New industries

The new industries on the NCS

Extraction of seabed minerals, CO2 storage and offshore wind could become important, profitable new industries on the Norwegian continental shelf (NCS), presuming they are cost-effective and can compete with the alternatives. They can also strengthen established value chains within oil and gas.

In this chapter:

- Resource potential in seabed minerals

- Storing CO2 on the Norwegian continental shelf (NCS)

- Offshore wind

The Storting (Norwegian parliament) passed the Seabed Minerals Act(63) in 2019. The objective of the Seabed Minerals Act is to contribute to socio-economic management of these mineral resources(64).

The statute lays out the terms and framework for such activity, including the award of exploration and extraction licences for minerals. The overall framework is based on the principle of government management and control of natural resources through a licensing system.

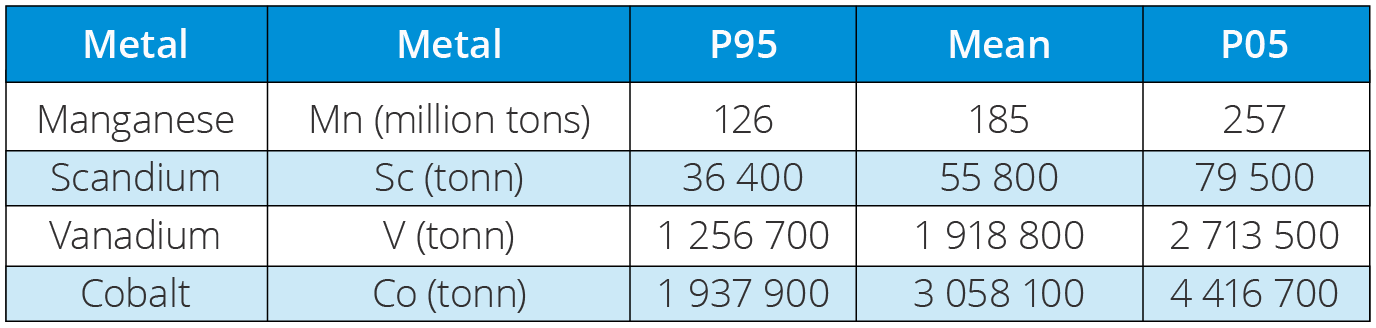

The Norwegian Offshore Directorate has been appointed by the Ministry of Energy’s to take stewardship for minerals on the seabed. Over several years, the Directorate has collected data, in part alongside the academic community, to determine the resource potential for seabed minerals on the NCS, see figure 7.1. This data has been made available to interested stakeholders in the industry.

Seabed minerals

Mineral deposits on the seabed are divided into three types: manganese nodules, manganese crusts and sulphides. All three types are mainly found at depths between 1500-6000 metres and contain a range of different metals.

Manganese crusts and sulphides have been found in the deep sea on the NCS, where the waters are between 800–3500 metres deep.

Manganese crusts are formed through precipitation of minerals directly from seawater onto naked bedrock on the seabed. The crusts are mainly composed of manganates and hydroxides. The Norwegian Offshore Directorate has estimated the extend of mineralised bedrock using existing bathymetry data.

Sulphides are precipitated from hot springs associated with volcanic activity on the seabed along the axes of mid-ocean spreading ridges. As for Norwegian waters, this applies to the Mohns Ridge in the Norwegian Sea, the Knipovich Ridge between Svalbard and Greenland, and parts of the Kolbeinsey Ridge north of Iceland.

