4 – Changes to the players

The number of players on the NCS has declined considerably in recent years. Nevertheless, the level of activity remains high. Many small and medium-sized companies have merged and strengthened their position. The medium-sized companies have become an increasingly important force in the continued development of the NCS.

4.1 Development of the player picture

Developing oil and gas operations on the NCS depends on the size of the resource base and the industry’s ability and willingness to find and recover as much of these resources as possible in an efficient and sustainable manner.The oil and gas resources provide differing commercial opportunities for the oil companies. So it is important that the player composition is sufficiently varied and represents a diversity of knowledge and approaches.

Most of the big discoveries on the NCS were made in the first decades of exploration. This represented commercial opportunities for the oil majors, and the NCS was consequently dominated by these together with Statoil, Norsk Hydro and Saga Petroleum.

Figure 4.1 Development of oil prices and number of companies by type.

As the NCS became better explored and a number of majors merged, a broader player composition became necessary. The big participants who could undertake demanding and capital-intensive projects were still needed. At the same time, it was important to attract companies whose attention was focused on the smaller projects. The government took a number of steps to make it attractive and easier for new players

to enter the NCS. Examples included a new arrangement for prequalifying companies, awards in predefined areas (APA rounds) and a reimbursement system for exploration costs.

Table 4.1 Licensees at 31 December 2021 by various company types.

Combined with rising oil prices, these measures led to a marked increase in both number and breadth of companies. Their number rose from 29 in 2002 to 56 by 2013 (Figure 4.1 and Table 4.1). The new entrants contributed to increased competition over acreage, and have secured a large proportion of the production licences awarded over the past 20 years (Figure 4.2).

Figure 4.2 Share of awards by company type (licensees)

Figure 4.3 presents the development in exploration wells by company type. In line with the rise in the number of players, exploration activity rose markedly from 2007. Over the first decade, large Norwegian companies and majors accounted collectively for more than half the wells drilled. During the second 10 years, these players reduced their share of exploration wells while medium-sized and small companies substantially increased their proportion.

Figure 4.3 Development in number of exploration wells by company type (licensees).

More players and rising oil prices have contributed to increased exploration, many new discoveries and greater resource growth (Figure 4.4). The new players have contributed to a number of discoveries and field developments on the NCS.

Figure 4.4 Accumulated resource growth from discoveries by company type.

At 31 December 2021, 36 companies were active on the NCS – a reduction of 20 from the 2013 peak (Figure 4.5). During the first six months of 2022, two companies have been taken over. Aker BP is acquiring the oil and gas business of Lundin Energy, and Sval Energy has bought up Spirit Energy. In addition, Suncor Energy has announced that it is withdrawing from the NCS.

Figure 4.5 Changes to player composition since 2013.

The decline in player numbers is partly a result of majors and European gas/power companies selling out of the NCS in recent years. Following the oil price slump in 2014 and an increased emphasis on the rate of return among majors, the international oil industry has seen a consolidation of activity. Combined with a more mature NCS and a lack of big projects, this contributed to several majors departing. Some have committed to petroleum provinces where big discoveries can be made, while others are concentrating on such business opportunities as shale oil, LNG and renewable energy. European gas/power companies have increasingly committed to renewables and withdrawn from petroleum activities.

Medium-sized companies have strengthened their

position

A number of mergers and acquisitions, largely involving companies with exploration as their main activity, have further reduced the number of players. One result of this process is that several companies have strengthened their position on the NCS.

Diversity has increased among field operators. Figure 4.6 presents the number of approved PDOs by company type in 2002-21. During recent years, several medium-sized companies and one small company have become field development operators. The proposed restructuring of the petroleum tax regime [26] could facilitate greater operator diversity in bringing discoveries on stream, since it will be easier for companies without taxable earnings to finance the development phase

Figure 4.6 Approved development plans (PDO and PDO-exempt) by company type (operators).

Figure 4.7 presents the trend for the share of production by company type over the past 20 years. Majors and European gas/power companies have substantially reduced their proportion of total production, while medium-sized companies have increased theirs correspondingly.

Figure 4.7 Development in production by company type (licensees).

4.2 Ability and willingness

A precondition for value creation is that the licensees not only possess expertise but are also willing to apply this along with investment funds to their Norwegian portfolio of production licences, discoveries and fields. Exploration results depend on a number of factors, including the prospectivity of the acreage awarded, where exploration takes place, and its scope and quality. Figure 4.8 and Figure 4.9 present the correlation between the number of wildcats and resource growth for the past five years.

Figure 4.8 Wildcats in 2017-21 by company type (licensees).

Figure 4.9 Resource growth in 2017-21 by company

type (licensees).

Medium-sized companies participated in the greatest number of wildcats in 2017-21, and had the largest resource growth. However, resource growth per wildcat has been relatively low. Large Norwegian companies also drilled many wildcats and these have yielded higher resource growth per well than for medium-sized companies. Majors drilled relatively few wildcats, but achieved relatively high resource growth.

A total of 57 wildcats were drilled on the NCS in 2020-21. Thirteen were not close to infrastructure, with medium-sized companies as the operator for almost half of these (Figure 4.10).

Figure 4.10 Wildcats spudded in 2020-21 by company type (operators).

