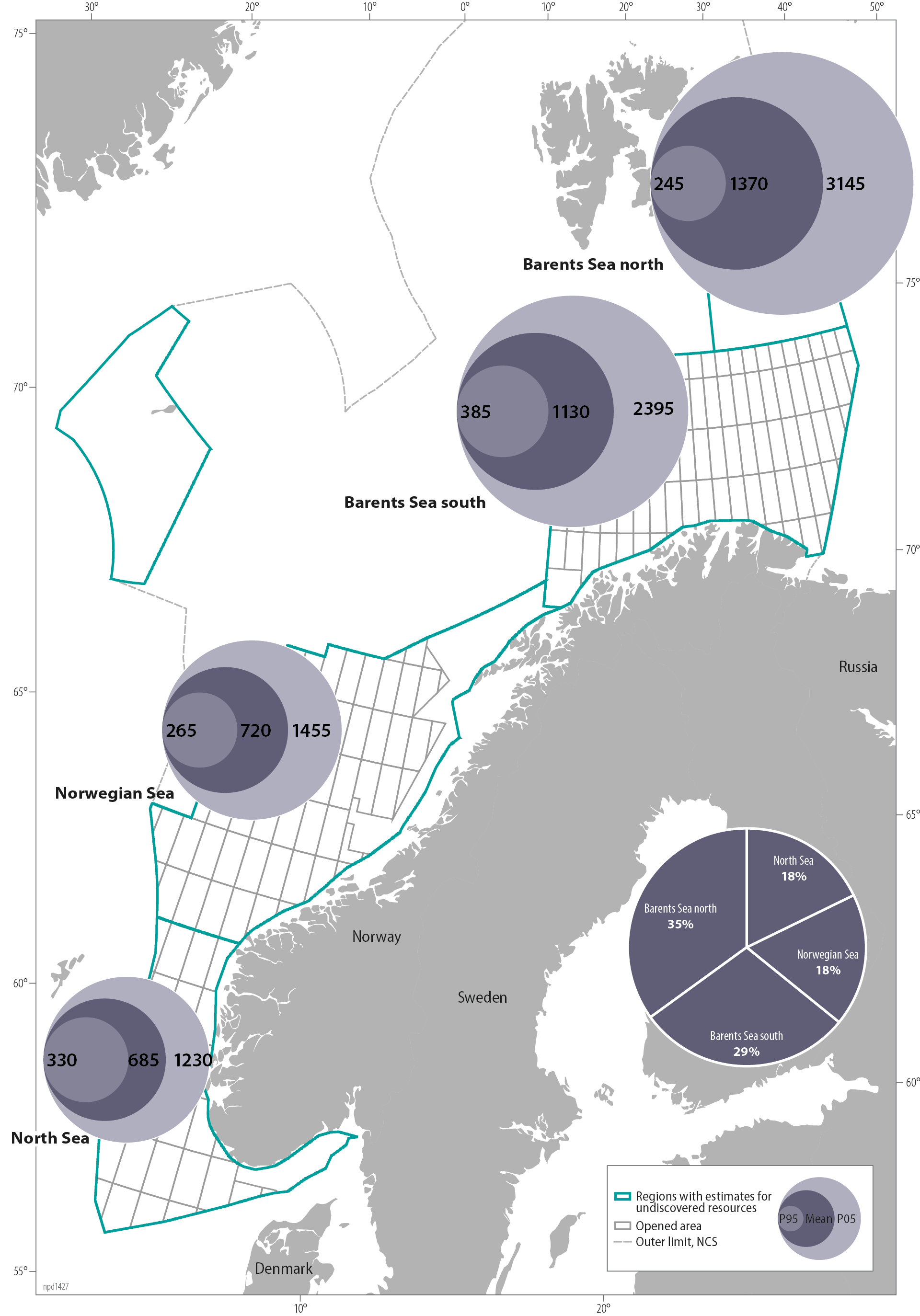

Undiscovered resources represent substantial quantities (figure 3.2). The expected volume is 3 910 million scm oe, with an uncertainty range of 2 200 (P95) to 6 200 (P05) million scm oe (figure 3.1). More than 60 per cent of these resources are expected to lie in the Barents Sea, but this is also where the uncertainty in the estimates is highest (figure 3.2).

Figure 3.1 Undiscovered resources on the NCS (with uncertainty range)

The undiscovered portion accounts for almost half the remaining resources on the NCS. About 40 per cent lies in areas not open for petroleum operations (figure 3.3) – off Lofoten, Vesterålen and Senja, around Jan Mayen, and the whole of Barents Sea North. Base data are limited in these areas and uncertainty is thereby greatest there (figure 3.4).