Sulphide sample

Resource potential in seabed minerals

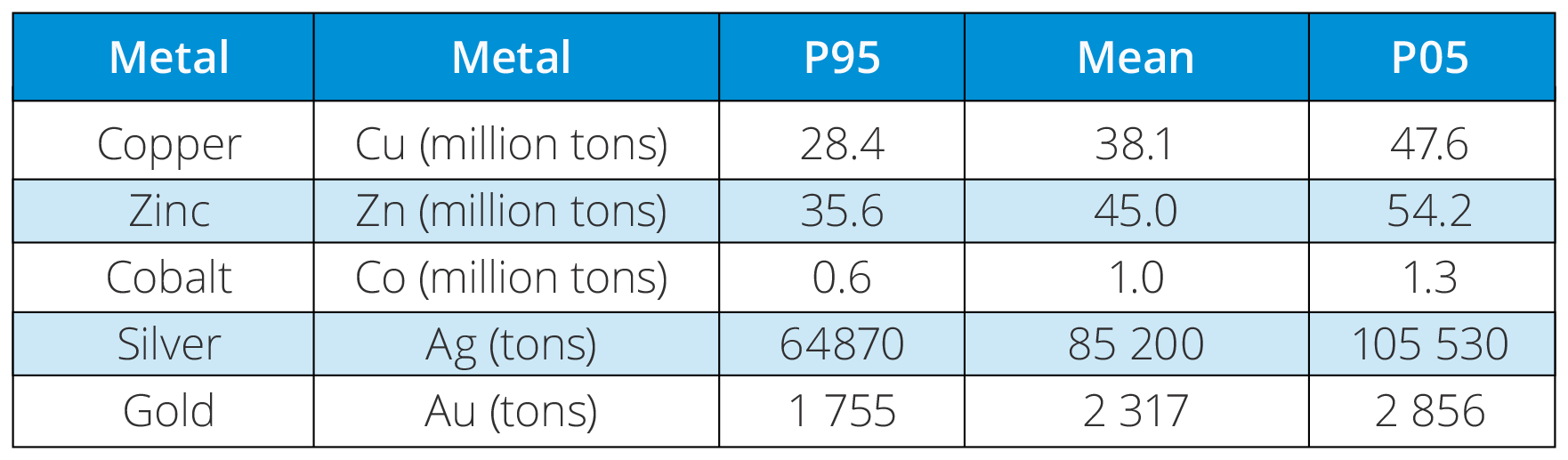

The Norwegian Offshore Directorate has mapped the most commercially interesting mineral deposits and assessed the overall resource potential on the NCS. The results are shown in tables 7.1 and 7.2.

Table 7.1. Estimated total volumes of some important metals found in sulphide deposits in the assessment area.

Table 7.2. Estimated total volumes of some important metals found in manganese crusts in the assessment area.

The resource evaluation(65) is based on the same methodology used to evaluate oil and gas resources, so-called play analysis, but adapted to seabed minerals. Based on geological parameters, the mineral deposits are divided into different types of deposits (also called plays). These are defined with a range (from lowest to highest value) and then run through Monte Carlo simulations to calculate the total volume of metals in the plays, both individually and in total.

The Norwegian Offshore Directorate has compiled geophysical data and seabed mineral samples during expeditions alongside researchers of the University of Bergen since 2011, and since 2020 also with the University of Tromsø. In addition to the research collaborations collected the Directorate also collected large volumes of its own data and samples during annual expeditions since 2018. The resource assessment is based on analyses of the results of all these expeditions, supplemented with data obtained from scientific work and other publicly available sources.

Data has been collected from both hydro-thermally active and inactive sulphide deposits during this mapping. Active deposits are only found in the rift valley along the axes of currently spreading ridges. The inactive deposits, on the other hand, are found in all areas with oceanic crust outside the rift valley and make up 99 percent of the total sulphide resources. In these same areas, manganese crusts along subsea highs and steep slopes can also be found. Mapping has shown that the age of underlying rocks can be directly correlated to the thickness of the manganese crusts. In other words, the older the base layer, the longer the crust has been growing.

These resources are listed as in-place resources in the Norwegian Offshore Directorate’s assessments. The final Monte Carlo simulations in the resource assessment give probability distributions which delineate the range of possible outcomes), hence the range in potential size of the in-place resources.

For this reason, in-place resources are published as probability distributions with a range of outcomes, rather than one specific number. It is however best practise to use the average numbers from the distribution when discussing the resources. The most common to use are the expected value (the arithmetic mean) and the median. Tables typically illustrate calculated values for low, medium and high estimates (usually the P95, P50 and P05 values in the probability distribution), as shown in tables 7.1 and 7.2.

Extraction can generate value for the future

The resource base indicates that seabed mineral activity could become a new industry in Norway, an industry that can contribute to value creation, jobs and securing the supply of important metals. Technology that allows extraction of potential mineral deposits is an underlying assumption for all activity. Another prerequisite is that such deposits have a presumptive market value that is at least as high as the cost of finding and recovering the deposits.

Today, mining for minerals takes place nearly exclusively on land, as the technology and costs of recovery entail greater profitability for extracting minerals on land rather than in deep waters.

Establishing seabed mineral activity is still in its early stages, both on the NCS and worldwide. This makes it difficult to draw clear conclusions as to whether deep sea mining will be profitable on the NCS, even with high demand and prices.

