Drivers, challenges and opportunities

Drivers, challenges and opportunities on the NCS

Technology and expertise contribute to profitable exploration, extracting value locked in challenging reservoirs and small discoveries. Increased gas export capacity from the Barents Sea can help create even more value. Fortunately, all this can be accomplished with minimal emissions.

In this chapter:

- Technological development pushes the envelope

- Exploration creates enormous value

- Gas infrastructure is important for extracting value from remaining resources

- Measures to curb greenhouse gas emissions

- Electrification reduces emissions

Technological development pushes the envelope

Learning and developing new expertise and technology have always been important factors when it comes to finding, developing and producing oil and gas resources on the Norwegian continental shelf (NCS).

Framework conditions that are good, and foremost predictable have stimulated oil companies to commit to research and development (R&D) in Norway. The Ministry of Energy (MoE) also grants substantial public funding for research programs within the petroleum sector.

The MoE established a strategy group called OG21 (Oil and Gas for the 21st Century) in an effort to ensure coordinated, efficient and focused research and technology efforts. The group’s mission is to delineate national R&D strategies for the petroleum sector that can provide guidance for both the industry itself and for the authorities.

OG21 strategy

Research, technological development and innovation within eight specific areas deemed to be of particular importance:

Improved understanding of the subsurface and associated tools are fundamental for the attractiveness and competitiveness of the NCS.

Cost-effective drilling, plugging and abandonment of wells (P&A) target two major cost elements on the NCS.

Efficient use of existing infrastructure will be key for producing remaining reserves in the fields, and to realise contingent resources.

Unmanned installations and subsea tie-back solutions include technologies such as multiphase modelling. These solutions can extend potential tie-back distances and help promote use of subsea processing technologies and unmanned production facilities.

Energy-efficient and cost-effective electrification is a significant factor in achieving the sector’s goal of reducing greenhouse gas emissions by 50 per cent by 2030.

Carbon capture and storage (CCS) is a core technology for reducing CO2 emissions.

Being a world leader within HSE and environment is one of the sector’s fundamental values, and an essential factor in maintaining acceptance from the broader society.

Digitalisation is crucial in achieving faster, better decision processes. It yields lower costs, increased overall resources, reduced greenhouse gas emissions and improved safety.

The OG21 strategy establishes a framework for the Norwegian Offshore Directorate’s initiatives to advance technology development and enhance the utilisation of technology on the NCS.

A strategy has been developed to increase the use of technology on the NCS, based on the Directorate’s mandate and its awareness of where the companies and the market have not facilitated sufficient commitments. This strategy(39) focuses on selected areas of technology aimed at finding more, recovering more and reducing emissions.

Tight reservoirs pose challenges

A tight reservoir is a reservoir with low permeability.

Recovery from tight reservoirs normally entails relatively low production rates spread over a long production horizon. In most cases, this recovery is only profitable if the development is based on tie-backs to existing infrastructure. Hence the importance of bringing developments on stream at a sufficiently early stage to ensure resources can be produced within the lifetime of existing infrastructure, further discussed in chapter 6, the time-critical aspect.

In 2023, the Norwegian Offshore Directorate compiled an overview of all stranded gas discoveries (discoveries that have yet to be developed) and identified alternative solutions that can be implemented to enable recovery of these resources. The study revealed that a great many of the idle gas discoveries in the North Sea and the Norwegian Sea include tight reservoirs in all or parts of the discoveries. Technology that enables higher productivity in tight gas reservoirs is one option that can lead to improved recovery and value creation.

An extensive survey of tight reservoirs on the NCS was conducted and presented in Resource report 2019. This evaluation identified a total of around 2000 million scm oe in place in tight reservoirs, across 42 discoveries and fields. The resources were distributed between around 1200 million scm of oil and 800 billion scm of gas.

The biggest challenge producing from tight reservoirs is low production rates, too low for recovery to be profitable using standard well solutions. This means implementing measures that increase reservoir exposure, and thus the productivity of the well, to ensure better flow of oil and gas. This can be done by fracturing the reservoir near the wells and/or by drilling multiple wellbores in the tight zones.

At present time, various types of fracturing and multi-branch wells are the most relevant methods for recovering resources in tight reservoirs. Fracturing combined with acid stimulation is used on the chalk fields in the southern North Sea.

Slim hole technology is also a relevant alternative in some locations. Many slim boreholes in the same well increase exposure to the reservoir and make it easier for oil and gas to flow into the wells. Fracturing combined with water and gas injection can also contribute to enhanced recovery.

A number of drilling and well technologies exist that are aimed at ensuring good well productivity in tight reservoirs, and thereby possible profitable recovery. Some examples include slim hole drilling, well stimulation and hydraulic fracturing, multi-branch wells and various combinations of the above. Some sporadic testing of these technologies has occurred, but they have rarely been used in tight reservoirs on the NCS.

Improved oil recovery from marginal reservoirs on the Edvard Grieg field

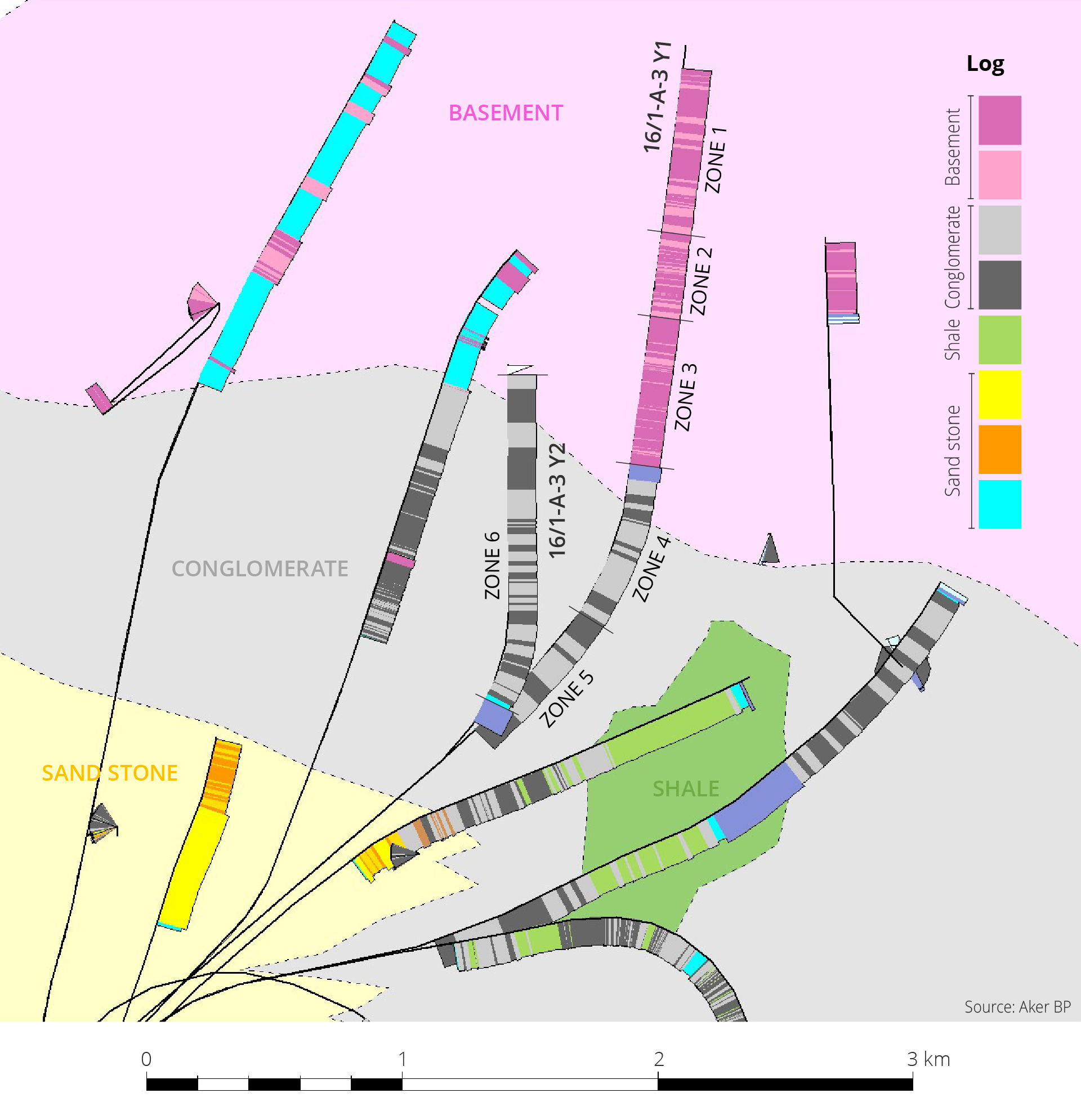

Production well 16/1-A-3 was drilled in the summer of 2023. The objective of the well was to improve the recovery rate in basement and conglomerates on and around the northeastern high on the Edvard Grieg field in the North Sea (Tellus Øst). The well has two branches.

The first branch (basement and conglomerate) was completed with five separate screen sections where different parts of the reservoir are isolated with intumescent seals. The second branch (conglomerate) was completed with so-called Fishbones, which means that a series of smaller branches are drilled into the formation to provide increased exposure to the reservoir and thus increased productivity in the well.

A total of six separate controllable production stations (Manara) were installed in the well. Five of the stations are situated in the first branch to enable monitoring and balancing production between the various zones in conglomerate and basement. The sixth and last zone controls production from the entire second branch.

Clean-up of this well, where production rates in certain periods exceeded 1500 scm of oil per day, shows good flow potential. However, production has been held back after the well came on stream, while waiting for seals to set. The objective is to prevent excessive early water break-through.

In the spring of 2024, the well produced around 250 scm per day with a total water cut of approximately 10–20 per cent.

The ability to monitor development and control production along the wellbore and between the branches is important for optimising total resource utilisation on the field, as well as to collect data that provides more precise understanding of how the various types of basement reservoirs behave over time.

The expectation is that large volumes of oil are present in the basement rock around Edvard Grieg. However, due to the unconventional nature of the reservoir, exactly how much can be produced from this reservoir remains uncertain. In this context, data and experience gained from 16/1-A-3 will constitute a small but important step in the ongoing work to develop a strategy for future utilisation of these resources.

Map section of Edvard Grieg field showing location of the wellbores and division into production zones (figure from Aker BP).

Advanced methods for enhanced oil recovery (EOR)

Most oil fields on the NCS rely on injecting water, gas or a combination thereof to improve recovery. This maintains pressure while also pushing oil through the reservoirs and towards the production wells. Despite these efforts, a substantial volume of oil is left behind, that cannot be recovered using this method as shown in chapter 5, figure 5.7.

Resource report 2019 highlights significant potential associated with EOR and the need for field pilots. The report estimates that around half of the oil left behind after the field is shut down is immobile. More advanced methods than water and gas injection are needed to recover some of this oil.

