2 - Increasing oil and gas production in the next five-year period

The Norwegian Petroleum Directorate’s production forecast up to 2023 shows an increase from 2020. Start-up of new fields, including Johan Sverdrup, will more than offset the natural reduction from operating fields. Total production of oil and gas is projected to approach the record year of 2004, with gas accounting for about half. It will be challenging to maintain such a production level up to 2030.

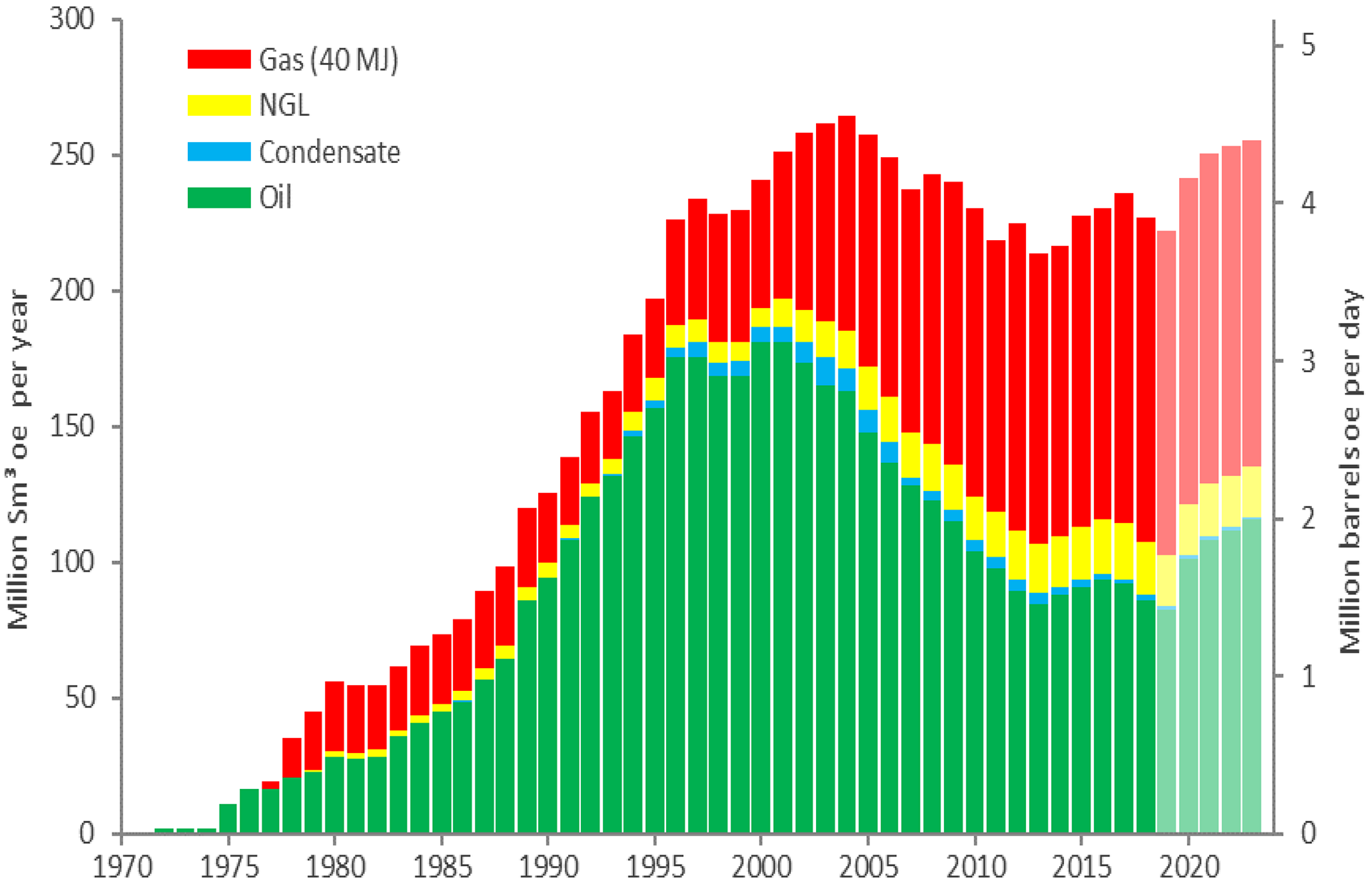

Figure 2-1

Actual and projected sale of petroleum 1971-2023

Preliminary figures show that 226.7 million standard cubic metres oil equivalents (Sm³ o.e.) were sold in 2018. This is 9.5 million Sm³ o.e. or 4 per cent less than in 2017. Gas sales are somewhat reduced and certain oil fields have produced less than expected. Total production of petroleum in 2019 is expected to be 222 million Sm³ o.e.