In such an early phase, there are a number of uncertainties that can complicate estimates:

- geology, including the extent and thickness

- development and deep sea mining technology

- market and prices

- government regulations and policies

Additional factors include the uncertainty and risk associated with environmental impact and potential disadvantages for other users of the sea, as well as uncertainty and risk linked to the lack of and quality of data.

To protect nature diversity around especially active hydrothermal structures, Report No. 25 to the Storting (2022-2023) included a requirement stating that recovery from active hydrothermal structures will not be allowed, and that these structures shall be protected to prevent damage from activity in adjacent areas. A production plan will only be approved if it can be documented that production can be carried out without leading to significant negative impact for nature diversity linked to the active structures(66).

The basis for overall stewardship of the opened areas entails a step-by-step approach, as well as a requirement increase the knowledgebase for both resources and the environment before initiating potential mining. This means proceeding with caution and utmost consideration for the environment.

Such an approach utilises "lessons learned" and is important for increasing the understanding of the resources as well as reducing subsurface risk. The Norwegian Offshore Directorate plays an important role by conducting its own mapping and analyses, thereby elevating data quality while at the same time facilitating essential sharing of data.

Exploring an area with this approach costs of clarifying the resource potential can be reduced, while clarifying the value potential. Step-by-step exploration can thus be a robust strategy to clarify the size of existing mineral resources, how much value can be realised, and whether this would entail substantial negative impacts for the external environment, nature diversity and other users of the sea.

Figure 7.1 The map shows the area opened for mineral activity including mapped locations (data points) for both sulphide and manganese deposits.

Storing CO2 on the Norwegian continental shelf (NCS)

Carbon capture, transport and storage (CCS) encompasses capturing CO2 from power generation and industries, transporting liquid CO2 by ship or pipeline, and storing CO2 in geological formations. Storing CO2 on the NCS could become an important industry if it proves cost-effective and can compete with carbon storage opportunities in other countries.

Capacity to store vast volumes of CO2 on the NCS

In Norway it is only possible to store CO2 deep under the seabed The NCS comprises extensive geological formations that provide adequate conditions for storage and have properties that prevent CO₂ from moving upward through the sediment layers towards the seabed. Safe storage without leaks is a precondition to be awarded a licence to inject and store CO2.

The Norwegian Offshore Directorate has extensively mapped areas on the NCS that are suitable for safe storage of CO2. The mapping shows that large volumes can be stored in the subsurface. The evaluation is based on access to more than 50 years of data collected in connection with petroleum activity, in addition to calculations of the potential for storing CO2 in relevant formations. The Directorate published the CO2 storage atlas in 2014 which summarises and illustrates storage opportunities on the NCS(67).

Based on this work the theoretical storage capacity is expected to add up to more than 80 billion tonnes of CO2, which is equivalent to around 1600 years of Norwegian CO2 emissions at the current level(68). CO2 storage has a number of similarities with petroleum activity. It requires good understanding of the subsurface such as collecting seismic data or drilling wells, among other things.

Open-door policy for acreage

Companies with necessary expertise and concrete industrial plans that entail a need to store CO2 on a commercial basis, can apply to the Ministry of Energy (MoE) for an exploration licence adapted to the company’s needs.