Water-based EOR – injection of low salinity water on Ekofisk

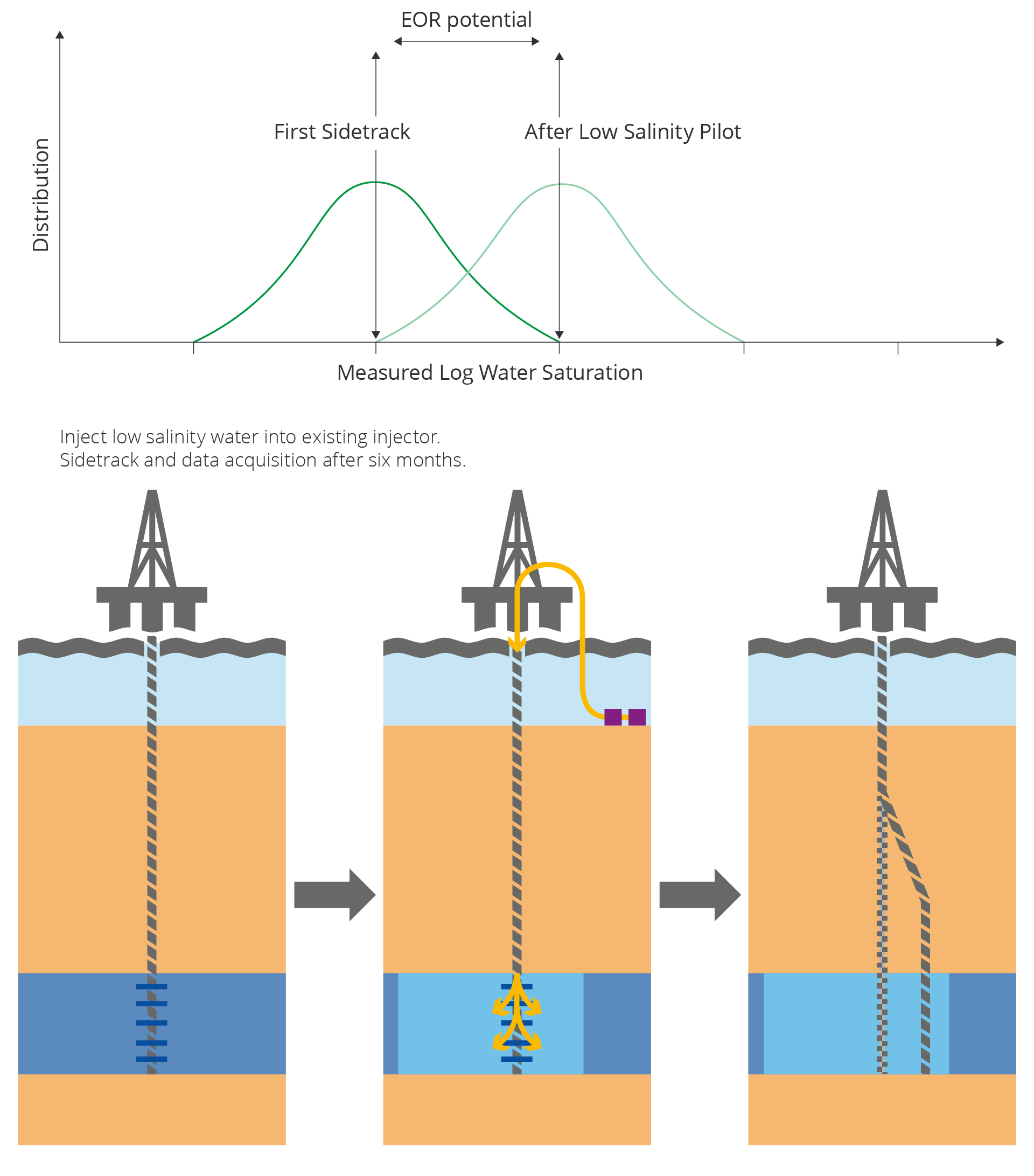

Many studies and laboratory tests have been conducted, involving various enhanced recovery methods (EOR). Field testing of these methods has nevertheless been limited to date. A test involving injection of low salinity water was initiated in the spring of 2024 on the Ekofisk field in the North Sea.

Laboratory experiments have shown that injection of low salinity water, as compared with injection of seawater, can yield improved oil recovery. The extra oil can be recovered as a result of chemical reactions between the low salinity water and the surface of the rock that can unlock more oil for production. In laboratories, the remaining oil saturation in the reservoir is reduced by four to eight per cent when low salinity water is injected, as compared with seawater.

The pilot on Ekofisk is being conducted in a well that has already injected seawater for years, and where extensive data was collected when it was drilled. Equipment has been installed to remove salt, reverse osmosis, and filters to remove particles. The plan is to start by injecting low salinity water, then drilling a sidetrack around 30 metres from the injection well to collect data, including cores.

Data from the injection well and the sidetrack will be analysed to determine the impact of low salinity water on recovery. Whether or not the pilot can be declared a success depends on both successful technical execution and documentation of improved oil recovery. Results from the Ekofisk pilot are expected to be ready in 2025. Large-scale implementation of the method will be assessed later.

The figure and diagram describe the pilot project on Ekofisk. The plan is to inject low salinity water in an already existing injection well, after which a sidetrack will be drilled 30 metres away from the latter. Data and cores will be collected from the sidetrack. Water saturation will be measured via well logs.

New methods yield better subsurface data

Good imaging of the subsurface is essential in order to identify and describe oil and gas accumulations. This is achieved through geophysical measurement methods where seismic imaging is crucial, while electromagnetic methods and other technology can be valuable supplements.

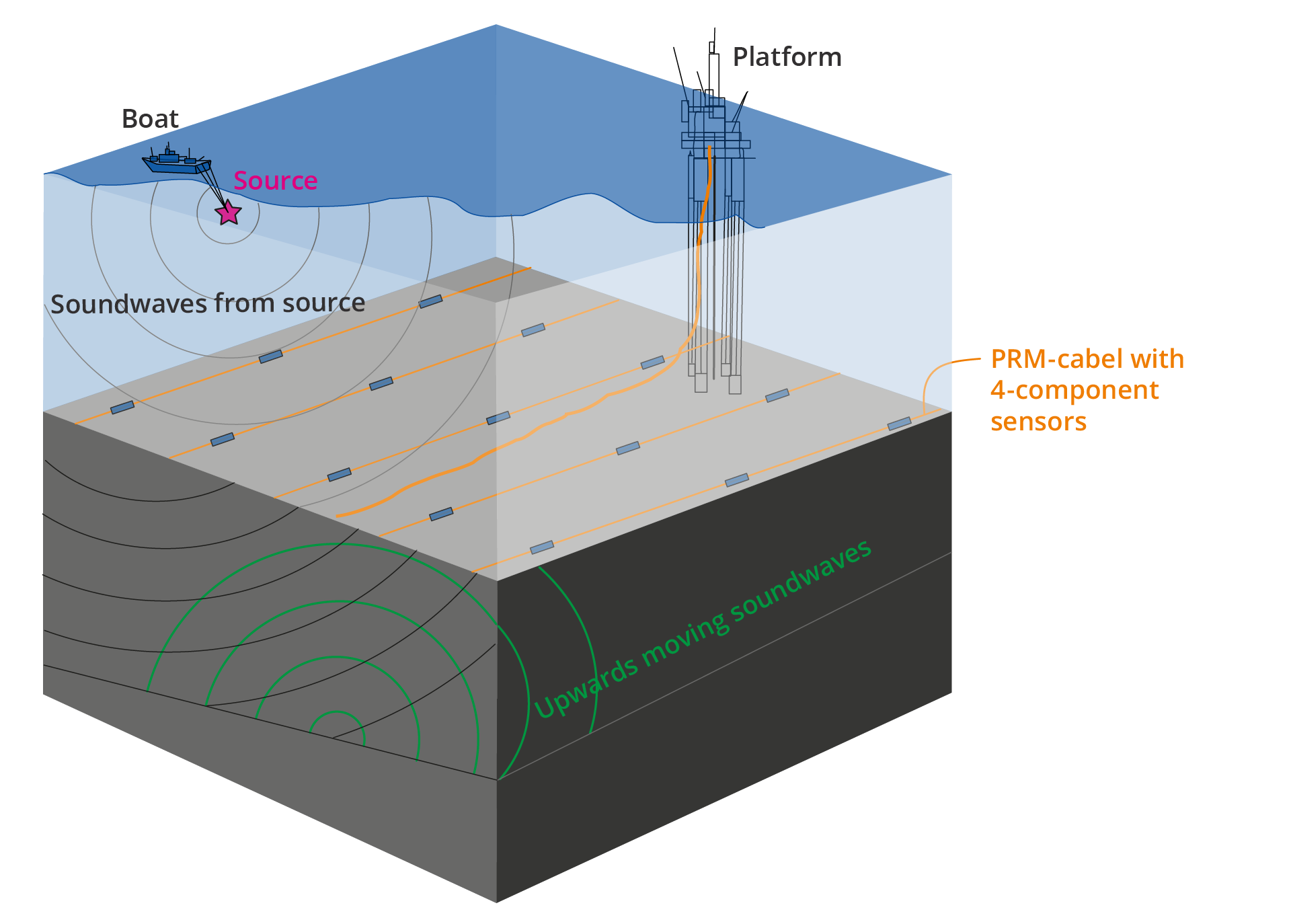

Good subsurface imaging and the ability to monitor changes over time are important to achieve efficient recovery of hydrocarbons. 4D seismic is carried out to evaluate whether there are changes in the reservoir as a consequence of production or injection over time. Technological development within 4D seismic is contributing to more effective reservoir monitoring, including permanent reservoir monitoring technology.

4D seismic can be carried out in three different ways: Cables with acoustic sensors (and fibre) that are either permanently placed (PRM), temporarily deployed seabed nodes or streamers that are towed through the upper layers of water. During data collection, vessels are used to tow airguns (sound sources) over the area.

The new methods collect data with denser sensor coverage that yields better imaging. The seismic images are available faster thanks to more powerful computing and better processing solutions. In 2024, there were seven fields on the NCS with permanent reservoir monitoring installed, including Grane.

Permanent reservoir monitoring on the Grane field

Permanent reservoir monitoring (PRM) on the Grane field started in 2014. The seismic cables are buried in the seabed at 300-metre intervals and are placed close up to the production platform. One disadvantage of towed cables (streamers) is that they need to maintain a certain distance from installations, which means poorer data coverage in an area around the installations.

Sketch of the permanent reservoir monitoring setup. The seismic cables with sensors (4C) are buried in the seabed at 300 m intervals between the cables and 50 m intervals between the sensors along the cables. The platform communicates with the seismic cables via a lead-in cable. When seismic is collected, the boat tows a sound source via a pre-determined grid over the area with nodes. The sensors detect reflections from the surfaces in the subsurface reservoir, and forward the signals to the platform.

Next generation production systems

A large number of subsea developments will be phased into existing infrastructure over the next few years. The field developments of the future include unmanned processing installations and subsea developments that require technological development within next generation production systems, including technology for separation, injection, seabed compression and electric underwater systems.

Standardisation of subsea developments by implementing electric vertical Xmas trees (eVXT)

Electrification of Xmas trees has been developed from a long-standing concept to fully developed equipment that is now ready for use in the first field developments. This equipment lowers the threshold for tie-backs to existing fields, as minimal platform modifications are needed to bring the production on board.

Technology

This cutting edge electrical technology reduces infrastructure needs for both subsea installations and platforms. This was achieved by removing the current hybrid solution, which requires both hydraulic and electrical distribution to drive the systems. The technology is based on a fully-electric system, where valves are powered by electric motors/gear systems operated by a control system that uses local batteries as an energy source.

Standardisation

The operators that developed electrically-powered Xmas trees have standardised the technical requirements. The result is an actuation system that can be used on all Xmas tree platforms, regardless of water depth and application.

Project implementation and operation

Fully-electric subsea technology can reduce both development and operating costs, provide increased accessibility, open the door for new operating models and facilitate digitalisation. Implementation of this standard will also result in removing hydraulic systems for operating Xmas tree systems, fewer and planned intervention activities due to higher redundancy and continuous monitoring.

Digitalisation and AI

Incredibly rapid development has also taken place within digitalisation and artificial intelligence (AI). AI can help process seismic data faster, interpret it automatically or analyse enormous volumes of data at super speed. This can be helpful in both analyses and modelling of geological data, further increasing the likelihood of making new discoveries while reducing costs.

The Norwegian Offshore Directorate supports the digitalisation efforts, in part by making it easy to access information and data for all phases of the business. It further delivers facts and expert knowledge to other authorities, the industry and society at large.

Market failure (see chapter 5) could lead to insufficient sharing of data and thus possibly an inability to realise the full value potential that can be achieved by sharing data.

The Directorate’s efforts to collect and make data and information available to the public has given the NCS a competitive advantage compared with many other petroleum producing countries, where access to data is more challenging.

This is also beneficial for the industry at large. A report prepared by Menon Economics(40) on assignment from the Directorate found that licensees and operating companies are achieving annual gains in the order of NOK 1.5 billion through savings in time and resources alone.