While these resources are expected for the most part to comprise oil in the North Sea, the proportion of gas should be somewhat higher than oil in the Norwegian and Barents Seas. Barents Sea North, which has still to be opened for petroleum activities, is expected for the most part to contain oil (figure 3.5). Barents Sea South accounts for the biggest change in the oil-gas distribution since the 2017 update, with the gas estimate now reduced there. The split between oil and gas in the undiscovered resources accords well with the historical discoveries. Liquids account for more than 60 per cent of the discovery volume in the North Sea, about 50 per cent in the Norwegian Sea, and roughly 40 per cent in the Barents Sea.

North Sea

The expected value of undiscovered resources in the North Sea is 685 million scm oe. Although this is the best-explored part of the NCS after more than 55 years of intensive exploration, the NPD expects that as much as 18 per cent of total resources yet to be found lie there (figure 3.2). This estimate has been reduced somewhat since 2017 because several identified prospects have been drilled. Most discoveries made since 2017 are relatively small, which is typical for a mature petroleum province.

Some of the biggest North Sea oil fields, such as Statfjord, Gullfaks and Oseberg, are in Late Triassic-Middle Jurassic reservoirs. More than 3 300 million scm oe have been proven in this play, but it still contains a substantial number of prospects. Most discoveries are expected to be relatively small (less than five million scm oe), but larger discoveries cannot be excluded.

The NPD also expects that new discoveries will be made in Late Jurassic reservoirs. New prospects are constantly being identified in this play, and a number of small discoveries have recently been made north of the Troll field. Late Jurassic sands form the reservoir in discoveries and fields across large parts of the North Sea, such as the Central Graben, around Ula, the Tampen area and the Horda Platform.

Figure 3.2 Undiscovered resources by region

Figure 3.3 Reserves and resources on the NCS

Interesting discoveries have also been made in Palaeogene injectites (fact box 2.3). Examples include 24/9-12 S (Frosk) and 24/9-14 S (Froskelår) near the Bøyla field. Such sands are found in several parts of the North Sea and comprise the main reservoir in the Volund field. They have good reservoir properties, but are often limited in extent and difficult to detect in traditional seismic data. The NPD expects more oil and gas to be found in injectites, since newer seismic techniques provide ever better imaging.

Figure 3.4 Undiscovered resources in open and unopened areas (with uncertainty range)

Relatively young and shallow sands deposited in the Miocene and Pliocene are found in the North Sea as part of the “Nanna” Member and the Skade and Utsira Formations. That they contain petroleum has long been known, but little systematic exploration has been done. The 25/2-21 (Liatårnet) discovery has made exploration in these reservoirs relevant.

Norwegian Sea

The estimate for expected undiscovered resources in the Norwegian Sea is 720 million scm oe, with gas accounting for about 55 per cent (figure 3.5). This figure includes the areas around Jan Mayen and off Lofoten, Vesterålen and Senja which are not open for petroleum activities. Liquids account for almost 75 per cent of the expected value in these parts of the NCS.

Gas accounts for two-thirds of the expected value for the rest of the Norwegian Sea, which has been reduced by 20 million scm oe. That reduction is less than half the size of resources proven by new discoveries in the Norwegian Sea since 2017.Several discoveries during recent years in Cretaceous sandstones of the Lange Formation have focused greater attention on this stratigraphic level on the Sklinna Ridge and the Halten and Dønna Terraces.

Discoveries made in this play since 2017 include 6506/11-10 (Hades) and 6507/3-13 (Black Vulture). Wells have also been drilled in the same play to appraise the 6608/10-17 S (Cape Vulture) oil and gas discovery made in 2017. Although the potential in the play is moderate, additional knowledge and new and better seismic data have prompted a substantial increase in the resource estimate. The possibility of discovering more accumulations of similar size in these areas still exists. Since the play lies in an area with well-developed infrastructure, even small discoveries could have high value.

The 6506/11-10 (Iris) and 6507/2-5 S (Ørn) oil and gas discoveries lie in a play with Early and Middle Jurassic reservoirs. This contains the biggest undiscovered resources in the Norwegian Sea, and has also yielded its largest proven resources – such as 6507/7-2 Heidrun, 6506/12-1 Smørbukk and 6507/11-1 Midgard. Liquids account for about 57 per cent of the proven volume, and were mostly found through many large discoveries early in the exploration phase. The average discovery size has gradually declined, and discoveries in recent years have consisted mostly of gas. The estimate for undiscovered resources has been reduced somewhat from 2017, with gas expected to account for almost 60 per cent.