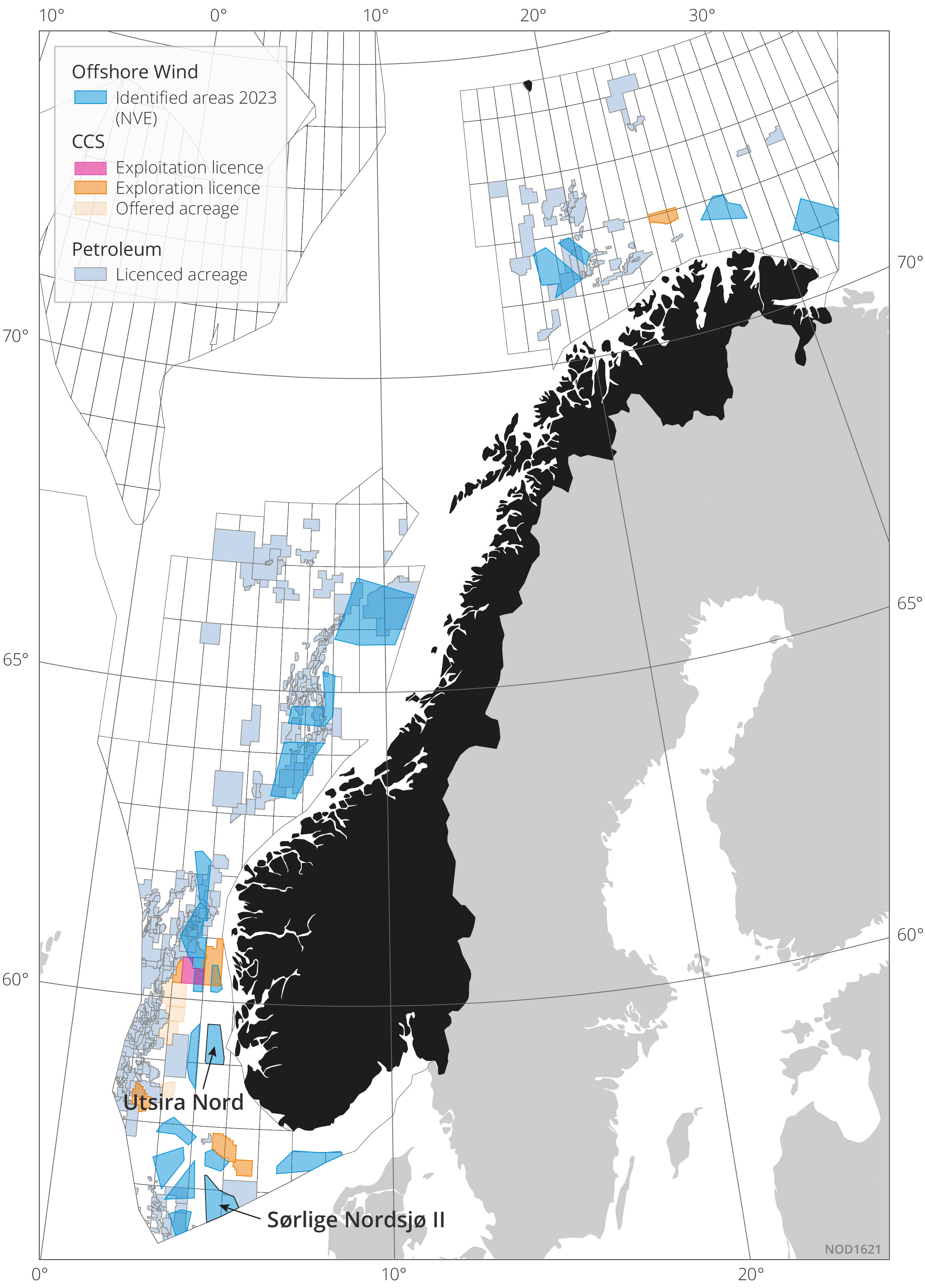

As of June 2024, a total of seven licences have been awarded under the CO2 Storage Regulations. Six of these are exploration licences for storing CO2as shown in figure 7.2.

Different types of CO2 licences

Survey licence: Licence that entitles companies to conduct surveys to map subsea reservoirs for storing CO2. This licence does not grant any exclusive rights to specific areas, nor does it give priority when it comes to the award of other types of licences. Survey licences are granted for periods of up to three years. The public announcement requirement does not apply.

Exploration licence: This is a licence that grants exclusive rights to explore for subsea reservoirs for permanent storage of CO2 within a defined area. The award of such a licence means that statutory award criteria have been met, including that the award is made according to objective, published and non-discriminatory criteria. Exploration licences are granted for a period of up to 10 years.

Exploitation licence: This is a licence type that grants exclusive rights to exploit (develop) a subsea reservoir on the NCS for permanent storage of CO2. The award of such a licence requires fulfilment of statutory award criteria, and that the award is made according to objective, published and non-discriminatory criteria. Companies holding an exploration licence for the relevant area shall be prioritised in the event, that an exploitation licence is awarded in the same area. The duration of the licence will be stipulated by the state when the licence is awarded.

Regulations

The Regulations relating to exploitation of subsea reservoirs on the continental shelf for storage of CO2 and relating to transportation of CO2 on the continental shelf(69) (the Storage Regulations) provide the legal basis for CO2 storage. The objective is to facilitate socio-economically profitable storage of CO2.

Among other things, the Regulations stipulate the terms and framework for awarding survey, exploration and exploitation licences, where the guiding principle is government control of storage resources through a licensing system(70).