Advancements in, and testing of new technology can contribute to more effective utilisation of the extensive database gained from the NCS. The Norwegian Offshore Directorate plays an active role in this work.

AI-Nina

The Norwegian Offshore Directorate has a long-standing desire to explore the potential of artificial intelligence. The technology company Fabriq has developed a pilot that uses the database for relinquishment reports and well results.

AI-Nina was launched in May 2023. This is one of the first solutions targeting the energy industry to use Large Language Models (LLM) to find and use information in documents. AI-Nina uses such an LLM alongside new search technology to get precise answers when users direct questions to this artificial intelligence.

AI-Nina responds to questions in Norwegian or English. The answers are based on the content of the solution’s underlying database. All answers come with references to sources and links to documents containing the origin of the answer. Today, this solution is isolated from other external services such as ChatGPT, which means that the questions asked will remain inside the solution.

The first version of AI-Nina operated with a database containing well data from the Norwegian Offshore Directorate, as well as relinquishment reports. This allows the user to interact with more than 600 relinquishment reports, each of which contains a summary of all the work done in the licence.

A new version of AI-Nina is in the pipeline, with the option of asking more complex questions that cannot be answered with the aid of a single source document. The goal is a solution that can provide users with even more valuable information obtained from unstructured sources.

Significance of digitalised microplankton for both business and academic communities

Equinor has started using "self-supervised learning” on paleontological data to crack the microplankton code. Equinor achieved this with the aid of digital copies of palynology slides the Norwegian Offshore Directorate has made available via the Diskos database(41).

Ever since the first well was drilled on the NCS, the petroleum industry has used microfossils to interpret the age and sedimentary environment of the rocks penetrated by drilling. The Norwegian Offshore Directorate has extensive physical archives of biopolymer-microfossils in the form of more than 100 000 palynology slides. These were produced from samples of drill cuttings and core samples taken from more than one thousand exploration, delineation and development wells.

From the perspective of the companies, there is always a need for new analyses of biostratigraphic data in light of new geological knowledge. This is why the Norwegian Offshore Directorate has lent out parts of its palynology archive to industries and universities since the early 1980s, as part of the Directorate’s mandate to release uninterpreted data.

Sharing palynology slides is a time-consuming and inefficient ways. The Norwegian Offshore Directorate has therefore cooperated with researchers within pathology and cytology, resulting in acquisition of the world’s fastest robot scanner for palynology slides. This was the origin of the Avatara-p project, "Advanced augmented analysis robot for palynology".

Through the Avatara project, the Norwegian Offshore Directorate has realised the world’s first public archive of digital microscope slides for fossil microplankton, pollen and spores. Eventually, it will be possible to download the entire dataset, currently 50,000 slides, from Diskos. With an optical resolution of 4000 pixels per millimetre, access to and analysis of digital microfossils will surpass traditional optical analyses in a few years time.

The significance of the Avatara project for palynological analysis of digital slides is on the rise in Europe. To date, five universities in Northern Europe have started using the digital slides as a basis for teaching palynology as well as research material for master’s and PhD theses. Two operating companies on the NCS and two consultant laboratories have developed machine learning software for electronic analysis and interpretation of the avatar data.

One example is Equinor’s "Scampi" program (Species Classification Automation for Microfossil Photomicrograph Images), which uses artificial intelligence in the form of deep neural networks and content-based image retrieval, to facilitate rapid and reliable identification of microfossils.

Exploration creates enormous value

The Norwegian Offshore Directorate has conducted an analysis of exploration activity over the last 20 years (2004–2023). The study shows that exploration for oil and gas helps create enormous value for the Norwegian society. Exploration activity has been profitable in all parts of the NCS.

All exploration investment from this period has already been offset by the resulting discoveries that have come on stream. They will continue to yield returns as even more fields come on stream. Total net present value from discoveries during this period is estimated at more than three times the initial exploration costs.

Despite fewer major discoveries and lower resource growth in the period from 2014–2023, the study indicates good profitability in this same period. For the last five years in particular, 2019–2023, the value of exploration has increased following good results in areas near existing infrastructure. The analyses also show that, over time, exploration activity is dependent on making major discoveries. Major discoveries provide significant value contributions and are important for establishing new infrastructure in emerging areas, thus making it possible to develop minor discoveries as well.

Method and assumptions

The profitability analysis is based on revenues from discoveries made during the period from 2004 to 2023, excluding all costs. The income base does not include resources in resource class 6, where production is deemed unlikely.

Costs include both exploration that has resulted in discoveries and exploration that has failed to prove resources. The income and cost data are based on historical figures until 2023, while future prices and forecasts are largely based on the 2024 Revised National Budget (RNB).

Revenue and cost flows are discounted to the same year (2024), where a 7 per cent future discount rate has been applied, as well as a 4 per cent historical discount rate (Vista Analyse, historical profitability, 2022(42)).

The profitability analysis shows the direct financial impact of exploration activity. Indirect financial impacts for associated activities and sectors are not included. Indirect impacts are commonly referred to as ripple effects.

Value creation from exploration through extended production on existing fields is not included in the analysis.

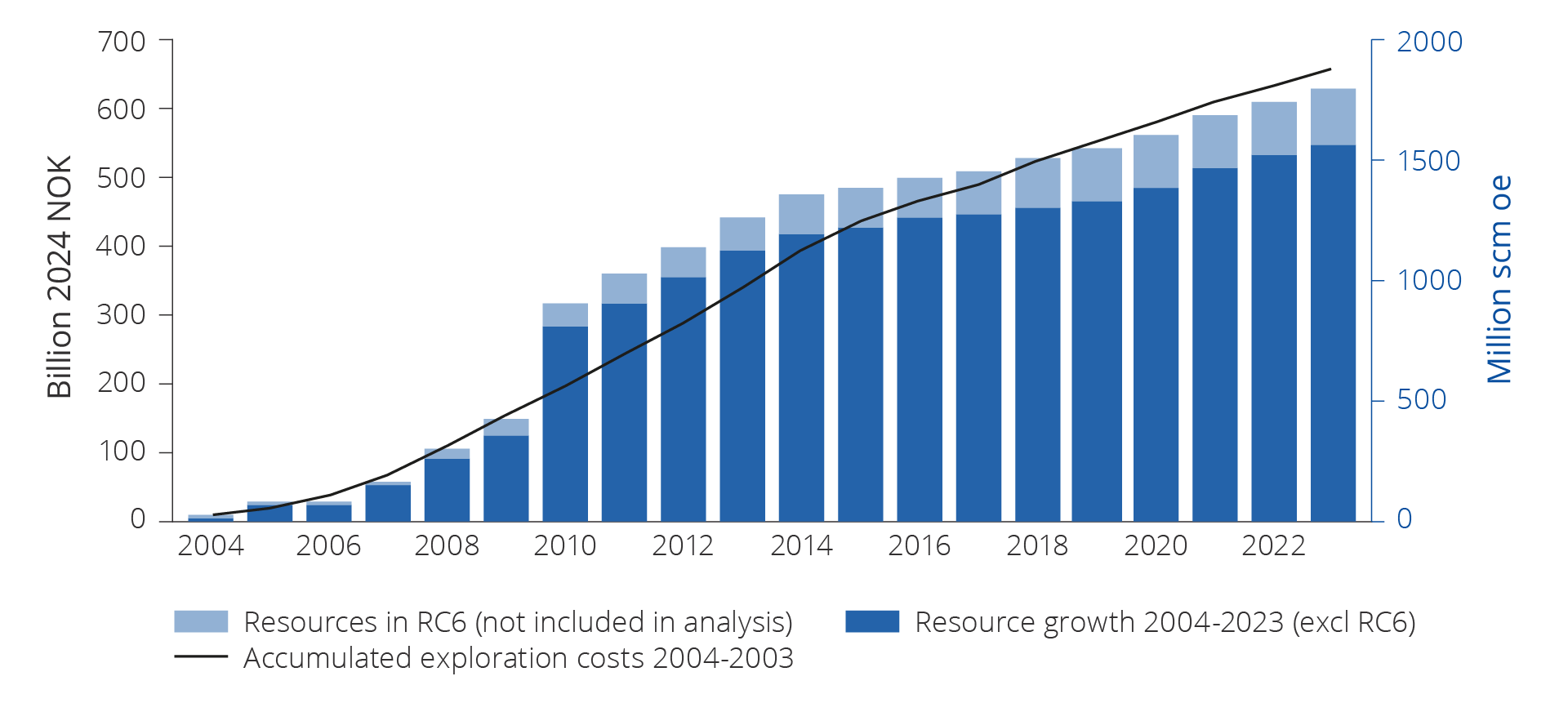

Investment in exploration and resource growth

During the period from 2004–2023, around NOK 660 billion were invested in exploration for oil and gas on the NCS, illustrated in Figure 6.1. This has resulted in more than 300 discoveries which in total amount to a resource growth of around 1800 million scm.

Production is considered unlikely for 110 of these discoveries (just over 200 million scm) (resource class 6). In other words, 190 of the discoveries correspond to just under 1600 million scm.

Figure 6.1 Exploration costs and resource growth from 2004 to 2023.

Creating value from exploration

The Norwegian Offshore Directorate has estimated that the total net cash flow for exploration activity in the period from 2004–2023 is around NOK 3800 billion.

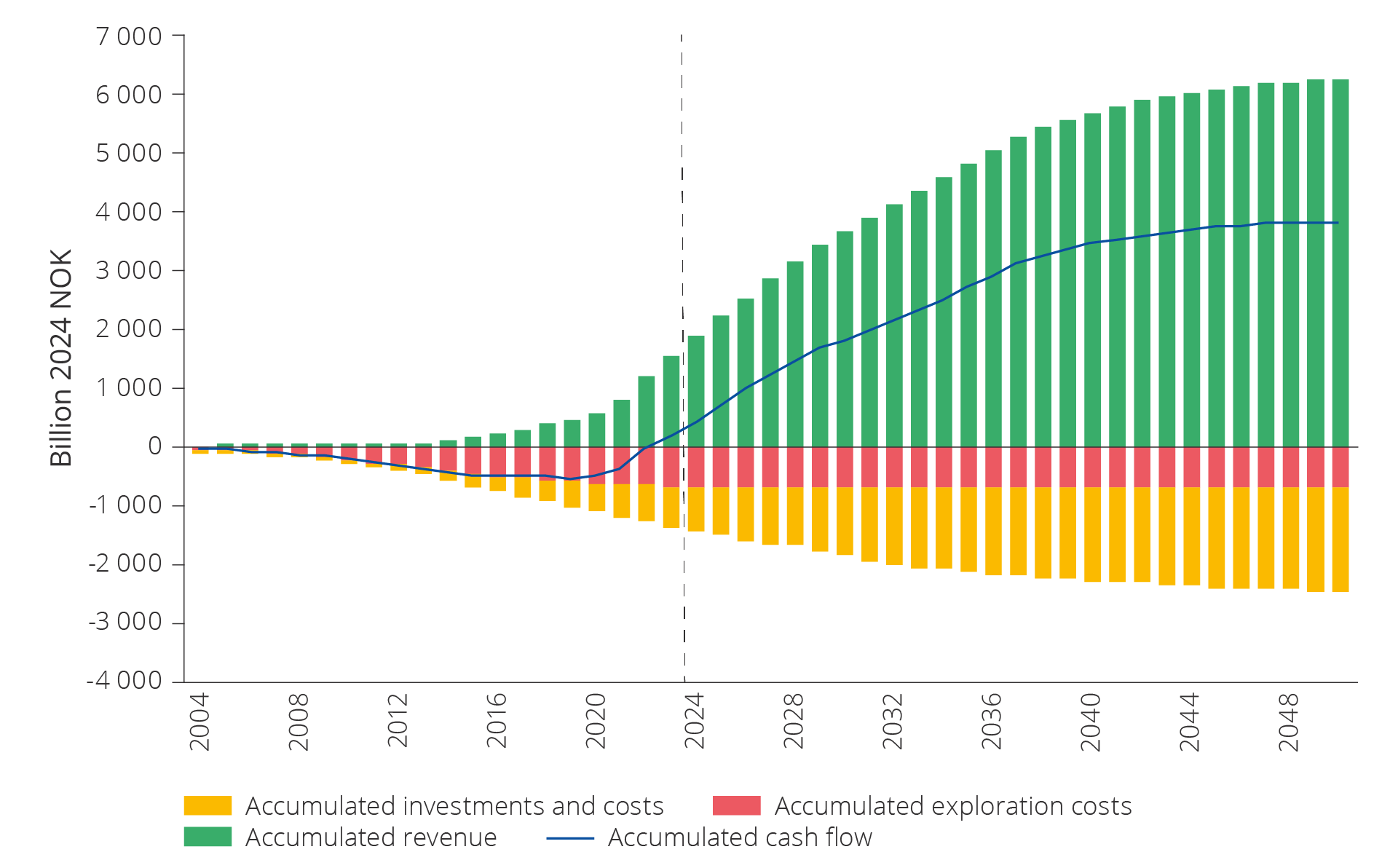

Up to 2024, around 50 of the 190 discoveries have been developed and are producing. Revenues from produced volumes to date are higher than all costs incurred, including exploration costs as shown in figure 6.2. About three-quarters of the resources discovered in the period have yet to be produced.