Figure 3.5 Distribution of undiscovered liquids and gas by region

Barents Sea

Although exploration began in the Barents Sea as far back as the early 1980s, and the Hammerfest Basin is now a mature petroleum province, large parts of this region have been relatively little explored. Its large geographical extent is evident from a comparison with areas in the North Sea (figure 3.6). Several substantial discoveries have been made in various areas, such as 7220/8-1 (Skrugard), 7220/7-1 (Havis), 7220/11-1 (Alta), 7120/1-3 (Gotha) and 7324/8-1 (Wisting). The 7220/8-1 (Skrugard) and 7220/7-1 (Havis) discoveries, together with 7220/7-3 S (Drivis), now make up the Johan Castberg field, which is under development for a planned start-up in 2022.

More than 60 per cent of the expected value of total undiscovered resources on the NCS lies in the Barents Sea and amounts to 2 500 million scm oe. Over half of this lies in areas not open for petroleum activities, mainly in Barents Sea North.

Discoveries in the latter area are expected to be bigger than in Barents Sea South. The analyses show that the expected volume of the largest possible oil discoveries has the potential to be among the top 10 on the NCS. However, data in Barents Sea North are limited and no exploration wells have been drilled. All plays are thereby unproven, and uncertainty is large (fact box 3.1).

Forty per cent of the

undiscovered resources

lie in areas not open

for petroleum activities

Barents Sea South

The expected value of undiscovered resources in Barents Sea South has been reduced by 35 million scm oe since 2017. This partly reflects a reduction in the south-eastern part of the area, primarily because of results from wells 7335/12-2 (Korpfjell Deep) and 7132/2-1 and 2 (Gjøkåsen and Gjøkåsen Deep) (figure 3.6). These encountered water-bearing and poor-quality reservoirs. Expectations have particularly been reduced for Triassic plays (the Kobbe, Klappmyss and Havert Formations).

Figure 3.6 Wildcats in the Barents Sea mentioned in the text

On the other hand, the estimate for central parts of Barents Sea South has been upgraded. This moderate rise partly reflects an increase in the number of Jurassic prospects mapped. The volume in some of the newly identified prospects is expected to be larger than predicted in earlier analyses, which contributes to a higher estimate for the associated play.

The play with the largest total resource potential in Barents Sea South includes Jurassic reservoir rocks (the Realgrunnen Sub Group on the Bjarmeland Platform and in the Nordkapp Basin), where the 7324/8-1 (Wisting), 7324/7-2 (Hanssen) and 7324/9-1 (Mercury) discoveries have been made. On the other hand, resources in a corresponding play further west have been downgraded somewhat because of well results such as 7317/9-1 (Koigen Central) and 7321/4-1 (Gråspett).

A new play has been defined in the south-eastern Barents Sea following updated mapping of the Carboniferous-Permian stratigraphic level. This is an analogue of the play involving reservoir rocks in the Gipsdalen Group on the Loppa High and the Finnmark Platform. While the mapping shows many possible petroleum accumulations, the resource potential is very uncertain.

Barents Sea North

The resource estimates for Barents Sea North were presented in 2017 [5] and have not been updated in anticipation of new data. The current expectation value for undiscovered resources in this area is about 1 370 million scm oe. It has not been opened for petroleum operations, the amount of 2D seismic data is limited and there are no exploration wells – only shallow scientific boreholes. The uncertainty in the volume estimates is greatest in this area, since none of the plays have been confirmed by wildcats. Barents Sea North has the biggest resource potential of the unopened areas (figure 3.4).

Surprises

All data acquired on the NCS can be considered pieces of a jigsaw puzzle. As they are slotted into place, an overall understanding emerges which makes it possible to see the full picture – the whole resource potential on the NCS.

The quantity of data varies between the three regions and declines northwards, since fewer exploration wells have been drilled the further north one goes. In other words, the largest

number of pieces has been laid in the North Sea, fewer in the Norwegian Sea and fewest in the Barents Sea. Insight grows as new pieces are added, and uncertainty is reduced.

Each well provides information on which rocks are present, their age, their type and their properties. These data add a real geological content to seismic maps and interpretations. In areas which have been seismically mapped but have few wells, information from each well will be highly significant for predicting geological conditions in the sub-surface. That is characterised as the “geological understanding” of an area (or good insight into what the completed jigsaw looks like).