Applications in accordance with the Storage Regulations are processed via an open-door policy. This means that stakeholders that want to secure a licence can apply as soon as they have developed a sound and adequate basis for such an application. Received applications are processed on a continuous basis. If the applications are of sufficient quality, the state makes a public announcement to allocate the area considered relevant for a potential award, and with an appropriate application deadline.

The role of the Norwegian Offshore Directorate is to assist and advise the Ministry within all aspects of CCS activity, including announcing and awarding acreage, processing development plans and injection of CO2. The Directorate shares facts and expertise about the storage potential and proposes how regulations for handling CO2 can be further improved. The Directorate is also responsible for obtaining and passing on analyses and data regarding storage of CO2 on the NCS.

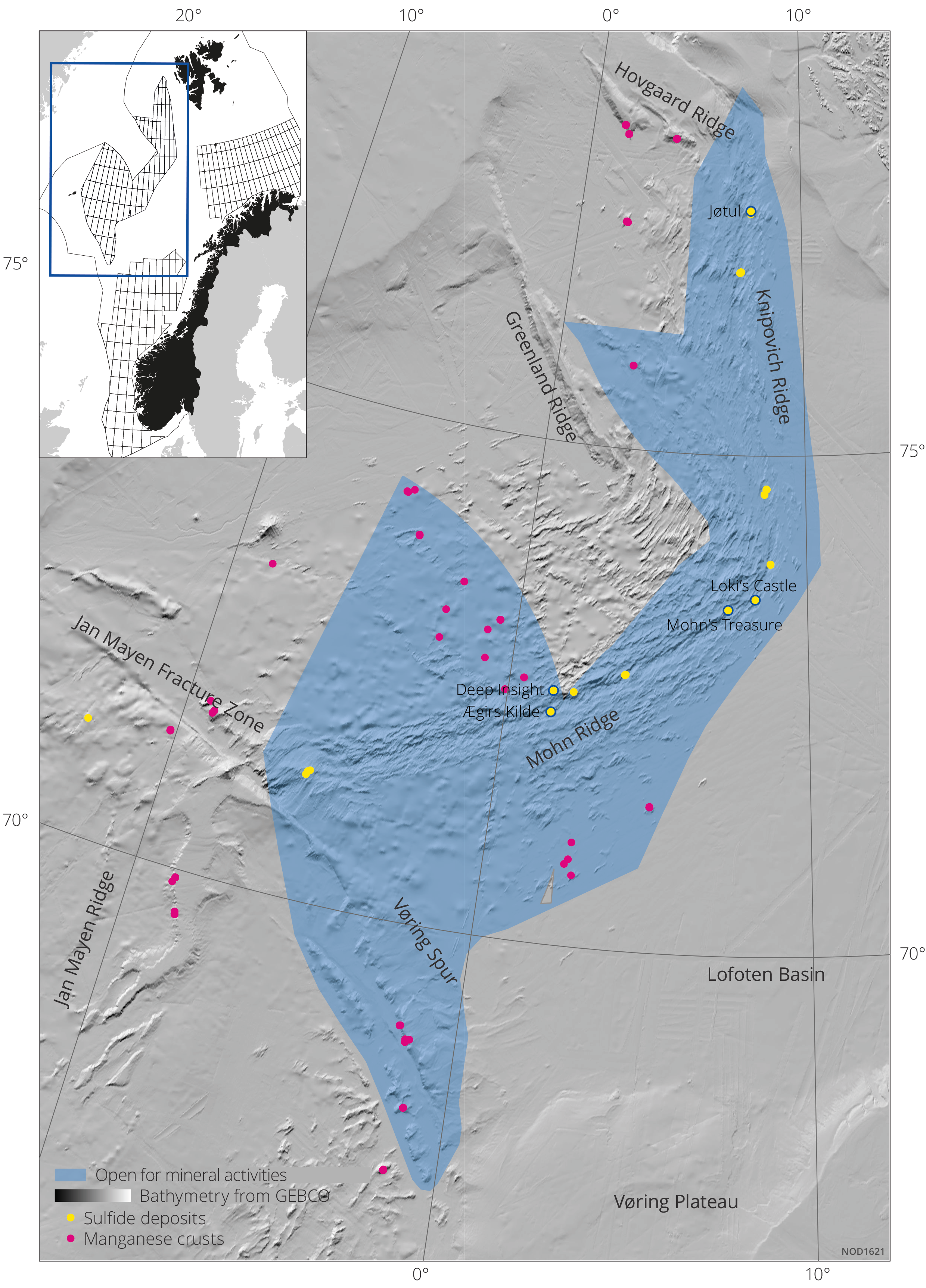

CO2 storage on the NCS since the 1990s

In connection with petroleum production, storage of CO2 has taken place on the NCS since 1996 on the Sleipner field in the North Sea, and from 2008 on the Snøhvit field in the Barents Sea. On Sleipner, CO2 is removed from the natural gas produced, and reinjected into the Utsira Formation, which contains an aquifer on the field.