Figure 6.2 Accumulated cash flow up to 2050 from exploration in the last 20 years (2004–2023)

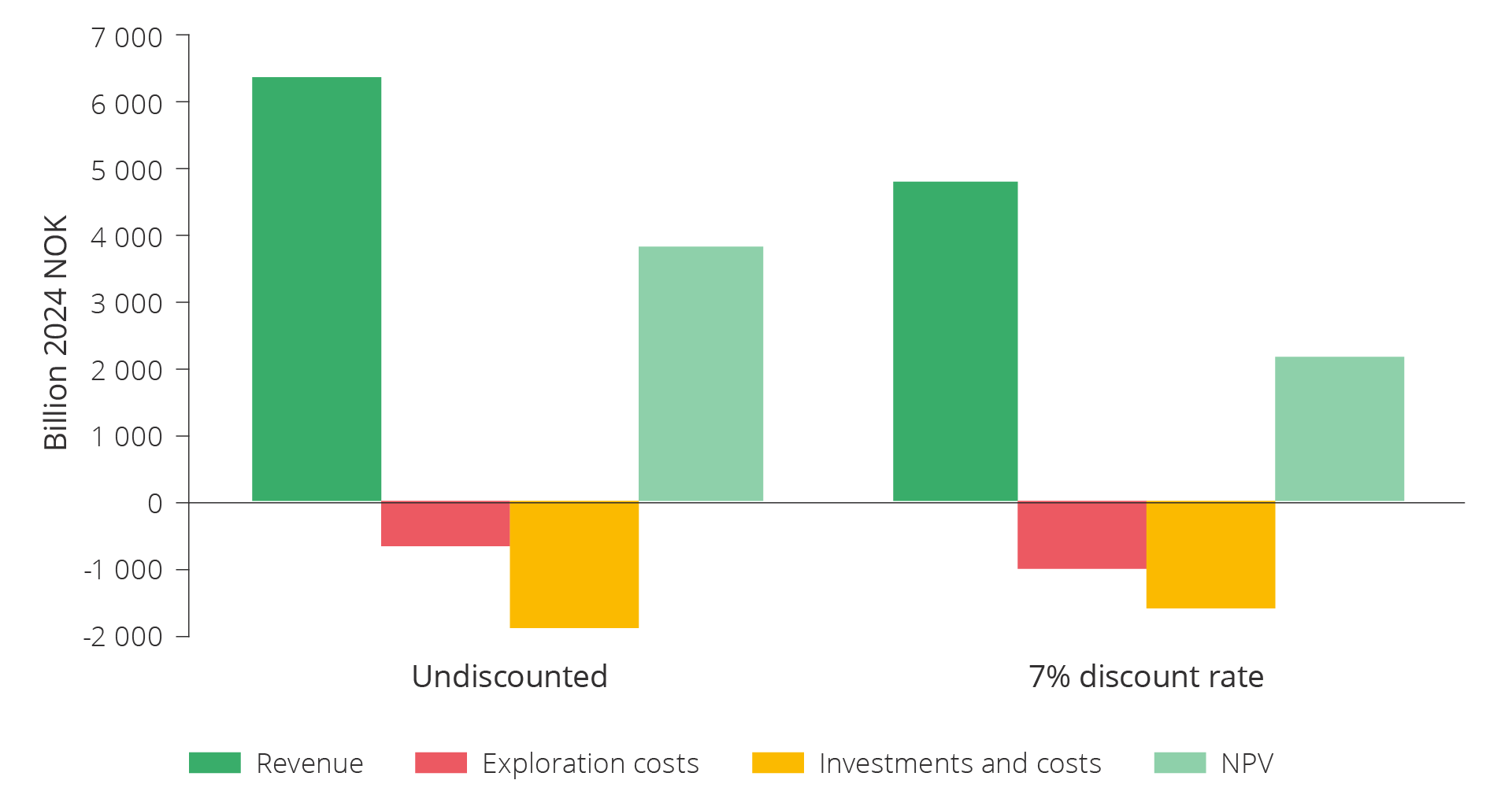

Total investments in development, operation and shutdown in the period from 2004–2050 for discoveries made from 2004–2023 are estimated at around NOK 1900 billion. Total revenues from discoveries during this period are estimated at around NOK 6400 billion.

If exploration costs for the period from 2004–2023 and operating costs for the period from 2004–2050 are deducted, an overall net cashflow of around NOK 3800 billion is realised.

With 7 per cent discount of future cashflow, this yields a net present value of more than NOK 2000 billion as illustrated in figure 6.3.

Figure 6.3 Value creation from exploration in the last 20 years (2004–2023).

Profitability per NOK spent on exploration

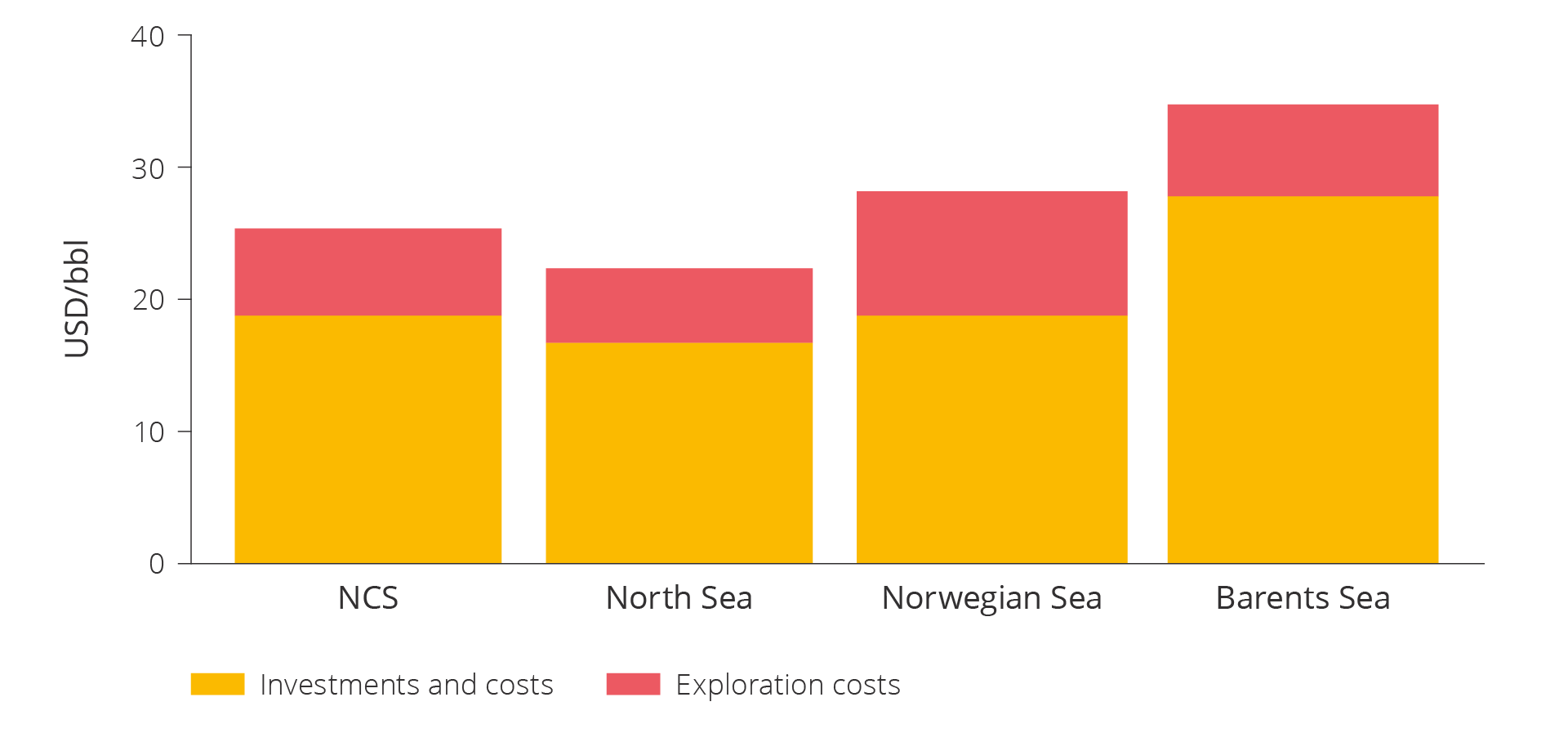

Exploration has proven to be profitable in all petroleum producing areas along the NCS. Figure 6.4 illustrates profitability per krone spent on exploration for the entire NCS, and for the various areas. Total value from discoveries made on the NCS during the period from 2004–2023 amounts to more than three times the costs spent on exploration during the same period.

The value of discoveries made in the North Sea is more than four times the exploration costs, while the value of discoveries in the Norwegian Sea and the Barents Sea is 1.8 and 1.5 times the exploration costs, respectively.

These are values where all costs have been deducted, including exploration costs, and calculated with a 7 per cent discount rate. If the profitability per krone spent on exploration is 1, this means that exploration investments are repaid with a 7 per cent rate of return.

Figure 6.4 Profitability per NOK spent on exploration in the various regions over the last 20 years (2004–2023).

The North Sea has seen high resource growth, and several major discoveries have been made. With economies of scale, well-developed infrastructure and low unit costs, this yields high profitability per krone spent on exploration.

The resource growth has been lower in the Norwegian Sea, fewer major discoveries have been made. The analyses nevertheless show that coordinated developments of multiple minor discoveries and cost-effective phase-ins have contributed to good profitability per krone spent on exploration also in the Norwegian Sea.

In the Barents Sea, exploration has led to high resource growth and several major discoveries, but considerable investments have also been made to establish new infrastructure in the area.

Unit costs

Total costs from exploration, development, operation and shutdown per producible unit from discoveries during this period yields an average undiscounted unit cost of about USD 25 per barrel.

Unit costs vary from project to project and depend, among other things, on discovery size, reservoir quality, development concept and distance to infrastructure.

The North Sea has the lowest unit costs at about USD 22 per barrel, while the Barents Sea has the highest at about USD 35 per barrel. Unit costs are about USD 28 per barrel in the Norwegian Sea.

This figure shows unit costs for exploration, development, operation and shutdown for discoveries 2004–2023 per region.