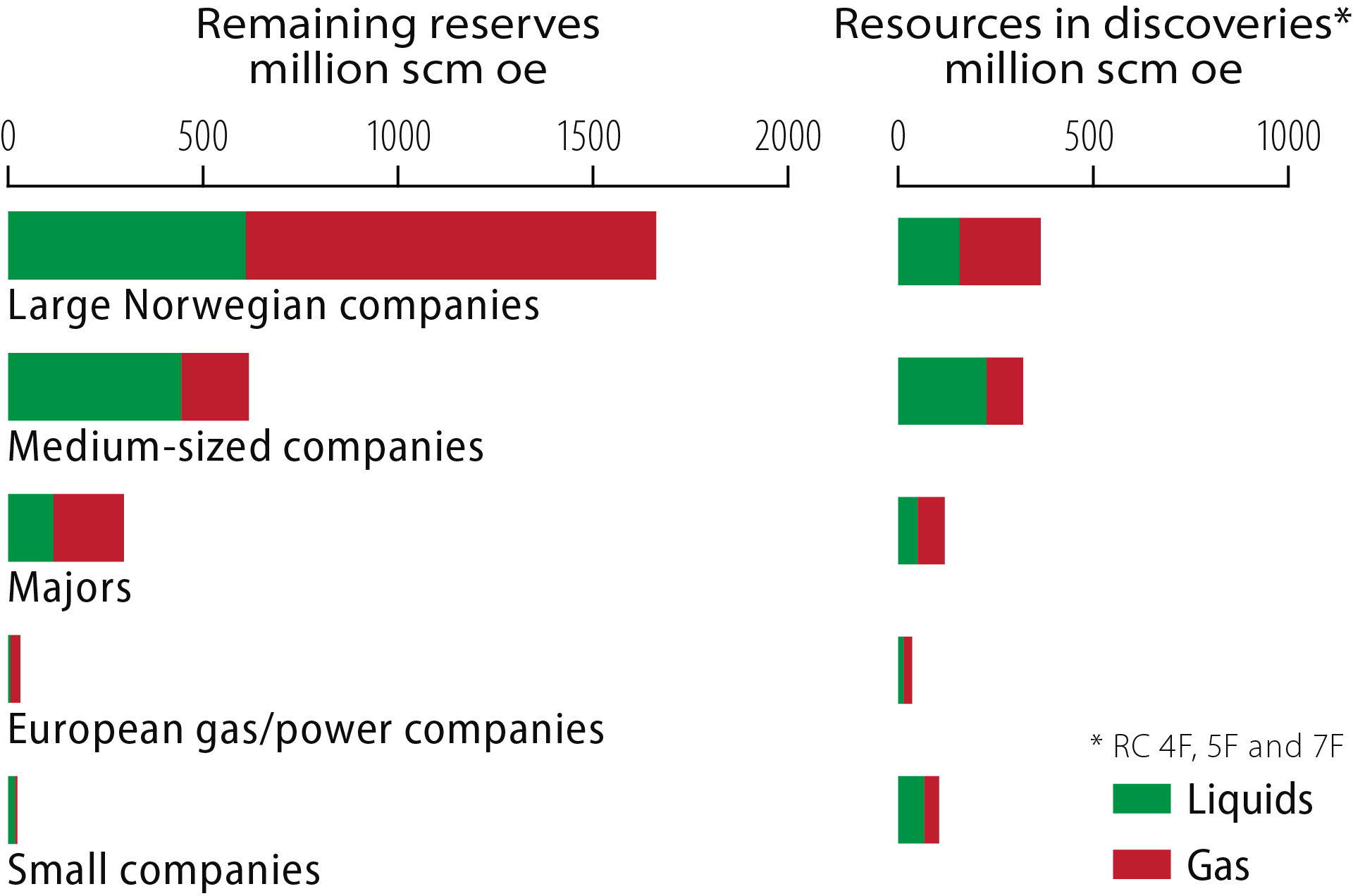

At 31 December 2021, large Norwegian and medium- sized companies held the largest remaining resources on the NCS (Figure 4.11). They account collectively for more than 85 per cent of remaining resources, with large Norwegian companies alone accounting for 63 per cent. Medium-sized companies have strengthened their position, and are the category with the largest increase in production licences and the highest level of exploration activity in recent years.That has yielded a number of discoveries and increased both reserves and resources in discoveries yet to be sanctioned for development.

Figure 4.11 Remaining reserves and resources in discoveries at 31 December 2021.

4.3 Player adaptation to the energy transition.

The energy landscape is changing, which could have major consequences for players in the petroleum sector. A key question for oil and gas companies is how they can position themselves to develop their core business in the best way while being part of the energy transition

A strategy directed at a heavy commitment outside the core business may pose a big risk for players, but a "wait-and-see" attitude could also be risky. As a result, a number of companies are widening their business model and trying to build an integrated and balanced portfolio which includes not only oil and gas but increasingly also renewable energy, hydrogen and CCS (fact box Large integrated European oil firms defining themselves as energy companies).

The energy transition may lead to underinvestment in oil and gas

The energy transition and company adaptations have been identified by several key players, such as the International Monetary Fund (IMF) [27], as one reason for underinvestment in oil and gas (fact box Underinvestment in oil and gas).

Fact box – Large integrated European oil firms defining themselves as energy companies

Fact box – Underinvestment in oil and gas

In the longer term, such an adjustment by players, where they "develop a broader commercial base", could pose challenges for resource management on the NCS. "In order to reallocate equity investment towards renewables, the required return for upstream oil and gas activities has been adjusted up in a number of companies to around 20 per cent, so that these companies ensure through capital rationing that only the investment opportunities with the highest return are realised" [17].

When the oil companies increase their required return, a number of socioeconomically viable projects will not be realised on the NCS. This reinforces a known issue (fact box Required rate of return). Resource management will be challenged if players reap from the petroleum sector without reinvesting adequately in profitable measures on the NCS.