6 – Future production and revenues

Uncertainty prevails over the future of both production on the NCS and revenues from the industry. Three scenarios show a substantial uncertainty range for both production and revenues. Purposeful technology development, players willing to invest and successful exploration can increase opportunities for maintaining both production volumes and revenues at high levels.

Background

An important precondition for continued development of the petroleum sector is that Norway has a resource base which can be exploited. The NPD’s analysis (chapter 2 Remaining petroleum resources) shows that large resources still exist in all NCS areas. Half the total expected resources have been recovered since production began in 1971. This means that the remaining half can provide the basis for production over several decades. Proportionately more of the oil than the gas has been produced.

Limiting the expected decline in output will be important for maintaining production on the NCS at a high level, contributing large assets to society and providing stable, long-term and secure oil and gas deliveries to Europe. This can be achieved by improving recovery from existing fields, developing commercial discoveries and continuing active exploration of prospective acreage in both mature and frontier regions.

Large resources remain in fields on stream, with a substantial potential for improved recovery which can help to counteract the decline. That calls for investing more than the present level in improving recovery, maturing discoveries already made for development, and keeping down unit costs.

Current forecasts show that a steadily rising share of production in 2030 and beyond must come from undiscovered resources. Much of this growth will be provided by small discoveries. Larger discoveries than those being made today are also needed to slow the production decline. The potential for making large discoveries is greatest in frontier areas and those still not opened for petroleum activities.

Figure 6.1 Three scenarios for production development on the NCS 2022-50.

Three scenarios

Given the challenges and opportunities on the NCS described above and elaborated in chapters 1-5, three scenarios have been developed for oil and gas production off Norway up to 2050 (Figure 6.1).

The starting point is the production trajectory illustrated in Figure 1.1, which represents the government’s expectation if today’s policies are maintained. In purely methodological terms, this trajectory is determined using data reported by the companies (for the RNB) to establish production curves for fields, discoveries and improved recovery. The NPD’s estimate for undiscovered resources forms the basis for forecasting production from new discoveries. Random drawing is used to determine the order of discoveries, with a bias for larger discoveries to be drawn before smaller ones.

Each scenario incorporates assumptions for exploration activity, success rates and lead times. All three pictures assume the same market development. For technical calculatory reasons, future real oil and gas prices of USD 55 per barrel and USD 5.85 per metric million British thermal units (MMbtu) respectively are assumed for 2030-50. An NPV (seven per cent before tax) is calculated for discoveries, and only projects with a positive NPV are included.

Corresponding profitability assessments are made for discoveries, fields and improved recovery to provide a production trajectory up to 2050 for each scenario.

The pictures will vary with regard to the properties of the resource base, exploration activity, and the strength and speed of technology development.

Expectation

The Expectation scenario envisages exploration at its present level for the early years, followed by a decline over time. Such activity will largely occur in known areas close to infrastructure. Production on the NCS more than halves from 2025 to 2050. Development of new discoveries and projects for improved recovery are not on a scale which succeeds in countering the production decline from fields on stream. Most new discoveries brought on stream are developed as satellites to existing infrastructure. The fall in production, combined with investment in low-emission solutions, mean that the sector reaches its goal of net zero emissions by 2050

Gas as a proportion of total production has been rising over time, and will continue to do so. Since the industry is efficiently run, new production capacity on the NCS will be almost entirely competitive on a global basis.

More than a halving of production from 2025 to 2050 will reduce the industry’s significance in the Norwegian economy, both as a growth engine and as a source of government revenue.

Low resource growth with little and late technology development (Low)

The Low production trajectory illustrated in Figure 6.1, is below the government’s Expectation, with the resource potential in fields, discoveries and undiscovered resources failing to be realised.

More dry wells are drilled, with few new discoveries, during the early years, and exploration activity stagnates over the coming 10-20 years. The industry downgrades its expectations of the resource potential on the NCS and declares itself satisfied with what has been achieved, and reaps from the investment made. Exploration declines sharply and eventually ceases, few new discoveries are developed and very few improved recovery projects are initiated.