Significance of major and minor discoveries

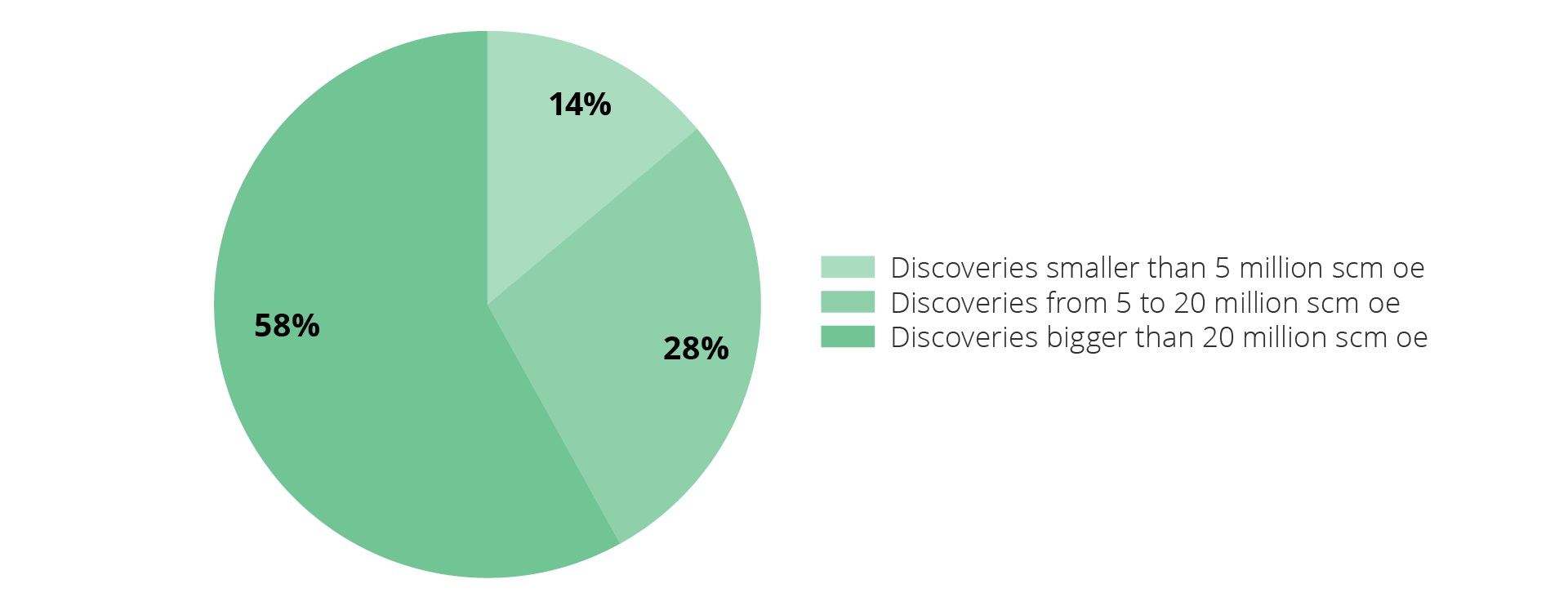

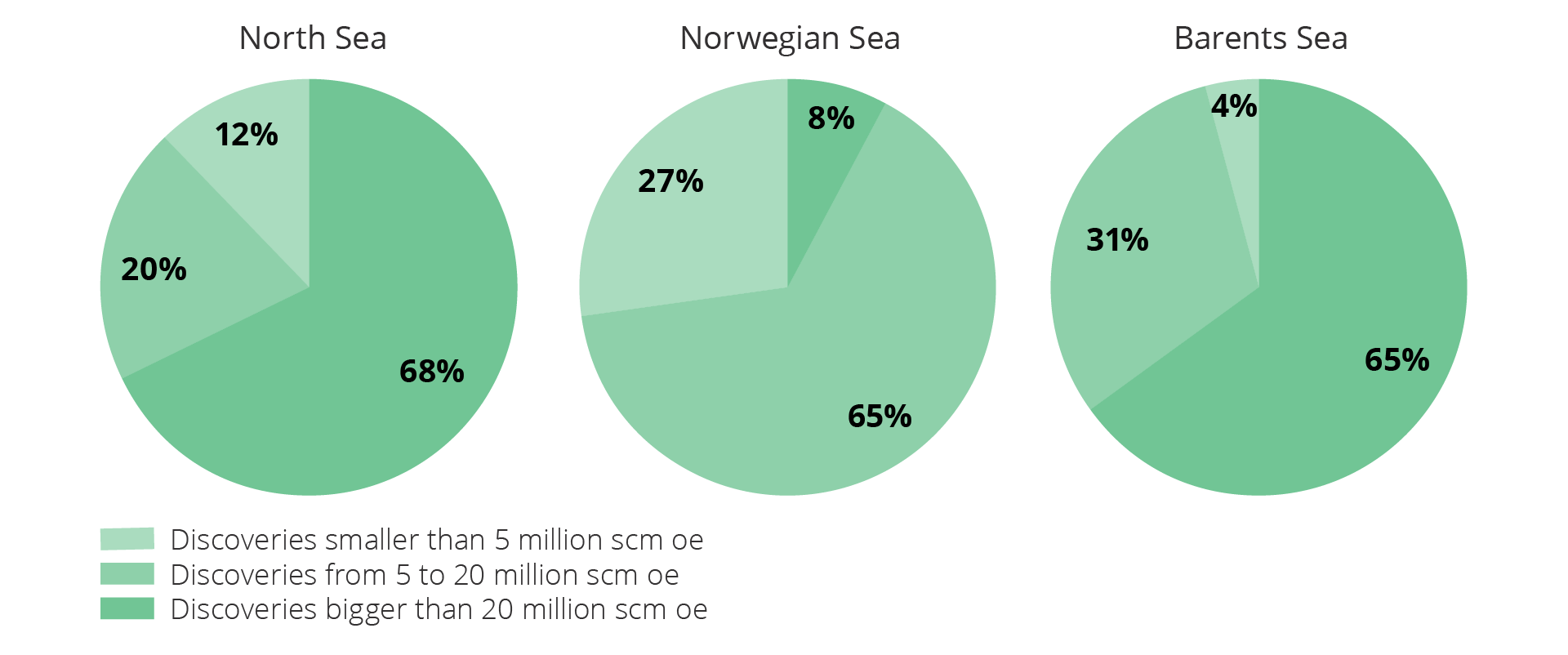

A total of 9 discoveries have been made that are exceeding 20 million scm oe. In total, these discoveries account for close to 60 per cent of the present value contribution from exploration during this period as highlighted in figure 6.5. In addition to providing significant value contributions, several of these discoveries are important for developing infrastructure and for other discoveries in the surrounding areas.

Figure 6.5 Present value contribution from different discovery sizes.

The other 181 discoveries are smaller than 20 million scm oe and constitute a total of more than 40 per cent of the present value contribution. Despite more than 110 of them being less than 5 million scm oe, they account for 14 per cent of the present value contribution.

Figure 6.6 compares present value contributions for different discovery sizes across the NCS. Discoveries larger than 20 million scm oe are very important for profitability, both in the North Sea and the Barents Sea, and account for about two-thirds of the present value from these areas. In the Norwegian Sea, discoveries smaller than 20 million scm oe account for more than two-thirds of the present value creation.

Figure 6.6 Present value contribution from different discovery sizes per region during the 2004–2023 period.

Very profitable exploration over the last five years

Figure 6.7 shows profitability per krone spent on exploration for the entire NCS from discoveries made during the period from 2014–2023 and between 2019–2023 (the last ten and five years).

The value of the discoveries made over the last ten years, is about 1.3 times higher than the exploration costs. About 100 discoveries have been made during this period with an average discovery size of less than 5 million scm oe.

Over the last five years, the value of discoveries is more than twice the exploration costs. This means that the profitability in exploration has been higher over the last five years than the last ten.

Several of the discoveries over the last five years are highly profitable because they can be phased into existing infrastructure in a timely manner. Discoveries in the Troll area are particularly good examples of this.

Phasing new resources into existing fields can also lead to longer lifetimes for the infrastructure and increase the value of tail-end production. This effect is not included in the profitability analyses.

Figure 6.7 Development in profitability per NOK spent on exploration over the last ten (2014–2023) and last five years (2019–2023).

Gas infrastructure is important for extracting value from remaining resources

It is important to explore for more gas in order to maintain gas production and exports over the long term. Nearly two-thirds of the undiscovered gas resources are expected to be located in the Barents Sea. Significant gas resources and values could be stranded without increased export capacity from this petroleum province.

The Norwegian gas transport system

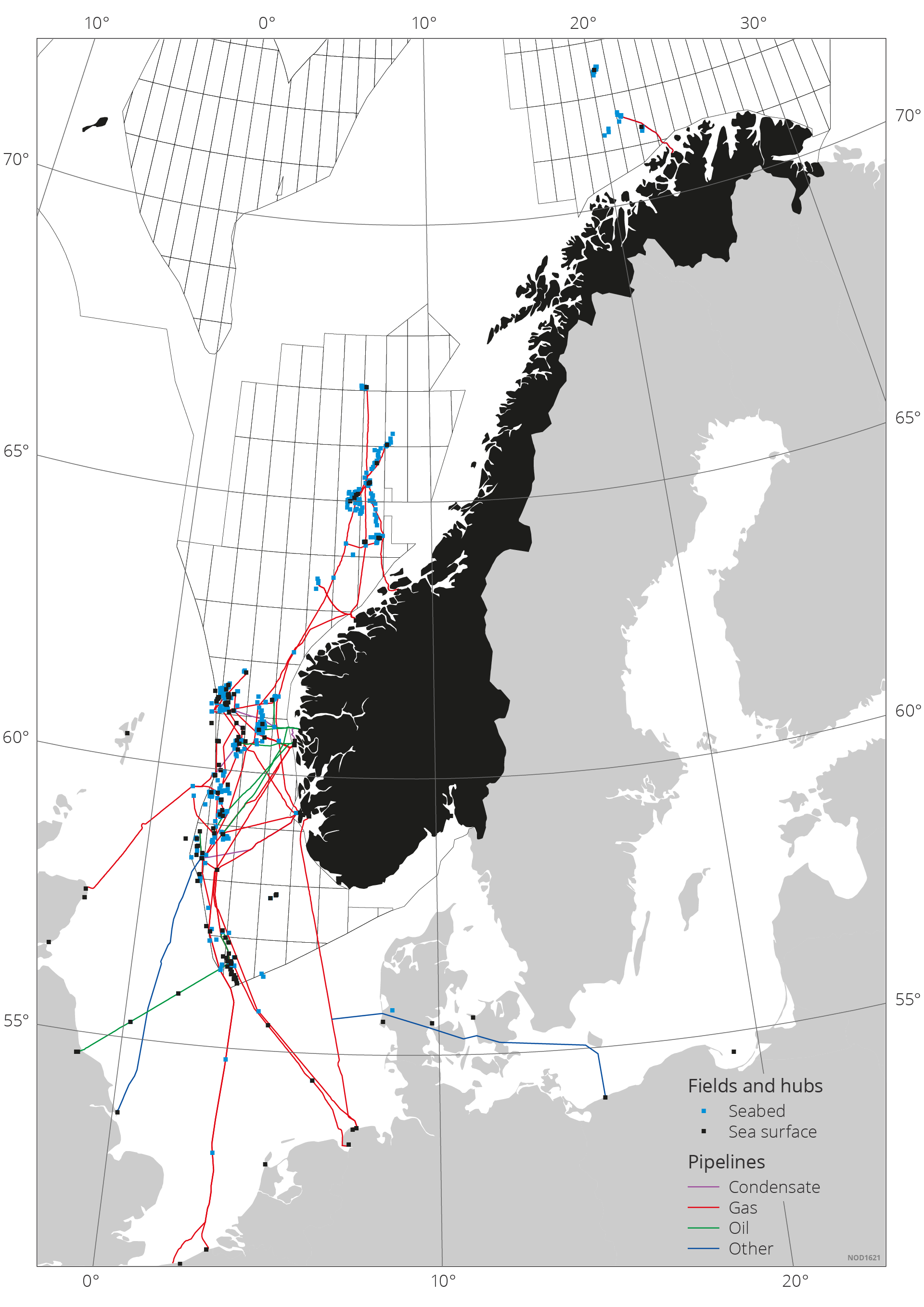

The Norwegian gas transport system consists of a network of more than 8000 kilometres of pipelines, three large process facilities in Norway and multiple receiving facilities in other countries. Figure 4.8. shows gas from the Snøhvit field is exported using ships from the LNG plant on Melkøya outside Hammerfest.