The value of adding a new piece in less well-known parts of the NCS is high. Drilling information from such an area can be worth a lot if the well has been positioned to provide the maximum possible geological information about the rocks assumed to be the most important. That is particularly true if the information can be extrapolated over all or large parts of the area.

In frontier parts of the NCS, drilling wells can consequently produce positive surprises because base knowledge is smaller than in mature areas. When Draugen was discovered in its day, this field lay in a frontier area where resources were expected in the Fangst Group. Instead, the well encountered extremely good oil-bearing sandstones in the overlying Viking Group. These have subsequently been designated the Rogn Formation.

Exploration will always

produce surprises

The 7324/8-1 (Wisting) well yielded a different type of surprise. Oil encountered here in a very shallow reservoir had experienced very little of the biodegradation expected at thisdepth. Bacteria will normally consume the light components in the crude to leave only heavy components, making the oil viscous and difficult or impossible to produce with conventional methods. Including 7324/7-2 (Hanssen), this discovery contains about 75 million scm oe, and is the largest oil accumulation found in the Barents Sea so far.

Well surprises resulting in unexpected resources are not confined to frontier areas with little data. When discovered in 1978, 15/5-1 (Dagny) – later to become the Gina Krog field –was initially assumed to be a pure gas discovery. About 25 years later, mapping and interpretation utilising much better data than were originally available, along with continuous 3D seismic surveying and data from surrounding wells, led to the definition of the Ermintrude prospect.

Drilling 15/6-9 S (Ermintrude) in 2007 proved oil beneath gas/condensate. This led to a reassessment of the whole area and the idea that an oil column might lie beneath the gas in Dagny. Appraisal of the latter in 2008-11 identified a substantial volume of oil beneath the whole Dagny-Ermintrude structure.

The discovery of the unexpectedly large Johan Sverdrup field on the southern Utsira High also demonstrates that both knowledge and understanding can be inadequate, and that surprises are still possible in mature areas. This field lies in that part of the NCS where the very first production licence (PL 001) was awarded and Norway’s second exploration well was drilled in 1967.

Large oil discoveries to the north and south confirmed functioning petroleum systems in the area. It was to take 40 years of exploration before substantial quantities of petroleum were proven in Utsira High South. Utilising new technology, 3D seismic surveying, existing well data and substantially greater knowledge than four decades earlier allowed new prospects to be defined.

Insight into the petroleum system on Utsira High South improved in 2007 with the discovery of 16/1-8 (Luno), now known as the Edvard Grieg field. Geological understanding was turned on its head and existing theories challenged. The question was how petroleum could migrate from west to east on Utsira High South. Johan Sverdrup was proven by 16/2-6 (Avaldsnes) in 2010 and then by 16/2-8 (Aldous) in 2011, which supported the theory that petroleum can migrate through fractured and chemically weathered basement rock. After 30 appraisal wells, this discovery ranks as Norway’s third largest oil field. Big surprises can still occur even after 40 years of exploration.

The examples above show that surprises will always occur in exploration. They are normally termed “serendipitous” by the industry, meaning a happy chance. But many people believe that serendipity is not a matter of good luck. Instead, it reflects experience and insights acquired over a long time, combined with an open and curious mindset.

Taking account of the unexpected when estimating undiscovered resources is difficult. Surprisingly large discoveries such as Johan Sverdrup will seldom or never be included in the uncertainty range for resource estimates in mature areas. New digital methods, such as machine and deep learning, could yield several surprises in coming years. Being aware that unexpected outcomes may occur is in itself knowledge. But taking this into account in resource classification and estimation is demanding. An attempt is presented in figure 3.7 [6].

Figure 3.7 Alternative resource classification. Modified from Hall (2011).

Being aware that unexpected

outcomes may occur

is in itself knowledge

The NPD’s resource estimate is based on existing knowledge. In estimating undiscovered resources, its attention is on the uncertainty range, with a downside and an upside which represent the whole span. But it can be challenging to extend this far enough, given that the analyses are to rest on “known” knowledge and data.

The NPD has made use of scenarios on several occasions to enlarge the possibility space when base knowledge is limited and uncertain – most recently in assessing the resource base in Barents Sea North (fact box 3.1).

Fact box 3.1 A high resource outcome

Estimating undiscovered resources

Estimating undiscovered resources

Mapping and geological evaluation permit plays to be defined (fact box 3.2). In this way, possible petroleum accumulations can be identified.