Investment on the NCS virtually ceases, leading to sharply reduced production and lower value creation in relation to the potential for revenue and value creation offered by the resource base. The decline in exploration, development and production has major negative effects, both direct and indirect, for several mainland industries delivering to the petroleum sector. That means a substantial increase in the need for restructuring over coming decades.

High resource growth with considerable and fast technology development (High)

The High production trajectory illustrated in Figure 6.1 exceeds the government’s Expectation. This is because it incorporates additional opportunities offered by fields, discoveries and exploration. The forecast falls well within the uncertainty range in the NPD’s estimate of remaining resources on the NCS.

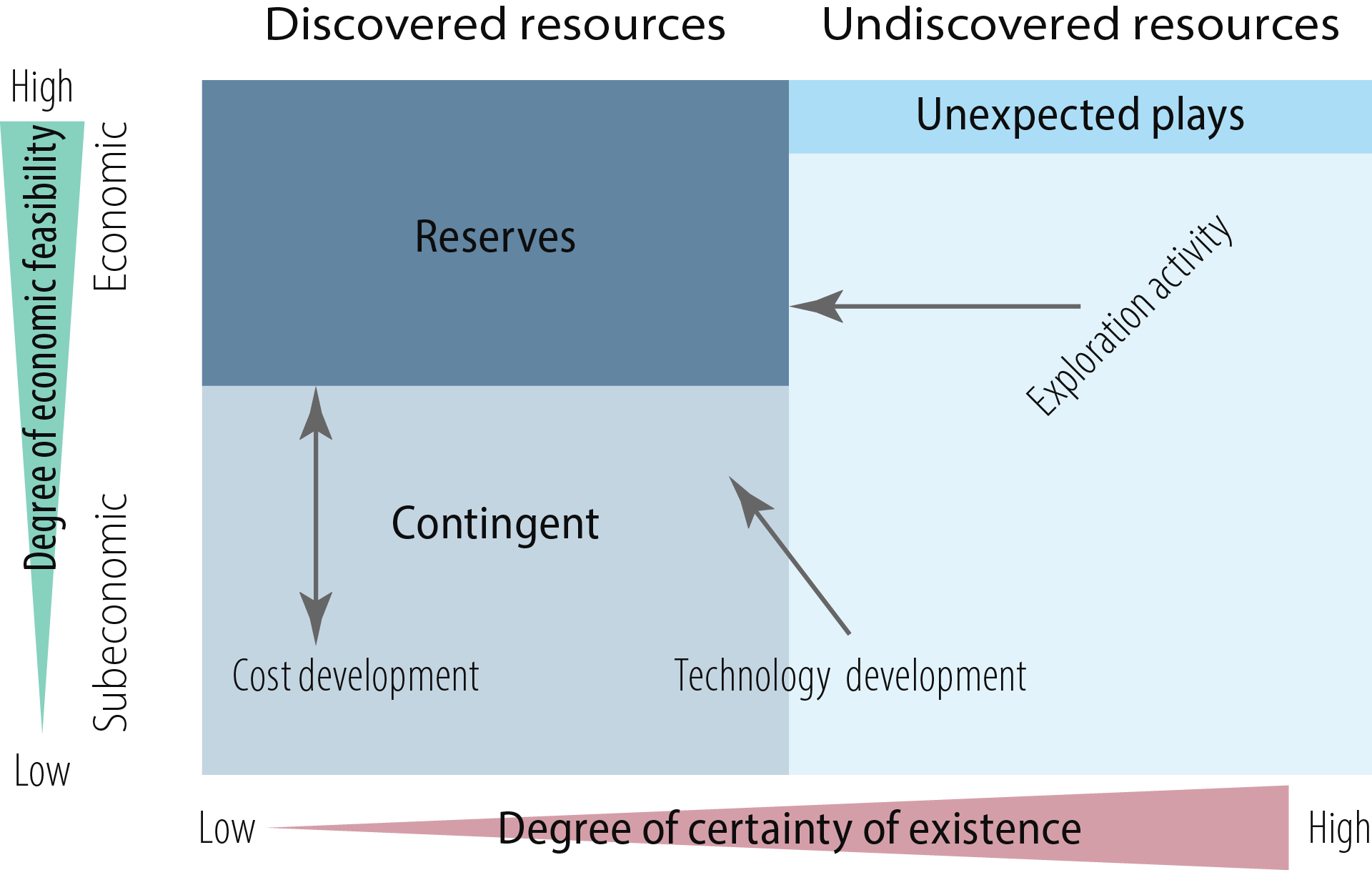

New discoveries are made rapidly along High, with several large ones in frontier areas. Gas discoveries are made in the Barents Sea and quickly developed. The logic is based on the McKelvey box [35] (Figure 6.2). which illustrates how market conditions, technology development and exploration activitycommercial resources into proven and commercially recoverable assets. Unforeseen resources are also included in the figure, reflecting the way drilling can lead to surprises in both mature and frontier areas as a result of encountering unexpected resources. See fact box Surprises in chapter 2 Remaining petroleum resources and the Resource report exploration 2020 [5].

Figure 6.2 Modified McKelvey box.