The North Sea and Norwegian Sea have well-developed gas infrastructure and export capacity, and there is expected to be available capacity moving forward. This lowers the threshold for exploring for and developing gas discoveries. Available capacity also increases the companies' interest in exploration for smaller gas accumulations if unit costs and tariffs in the infrastructure are kept low.

The system has high regularity and provides significant flexibility for users in choosing landing points for gas. In addition to market proximity, this means low transport costs and in return represents a major competitive advantage for Norwegian gas.

The authorities regulate access to the system and ensure that access to capacity is available for anyone who needs it, on reasonable terms. Gassco is the operator and is assigned the roles of neutral capacity administrator and architect for further system developments Gassco's role as architect covers all relevant export solutions for gas. The Norwegian Offshore Directorate assists Gassco in its role as architect and helps ensure the development of good, long-term gas infrastructure solutions.

Large parts of the licences in Gassled have licence periods that expire in 2028, and the state has the right of reversion when the licence periods expire. Some plants do not have explicit licence periods. The state aims to exercise its right of reversion when the licence periods expire and ensure 100 percent state ownership of key parts of the Norwegian gas transport system.

When the takeover potentially requires remuneration, the Ministry presumes that such remuneration will be based on the owners' expected future net income. Transitioning to 100 percent state ownership is presumed to be value-neutral for the state. This means that the state's ownership costs for the system will be covered in their entirety by future tariff revenues.

The aim is to continue the fundamental characteristics of how the system is regulated beyond 2028. Gassco is presumed to remain the operator. The tariffs will be cost-based. Any investments in new gas infrastructure will still be driven by the commercial players and their need for gas transport.

Gassled

Gassled was established on 1 January 2003, when the majority of transport systems were merged into a new, large joint venture.

Gassled consists of the onshore plants at Kårstø and Kollsnes, as well as the pipeline systems that connect producing fields in the North Sea and parts of the Norwegian Sea to these facilities and/or further transport to the United Kingdom and mainland Europe.

As of May 2024, Gassled's ownership configuration is as follows: Petoro AS (46.697 percent), CapeOmega (26.322 percent), Hav Energy NCS Gas AS (15.553 percent), Silex Gas Norway AS (6.428 percent) and Equinor Energy AS (5.000 percent).

Figure 6.8 The figure shows transport systems (pipelines) and receiving facilities in the United Kingdom, Netherlands, Germany, Denmark and Poland. There are no pipelines between the Norwegian Sea and Barents Sea.

Limited gas export capacity in the Barents Sea

Gas export capacity in the Barents Sea is limited to the LNG plant on Melkøya outside Hammerfest. The plant is fully booked with production from the Snøhvit field until about 2040.

There are multiple fields and discoveries in the Barents Sea in need of gas offtake. The development of already proven oil and gas resources is dependent on building more infrastructure both within and leading out of the area. Greater export capacity will also provide incentives for gas exploration. At the same time, a prerequisite for new infrastructure is often that more resources need to be discovered (see network effects under market failure in chapter 5).

Gassco and the Norwegian Offshore Directorate have conducted analyses over multiple years of whether or not there is a socio-economic basis for increased gas export capacity from the Barents Sea.

Earlier studies on the basis for increased export capacity from the Barents Sea

In 2012, Gassco published the study "NCS 2020", in which one of the observations was that there was a basis for a pipeline solution from the High North. It was pointed out that a potential pipeline from the Barents Sea should have relatively high capacity in order to facilitate potential future volumes and thereby create a basis for further developing the High North as a petroleum province(43).

In 2014, Gassco published the study "Barents Sea Gas Infrastructure", which pointed out that resources in the Barents Sea could play a key role in maintaining Norwegian gas production beyond the 2020s. One prerequisite for success was cooperation across production licences in the area, as no individual production licences were able to bear considerable new gas infrastructure investments on their own(44).

In 2020, Gassco published a new study in cooperation with the Norwegian Offshore Directorate assessing potential new gas transport alternatives from the Barents Sea(45). The report pointed out that it could be socio-economically profitable to invest in new gas export capacity. The study also pointed out that a socio-economically profitable increase in gas transport capacity from the Barents Sea could be a key factor in further developing the region as a petroleum province. This would make it possible to maintain Norwegian oil and gas production at a higher level into the future.

In 2023, the Ministry of Energy asked Gassco to update the study from 2020 and reassess alternatives for increased gas transport capacity from the Barents Sea. Gassco delivered an updated report in April 2023(46). This report concludes that increased gas exports from the Barents Sea South will be profitable for society at large. Several of the alternatives appear to be profitable. Of these alternatives, a new dew point control unit (DPCU) and pipeline down to the existing gas pipeline network in the Norwegian Sea appears to be the most profitable. Such a solution can also contribute to an area solution in the Barents Sea South with the flexibility to handle potential additional resources and upsides, and thereby contribute to sound resource management.

The analyses show that solutions, that make it socio-economically profitable to increase gas export capacity from the Barents Sea, exist.

A profitable increase in export capacity will provide opportunities to accelerate the production of gas from fields in the area, make it possible to develop minor gas discoveries and make exploration more attractive. The earlier an increase in export capacity can be realised, the greater the value of accelerated production and exploration.

A potential pipeline solution from the Barents Sea can connect to the infrastructure in the Norwegian Sea and thereby be incorporated into the established gas infrastructure network. Gas from the north can help keep the overall unit costs down. The gas infrastructure network in the south will have significant available capacity in the near future to take in potential gas from the north.

Measures to curb greenhouse gas emissions

In 2023, greenhouse gas emissions from the petroleum sector accounted for about one-quarter of Norwegian emissions. These emissions must be reduced significantly in order to reach the national climate targets in 2030. Additional reductions will be needed leading up to 2050. The companies are working to find solutions that can reduce emissions on the NCS by 50 percent by 2030, compared with the level in 2005.

Several major projects, primarily power from shore, have already been approved, and the companies have a number of major emission-reducing measures in the planning stages. Measures that reduce emissions will yield lower environmental costs and can help extend production and field lifetimes.

Emissions from the petroleum sector

Exploration for and production of oil and gas result in greenhouse gas emissions. Emissions from petroleum-related activities in 2023 amounted to about 11.5 million tonnes of CO2 equivalents. These emissions cover all fixed and floating facilities on the continental shelf, as well as associated onshore plants.

Most of these greenhouse gas emissions on the NCS are CO2 (about 96 percent). The emissions are mainly derived from energy generation on production facilities and onshore plants through the combustion of fossil fuels.

Greenhouse gas emission on the NCS

Greenhouse gas emissions from the petroleum sector mainly consist of CO2 and methane. Emissions of volatile organic compounds (VOC) will have an indirect effect through oxidation over time and will have an additional effect equivalent to CO2.

CO2 emissions

About 95 per cent of CO2 emissions in 2023 were from fixed facilities and onshore plants. Five per cent are from mobile facilities, meaning drilling rigs and well intervention vessels that drill exploration and production wells and carry out well maintenance.

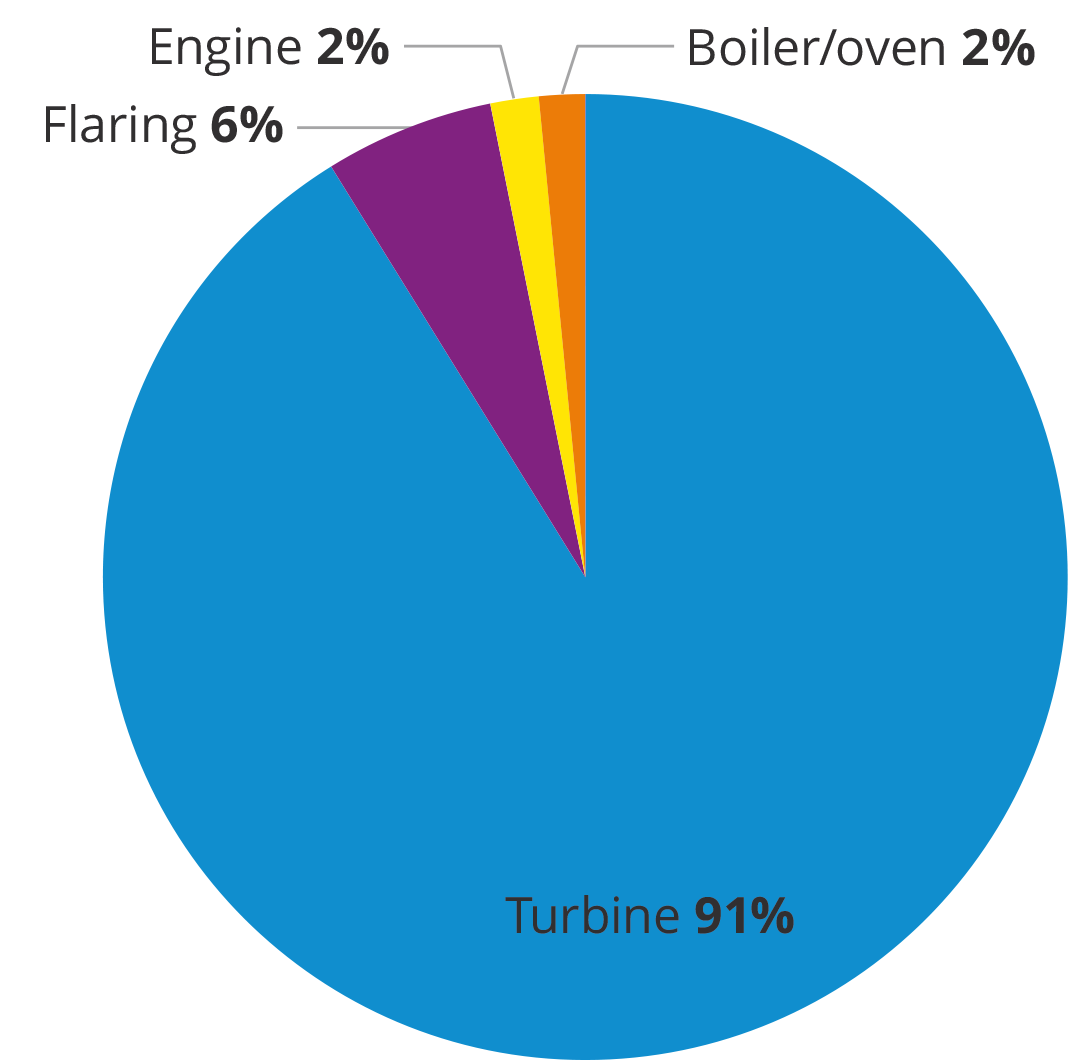

The figure below shows the distribution of CO2 emissions from fixed facilities and onshore plants. Emissions from gas turbines clearly constitute the largest emission source (90 per cent), followed by emissions from flaring (6 per cent).

Sources of CO2 emissions from fixed facilities and onshore plants. Total emissions of 10.2 million tonnes of CO2 in 2023. The onshore part of Kårstø is not included here(48).

The largest source of CO2 emissions on mobile facilities is the consumption of diesel in engines. In 2023, this amounted to about 97 per cent of emissions from these facilities(49).

Emissions of methane and nmVOC (volatile organic compounds)

The three main sources of methane and nmVOC emissions are as follows:

- Unburned gas from gas turbines, engines, boilers and flares

- Gas emission from shuttle tankers in connection with loading oil and gas on the field

- Cold-venting and fugitive emissions from the facilities, also called direct methane and nmVOC emissions.

In 2023, these emissions accounted for less than 4 per cent of greenhouse gas emissions on the NCS (in CO2 equivalents).