Undiscovered resources are petroleum which has not been proven by drilling, but which is expected to be recoverable from possible accumulations. The resource classification system is divided between discovered and undiscovered resources (figure 3.9).

The NPD’s estimate of undiscovered resources is based on analyses of more than 70 plays, drawing on large quantities of data from wells, information from licensing-round applications, data acquired through the NPD’s own field work, and seismic mapping (figure 3.10). These plays are analysed separately, and interdependencies between relevant ones are then incorporated before estimated resources are summed area by area to arrive at a total figure for the North, Norwegian and Barents (South and North) Seas.

Figure 3.9 Undiscovered versus discovered resources

Figure 3.10 Base data for estimating resources

Prospects and leads

Among the most important parameters in the analyses are the number of prospects and leads (possible petroleum accumulations), volumes and the probability of success (fact box 3.3).

Fact box 3.3 Prospects and leads

The NPD obtains information about mapped prospects through applications for licensing rounds and from documentation in active production licences. Another data source is its own mapping. This information includes where the prospects have been identified (geographical data), age and reservoir type, how much and what types of hydrocarbons they may contain (volume and hydrocarbon phase) and the probability of success.

All details about mapped prospects and leads are reviewed and assessed by the NPD before being stored in a database which currently contains information from about 2 500 possible petroleum accumulations. In addition to an assessment of the identified prospectivity, the NPD produces an estimate of postulated prospectivity for each play.

Prospects which have been drilled are categorised as dry or a discovery, and the possible discovery volume is registered. That provides the basis for statistics on discovery success and volume in the various plays. These figures provide important information for use in the analyses. On several occasions, the NPD has analysed prospect volume (pre-drilling) compared with discovery volume, and presented the results [7]. The latter show a tendency to overestimate prospect volumes, while the average estimated probability of success appears to be in line with the average discovery rate.

Well results

The NPD also reviews company data reported for discoveries and dry wells. Understanding why a well is dry is important. It could be because the well failed to encounter the reservoir, for example, or because the reservoir quality was poor. Other causes could be the failure of petroleum to migrate into the trap or the absence of a trap (fact box 3.3). The results of this work are used to assess which elements are the most critical (pose the biggest geological risk) in the various plays.

Exploration is learning ...

Although the quantity of data underpinning the analyses is substantial, the estimates will always contain an element of uncertainty. Only drilling wells can prove or disprove discoveries and their size. Uncertainty is lower in an area where many wells have been drilled, because knowledge there has increased through large quantities of well data and geological analyses.

... about complex relationships

A prospect is included in undiscovered resources with risk-weighted petroleum quantities – in other words, the expected (unrisked) volume of a discovery multiplied by the probability of success. A prospect with an expected volume of 100 million scm oe and a 10 per cent probability of success will contribute 10 million scm oe to resources in the play. The outcome of drilling a prospect could influence estimates for undiscovered resources in this play by removing it, either as a discovery or as a dry well.

The result of a well is always significant. If a discovery is made, was it larger or smaller than expected? How did the reservoir and liquid properties compare with expectations? Was the hydrocarbon phase as expected? For its part, a dry well can reveal whether reservoir rocks are present and, if so, what properties they have. Traces of petroleum in the reservoir or the rest of the well could also be significant. A dry well can also establish the presence of a good cap rock over the expected reservoir level, or organically rich rocks which could have functioned as a source for other prospects in the play (fact box 3.4).

Fact box 3.4 Analysing dry exploration wells

A discovery will generally have a positive impact on resource estimates. Should it be much smaller than expected, on the other hand, and if the reasons for this can also be extrapolated to more prospects in the play, the effect could be negative. In general, a dry well will affect the estimates negatively but the information it provides can have a positive effect in some cases.

The reservoir could be larger or better than expected, for example, or yielded clear traces of hydrocarbons. That might increase the probability of success for other prospects. A dry well in a prospect with a low probability of success will generally have a smaller impact on the total estimate than one in a prospect where the probability was high.

How much the estimates are altered by well results depends both on how much the latter deviate from expectations and on how much data was available before drilling. The estimates will not usually be affected as much in a mature play with many wells and discoveries as they are in a play without discoveries or wells.

The term “yet to find” is often used for undiscovered resources, but this can easily be interpreted to mean an estimate of what will be discovered rather than the quantity which might be found (if exploration takes place).

The NPD’s estimate of undiscovered resources covers oil and gas expected to be provable and producible with existing knowledge and technology. It makes no assumptions about commerciality or exploration activity.

Fact box 3.5 Uncertainty in the resource estimate