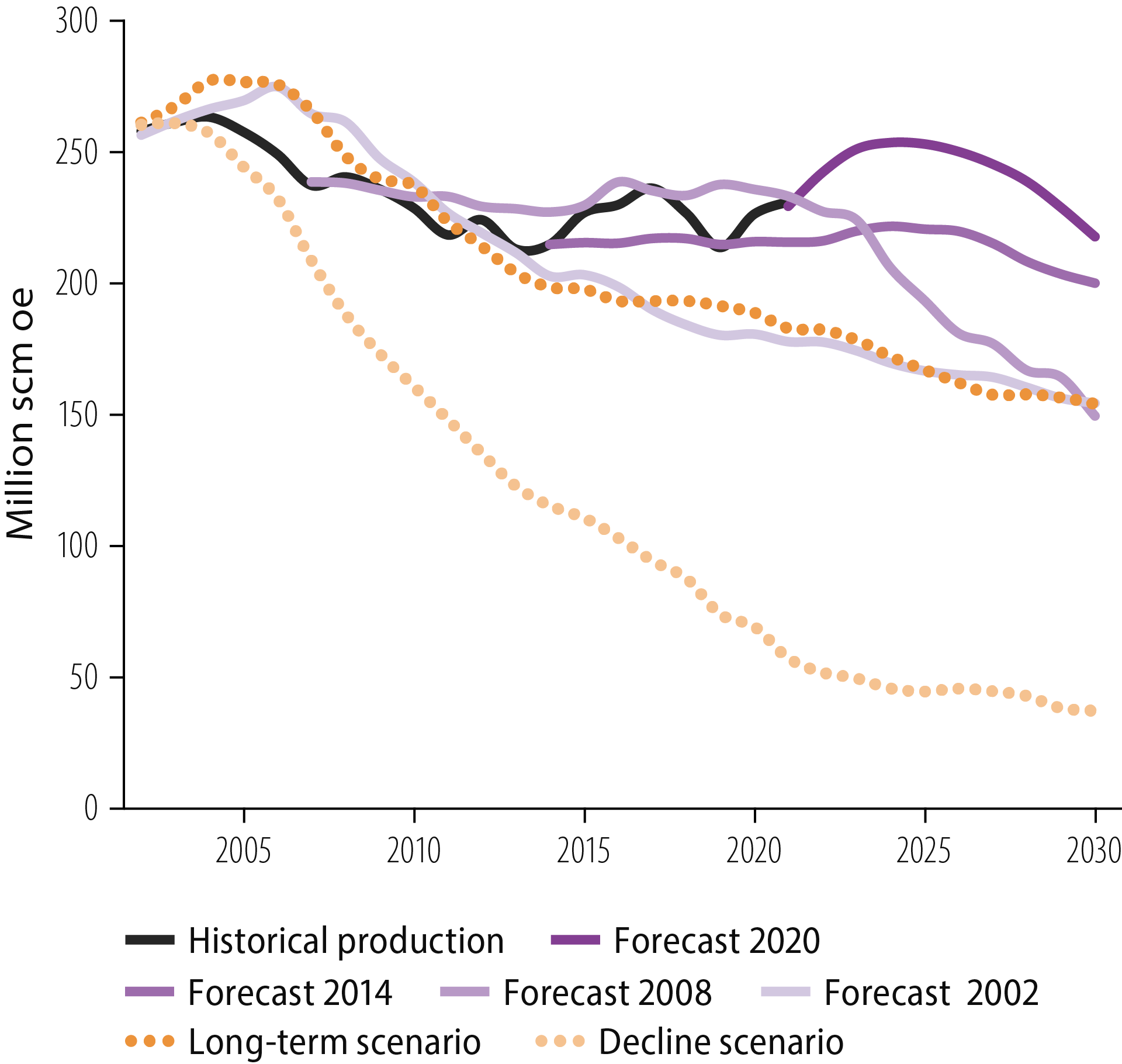

Historically, a tendency has been seen to underestimate how increased knowledge of the subsurface, technological progress, amendments to operating parameters and changes to market conditions, as well as surprises, contribute to resource growth and higher production. This is shown for the development of reserves and production forecasts in Figure 3.16 and Figure 6.3 respectively. The forecasts have been conservative and adjusted in line with developments on the NCS [36].

Figure 6.3 Forecasts for future production The long-term development and depletion trajectories from Report no 38 (2001-2002) to the Storting on oil and gas activities. NPD forecasts from the RNB.

In this scenario, the NCS sustains its position as an attractive petroleum province, and the government and the industry contribute to maintaining exploration activity, technology development and profitable production for a long period (Figure 6.1). Increased production helps to secure long-term oil and gas deliveries to Europe.

The industry will also be expanded gradually to include the new value chains such as CCS and hydrogen. In addition, commitments are made to seabed minerals and floating wind farms.

Technological development is pursued and investment made in low-emission solutions, so that the sector’s transition goal of net zero emissions in 2050 is reached.

Coordinated development makes it possible to exploit synergies between the various value chains. Reusing gas infrastructure and establishing large-scale solutions for CO2 transport and storage simplifies developing petroleum value chains to also incorporate blue hydrogen. Further development of petroleum value chains by integrating hydrogen and CCS represent important technological advances which will benefit the rest of the world. At the same time, this helps to maintain the value of Norwegian gas as Europe and the rest of the world switch their attention from natural gas to hydrogen.

Price sensitivities

To address the uncertainty range for future revenues, a sensitivity analysis has been carried out with prices equal to +/- 50 per cent. Low prices have been used with Low and high prices with High. The effect of the various price sensitivities on future revenues is illustrated in Figure 6.4. This shows that developments in prices, exploration activity, resource growth and technological progress can contribute to a considerable uncertainty range for future net revenues from activities on the NCS.

Figure 6.4 Net revenues from 2023 to 2050 in the three scenarios combined with low (-50%) and high (+50%) prices.

Different scenarios – different leeways

All three scenarios show a fall in production over time, but the pace of this decline will differ. In 2050, production in High is at the same level as the early 1990s and near zero for Low.

The production decline will depend on developments in the world at large, the resource base and exploration activity as well as the strength of technological progress. How these factors develop may produce substantial differences in future production and in Norway’s role as a long-term exporter of oil and gas to Europe. That could lead to substantial differences in future government revenues from petroleum operations

Measures for increasing resource growth and keeping unit costs low could be crucial to future production and revenues for society. At the same time, existing petroleum value chains must be further developed to also embrace CCS and hydrogen as well as seabed minerals. A high level of exploration, purposeful technology development and active players can enhance the chances of success.