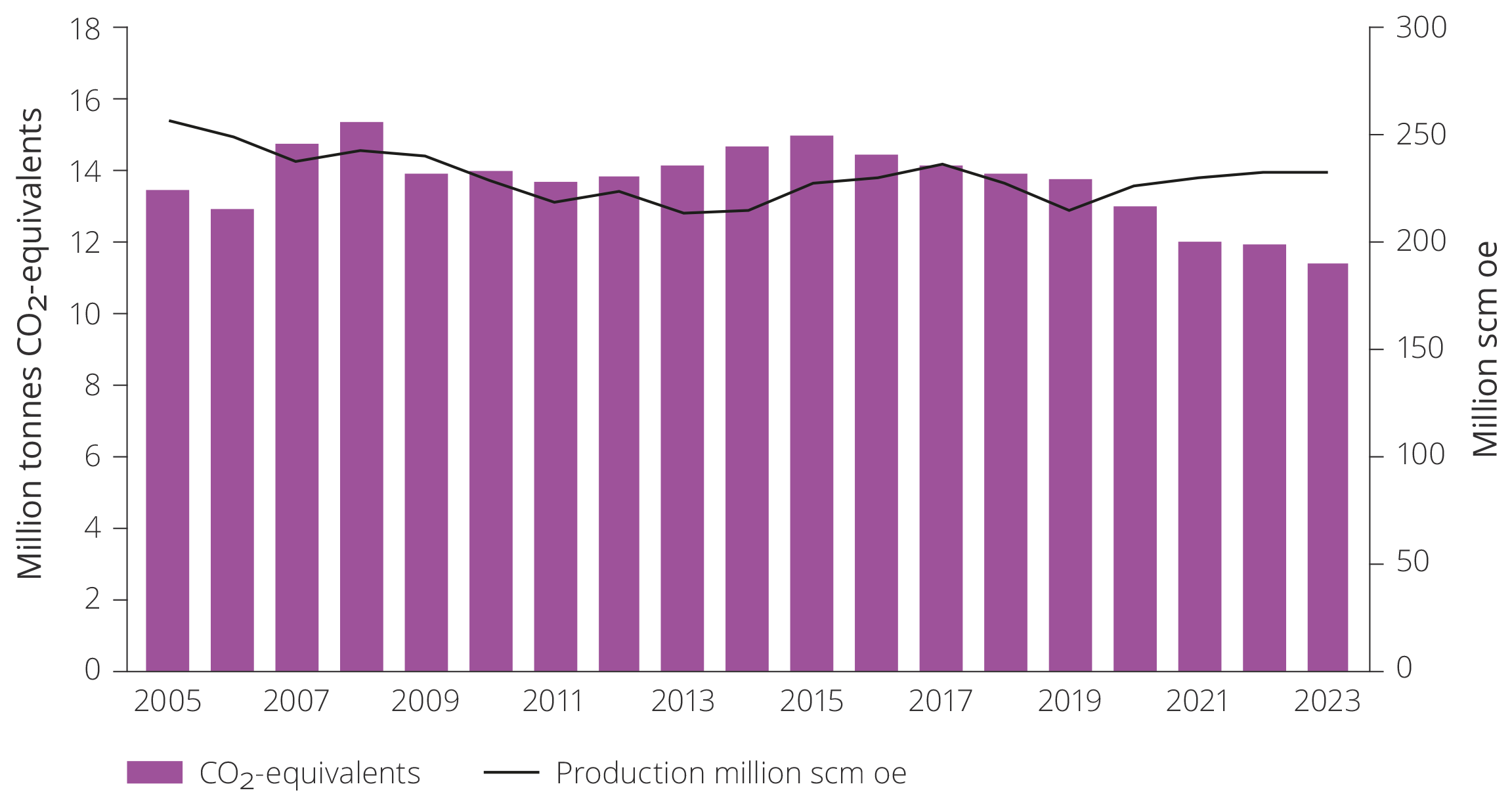

Emissions are declining

CO2 emissions from the NCS have been declining since 2015 in spite of production remaining relatively stable. Total emissions on the NCS as of 31 December 2023 had been reduced by about 24 per cent since 2015 as illustrated in figure 4.9. The primary cause of the decline in emissions since 2015 is that several facilities are now, in whole or in part, being run on power from shore. Emissions are expected to decline further in the years to come, despite a minor increase in production over the short term.

Figure 6.9 Petroleum production and emissions measured in CO2-equivalents.

Norway has multiple climate targets

Climate change is a global challenge that will require effective and goal-oriented measures. The primary goal of climate policy is to reduce greenhouse gas emissions and limit global warming.

- Under the Paris Agreement, Norway has taken on a commitment to reduce greenhouse gas emissions by at least 55 per cent by 2030, compared with the level in 1990. This has also been legislated in the Climate Change Act. Norway can achieve this climate target in cooperation with the EU.

- The Climate Change Act also stipulates that Norway shall be a low-emission society by 2050. The goal is to reduce greenhouse gas emissions in the order of 90–95 per cent compared with emission levels in 1990(50). The assessment of goal achievement must take the impact of Norway's participation in the EU's emissions trading system into consideration.

- Beyond the international binding targets, the Government has a transition target for the entire economy in 2030. This is worded on the government platform as a goal to cut Norwegian greenhouse gas emissions by 55 per cent, compared with 1990.

- As 95 per cent of emissions from oil and gas activities on the NCS are subject to the European emissions trading system, oil companies on the NCS will help reduce emissions subject to emission credits leading up to 2030 on equal footing with businesses in the EU.

- The Government has also set its own targets for emission reductions in the petroleum sector. The goal is for the Government, in cooperation with the industry, to ensure that emissions from oil and gas production on the NCS are cut by 50 per cent by 2030, and to net zero in 2050(51). This is in line with the Storting's (Norwegian parliament's) petition resolution from 2020(52).

- At the industry level, the petroleum sector's ambition is to reduce emissions from oil and gas production by 50 per cent by 2030, compared with 2005, and further to near-zero in 2050(53).

Most licensees also have their own targets to reduce their greenhouse gas emissions.

CO2 tax and emissions trading are the most important measures

The authorities' most important measures to limit greenhouse gas emissions from petroleum-related activities are the CO2 tax and emissions trading system.

Norway introduced a tax on CO2 emissions in petroleum activities in 1991. The statute stipulates that the companies are subject to the CO2 tax when gas, oil and diesel are combusted, and when CO2 or natural gas are emitted. The CO2 tax has increased gradually over time, and in 2024, it constitutes NOK 790/tonne of CO2 emissions.

Petroleum activities were included in the EU's emissions trading system (EU ETS) as of 2008. This means that each tonne of greenhouse gas the businesses emit must be covered by an emission credit. In addition to an initial award of credits in the form of auctions or awards free of charge pursuant to certain criteria, credits can be bought and sold in a second-hand market. The emission credit price is set in the emission credit market and varies over time. The credit price has been subject to greater fluctuations over the past year following a longer period of gradual growth. If one presumes a credit price of EUR 70/tonne (June 2024), this amounts to about NOK 800 per tonne.

If we add the CO2 tax and emission credit price together, they constitute an overall emission cost of about NOK 1600 /tonne, which is very high in an international context. The Government wrote in the Hurdal Platform that the CO2 tax will be increased gradually. This will be considered in the annual budgets.

In addition to the tax and credits for CO2 emissions, there has been a tax in effect on emissions of NOX (nitrogen oxides) since 2007. Emissions from gas turbines, boilers and engines, as well as flaring, are covered by this tax. Tax exemptions are provided for emission units covered by the environmental agreement (NOX fund) entered into between a number of industry organisations and the Ministry of Climate and Environment in 2008. Most businesses in the petroleum sector have chosen to participate in the NOX fund.

The overall environmental cost is a significant expense for fields where energy generation is based on gas turbines. On average, the environmental cost amounts to 30 percent of operating costs for fields that do not receive power from shore. Putting a price tag on CO2 emissions means that the companies have a financial self-interest in implementing measures to reduce these emissions.

Several other policy instruments are employed in addition to emission pricing. Using the best available technology (BAT), power from shore, carbon capture and storage as well as offshore wind must be considered for all new developments or major retrofits. There is also a ban on flaring beyond what is necessary for safety reasons. Support is further provided for research and technology development.

Over time, the various policy instruments have helped ensure that average emissions of greenhouse gases on the NCS are substantially lower per produced unit than the average in other oil and gas-producing regions as discussed in chapter 3, figure 3.4.

Electrification reduces emissions

As the cost of emitting CO2 and the authorities' expectations for emission cuts have increased, the licensees have redoubled their efforts to reduce emissions from the sector. High costs associated with CO2 emissions have, in isolation, increased the profitability of various measures.

Burning gas in gas turbines is the single largest source of greenhouse gas emissions on the NCS. The gas turbines provide electricity for different purposes on the facilities. Process equipment, pumps and compressors frequently run on electricity. Electricity is also used for alarm and control systems, as well as lighting and living quarters purposes. In most cases, this electricity is produced by generators operated by gas turbines on the local installation.

Larger equipment such as compressors for export or gas injection are frequently operated by gas turbines connected directly to the compressor. These are normally the most energy-intensive single units on board.

The facilities will need to be retrofitted to run on power from sources other than gas turbines in order to achieve major emission reductions. The most common solution has been electricity from the onshore power grid, but it is also possible to supply the facilities with electricity from offshore wind or build separate gas-fired power plants with CCS to supply the facilities with electricity. The scope of work and costs associated with such retrofits will depend on how much of the power supply will be replaced with different electricity.

Power from the grid

Electricity transmitted from the onshore power grid is considered to be the best technical solution and most profitable alternative to reduce emissions from gas turbines. Several fields are currently operated, in whole or in part, with power from shore, and multiple projects are under development or in the planning phase. These projects are considered to be more challenging to implement than the projects that have already been greenlit.

Power from offshore wind

The electricity can also come from other sources. Power generation started on Hywind Tampen in 2023. This is a floating wind farm that supplies electricity to the Snorre and Gullfaks fields. The farm consists of 11 wind turbines with an installed capacity of 88 MW. The operator estimates that this wind farm can cover about 35 per cent of its annual need for electricity. This can yield an annual reduction in CO2 emissions of about 200,000 tonnes, compared with when gas turbines covered this entire need.

Wind turbines do not generate electricity when there is too much or too little wind. For this reason, facilities supplied with electricity from offshore wind will also be dependent on an alternative power supply. On Snorre and Gullfaks, the alternative is currently gas turbines. In other words, the emission reduction offered by offshore wind is lower that what is provided by power from shore.

In the Barents Sea, a study is under way to explore the opportunity to connect wind turbines to the power grid using the power from shore infrastructure on the Goliat field. GoliatVIND aims to provide renewable electricity to the Hammerfest region. Since Goliat is already covering its power needs via a cable from shore, the GoliatVIND project will not reduce emissions from the petroleum sector.

GoliatVIND can be developed in 2027–28, given that the project is matured as planned, and the authorities issue a development licence.

Due to high development costs, neither Hywind Tampen nor GoliatVIND are profitable projects without subsidy schemes, and both projects have received support from Enova. Enova's support is anchored in technology development for more renewable energy. This support will also help ensure that Norwegian industry can take part in an international offshore wind market that is expected to grow. Report No. 36 to the Storting (2020–2021) singles out Enova as the primary vehicle for bringing about future Norwegian value creation associated with offshore wind.

Development costs are expected to come down once the projects become larger and the technology becomes mature through technology development, utilising economies of scale and increased volumes.

Power from gas-fired power plants with CCS

Another option for supplying electricity to fields is building gas-fired power plants with carbon capture and storage (CCS). Capturing CO2 from turbine exhaust from existing facilities is challenging due to spatial and weight limitations.

It is easier to build new independent gas-fired power plants where CCS is an integrated part of the solution. Such gas-fired power plants can either be built as dedicated facilities offshore that supply nearby fields with electricity, or they can be built as gas-fired power plants on or near shore. This will require larger investments than electricity from the onshore power grid. Retrofits on the facilities will be equally extensive, but this will also require the construction of a gas-fired power plant and infrastructure to import gas and store CO2.

Electrification of facilities

In 1996, the Storting decided that the companies must present an overview of energy needs and the cost of using power from shore rather than gas turbines in all new field developments.