On Snøhvit, CO2 is removed from the natural gas at the LNG plant on Melkøya to avoid ice formation in the facility, before it is returned to the field via a pipeline.

These are the only two CO2 storage projects currently in operation in Europe. They have provided valuable insight into CCS, as they have been in operation over a long period of time and are unique in an offshore context.

The figure shows the volume of CO2 stored so far on the NCS.

Cumulative CO2 storage on the NCS, 1996–2023.

By 2030, a total of 90 million tonnes of CO2 can be stored from fields, approved CO2 storage projects and projects currently in the planning stage.

With current plans, around 30 million tonnes of CO2 per year can be stored in the awarded exploration and exploitation licences, starting from 2030. This capacity will grow through the 2030s if more licences are awarded and capacity in the respective projects is expanded.

CO2 storage is still in an early phase

CCS is still in the early stages. Climate policy, particularly the CO2 price, is what determines whether or not an investment in CCS becomes profitable.

There are also coordination challenges linked to establishing a market for CCS. If no one captures CO2, no one will invest in CO2 storage. If no one establishes CO2 storage, no one will invest in CO2 capture. As this often involves different stakeholders, the authorities need to coordinate various forms of measures. Rapid award of storage acreage is one measure that could offset market failure associated with such network effects as discussed in chapter 3, market failure.

Both the open-door policy and terms and conditions imposed upon licensees when exploration licences are awarded according to the Storage Regulations can contribute to ensure fast and efficient maturing of awarded areas up to an investment decision and realisation of a CO2 storage site. Access to storage acreage makes it easier for industry players to develop and establish complex value changes with a lot of infrastructure.

Offshore wind

Norway has vast ocean areas with good wind conditions. The Government’s ambition of awarding acreage for 30 GW of offshore wind generation corresponds to nearly a doubling of total Norwegian power generation. The first areas on the NCS were opened for renewable offshore energy generation in 2020. Since then, the authorities have worked to stipulate regulations in close cooperation with both commercial and other users of the sea. The Norwegian Water Resources and Energy Directorate (NVE) assists the Ministry of Energy in establishing the framework for future development of offshore wind and follows up the work on a potential new management regime for renewable offshore energy generation.

In April 2023, a broad group of directorates led by NVE presented a report that identified 20 areas that are technically suited for offshore wind, and where conflicts with other stakeholders are presumably low(71) as illustrated in figure 7.2.

NVE will carry out a strategic impact assessment of these 20 areas in 2024 and 2025. The other directorates, including the Norwegian Offshore Directorate, will be involved in this work. Once the strategic impact assessment is complete, the Ministry of Energy will assess which areas can be opened.

The Norwegian Offshore Directorate will provide the Ministry with expert input on the responsible use of area identified and delineate zones where offshore wind interests do not reduce the value of petroleum and CO2 storage resources. These are also key considerations for the Directorate in conducting the strategic impact assessment of the 20 offshore wind areas. Dialogue and coordination between sectors at an early stage is essential for ensuring effective coexistence.

The Directorate has carried out subsurface surveys in the first phase of the Sørlige Nordsjø II and Utsira Nord projects, in advance of a potential development. The objective was to investigate whether the seabed is suitable for offshore wind installations. The wind turbines must be anchored to the seabed in a manner that can withstand extreme weather conditions. Development costs are high due to ocean depth and complex seabed conditions(72). Data from the subsurface surveys can be downloaded from Diskos(73).

The mapping carried out by the Norwegian Offshore Directorate can identify the suitability of the seabed (shifting, unevenness, stability), any large boulders on the seabed or gas pockets in the subsurface that could create instability. The mapping helps reduce risk and costs for offshore wind players and establish a shared basis of data for players that intend to apply for licences.

Figure 7.2 Map showing challenges of coexistence: CO2 licences are shown in orange and the 20 areas being considered for offshore wind in blue (Utsira Nord and Sørlige Nordsjø II should be noted). Petroleum licences are depicted in blue-grey.

Download