Several fields are running on power from shore, in whole or in part. This has reduced annual emissions from production by an estimated 3.2 million tonnes of CO2. The Johan Sverdrup, Troll, Gjøa, Goliat, Valhall, Edvard Grieg, Ivar Aasen, Gina Krog, Sleipner Øst and Martin Linge fields currently receive power from shore.

The Kårstø, Kollsnes, Melkøya LNG and Nyhamna plants also receive electricity from the power grid, in whole or in part. Additional electrification projects are under way on Melkøya and on Troll. Power from shore is also being established on the Oseberg Field Centre, Oseberg Sør, Njord, Draugen and fields in the Yggdrasil area.

Hywind Tampen is supplying Gullfaks and Snorre, and is the world’s first floating offshore wind farm to supply electricity to oil and gas platforms. Power generation from the first turbines started in 2022, and the project was completed and reached full capacity in 2023.

Studies are also under way for power from shore retrofits on multiple fields on the NCS. It applies for the North Sea, Norwegian Sea, as well as additional electrification of the onshore plant at Kårstø.

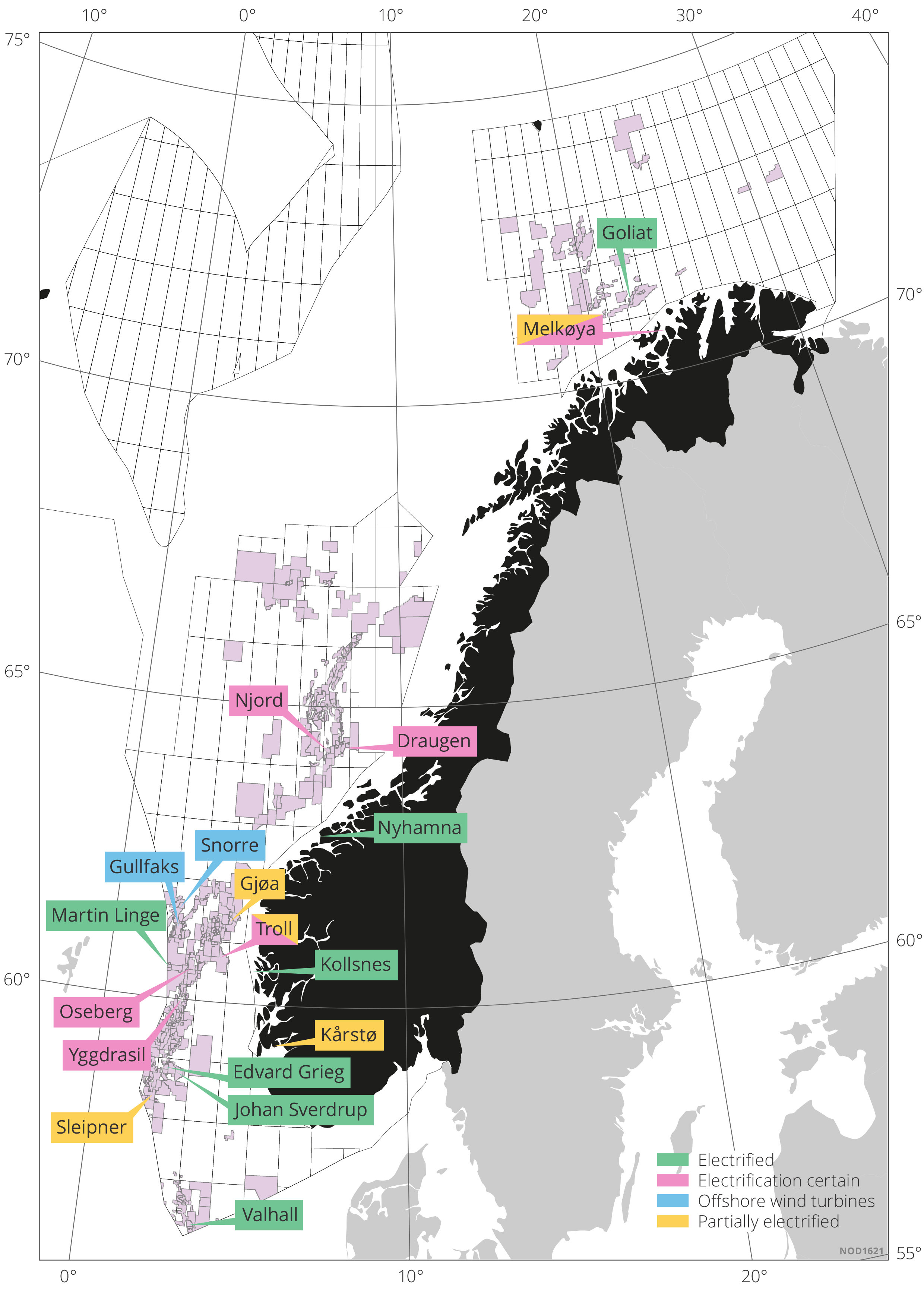

This map shows facilities that receive power from shore. Fully electrified facilities are indicated in green, and partially electrified facilities are indicated in yellow. Fields where full or partial electrification decisions have been made are indicated in pink. The Snorre and Gullfaks fields are partially supplied with power from offshore wind (Hywind Tampen) (blue). In this context, full electrification means that the fields or onshore plants do not use gas turbines to generate power.

Future emissions

How future emissions will evolve will depend on developments in production and activity levels in the petroleum sector, including the number of facilities and onshore plants as well as emissions from these sources.

From a forecasted production peak in 2025, we expect a gradual decline in production over time, despite the uncertainty associated with how quickly production and activity will decline, which was also discussed in Chapter for under potential scenarios. Over time, this will result in fewer producing facilities, which will reduce emissions. In addition to this, new measures to replace turbine-generated electricity with other sources will further reduce emissions from production. Beyond this, there will be measures that address other emission sources.

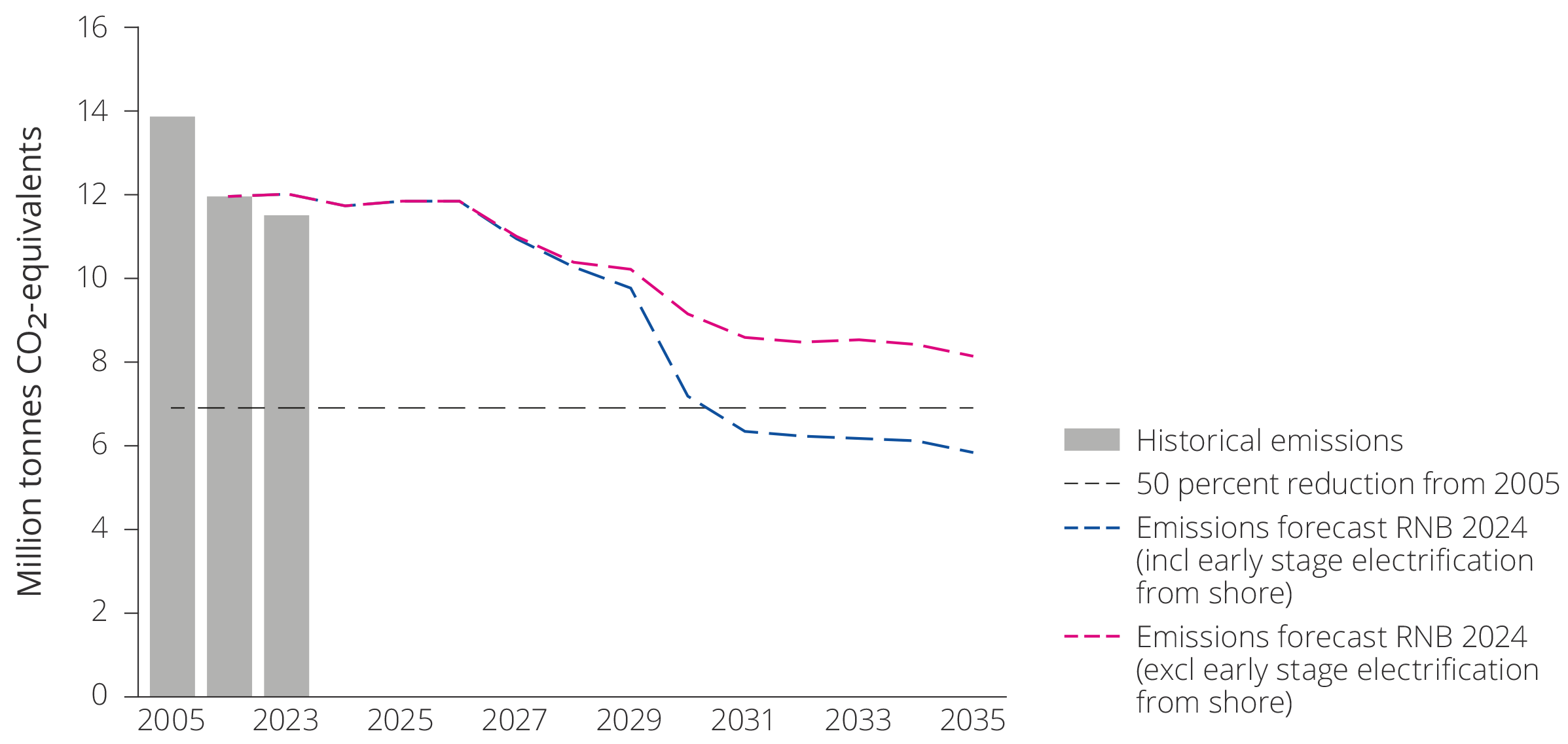

The Norwegian Offshore Directorate's projections as published in April 2024, are illustrated in figure 6.10. The figure highlights that emissions can reach the 50 per cent reduction target in 2031. This presumes that ongoing, but not yet approved, partial or full electrification projects in existing facilities proceed as planned. At this point, emissions in 2035 can be reduced to 5.9 million tonnes of CO2 equivalents.

Figure 6.10 Historical emissions, as well as the Norwegian Offshore Directorate's two projected emission trajectories. One of the emission trajectories excludes early stage power-from-shore projects, while the other includes them in full. The projections are based on reporting from the operators in autumn 2023.

The two emission trajectories illustrate the uncertainty associated with implementation of electrification projects in the planning phase. There will also be uncertainty associated with the implementation of other projects and plans without this being illustrated in an equivalent manner. For example, both emission trajectories contain assumptions linked to energy efficiency measures, recovery strategy and lifetime which all come with associated uncertainties.

The uncertainty associated with electrification projects is partly an uncertainty linked to the licensees' further maturation and decision to implement the projects, and partly an uncertainty as to whether the projects will have access to electricity and be approved by the authorities.

Consequences of environmental measures

Remaining resources on operating fields provide a basis for long-term production as discussed in this chapter. Investments in improved recovery measures will be necessary in order to realise these values. Several of the improved recovery measures may entail increased energy consumption or greenhouse gas emission.

For fields where energy production is partially or fully based on gas turbines, the associated costs related to CO2 emissions are becoming an increasingly significant portion of the expenses. This can lead to reduced profitability of measures to improve recovery. Future production is therefore affected by the level of CO2 costs.

The high costs associated with greenhouse gas emissions, combined with the licensees' own climate targets give the companies strong incentives to implement measures to bring these costs down. The companies presume that electrification with power from shore is the course of action with the lowest cost, and which can deliver the greatest emission reductions leading up to 2030. This is why power from shore projects are being explored on multiple fields on the NCS.

The alternatives to power from shore are offshore wind, or electricity generated using a gas-fired power plant in combination with CCS. These solutions are considered to be more expensive than power from shore.

Several of the fields have no plans to electrify to reduce emissions. Increased CO2 costs and operating costs can affect the production of resources, weaken incentives for exploration and result in decreased lifetime.

Fields shutting down earlier can lead to discontinuation of profitable production capacity and removal of future flexibility, which can often be very expensive measures in a comprehensive NCS perspective. The Government emphasises this in the Green Book, which is a special appendix to the fiscal budget.

DownloadUpdated: 9/23/2024