2.1 Gas

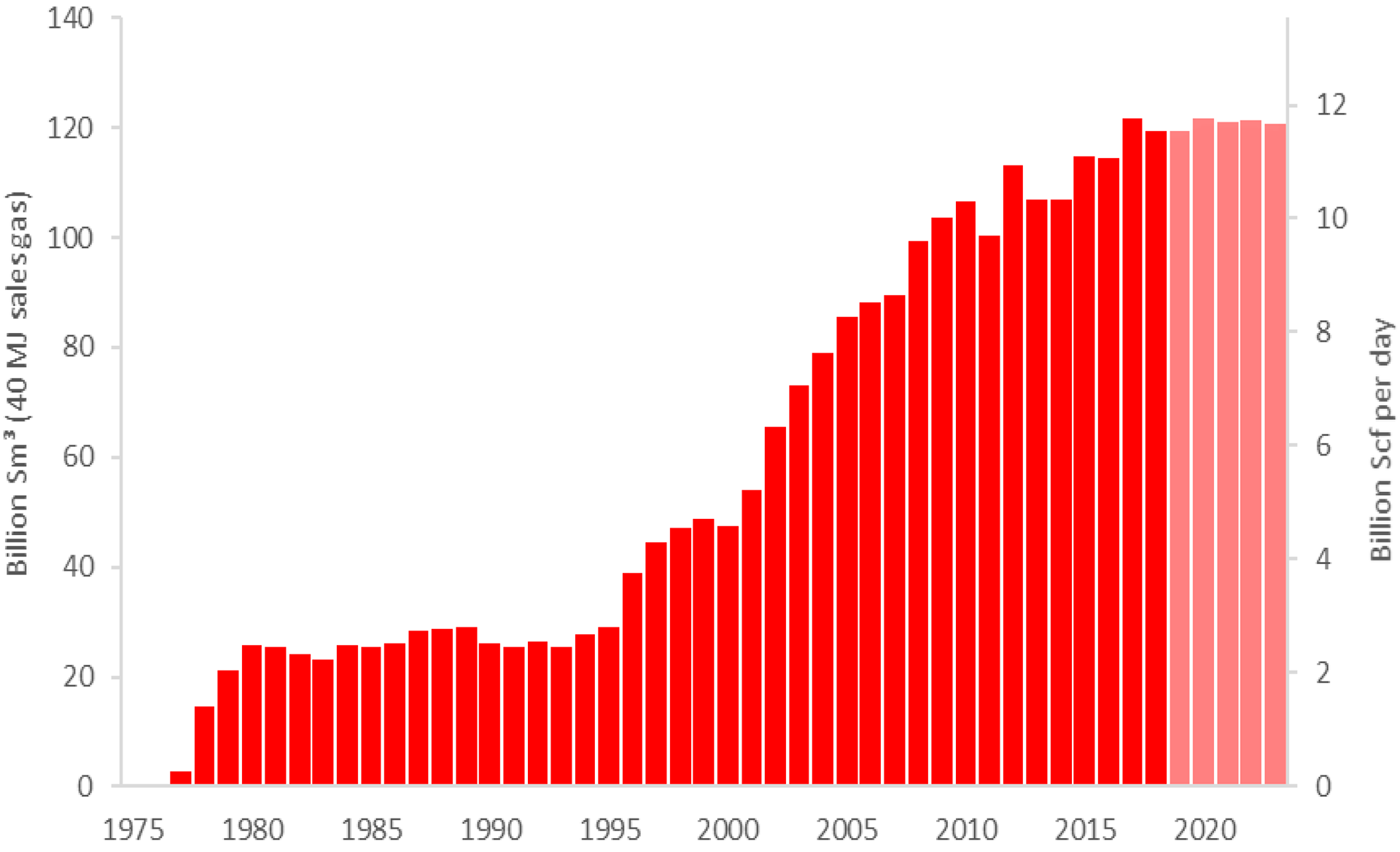

In 2018, 121.7 billion Sm³ gas (119.3 billion Sm³ 40 megajoule gas) was sold. This is a slight reduction from the record level in 2017. The forecast for short-term gas sales (Figure 2-2) shows an expected high and stable level with a slight increase over the next few years.

Figure 2-2

Actual and projected gas sales through 2023

2.2 Oil

A total of 86.2 million Sm³ oil (1.49 million barrels per day) was produced in 2018, compared with 92.2 million Sm³ (1.59 million barrels per day) in the previous year, a reduction of 6.3 per cent.

The forecast for 2018 showed an expected slight decline in oil production compared with the previous year. This decline proved to be greater than expected. This is due, in part, to the fact that certain newer fields are more complex than previously assumed, and certain other fields delivered below the forecast, mainly due to the fact that fewer wells have been drilled than expected.

For 2019, we estimate that oil production will be reduced by an additional 4.7 per cent, to 82.2 million Sm³ (1.42 million barrels per day). Production is expected to show a substantial increase in 2020, e.g. as a consequence of Johan Sverdrup. The uncertainty in the production forecasts is mainly linked to the drilling of new wells, start-up of new fields, the ability of the reservoirs to deliver and regularity for producing fields.

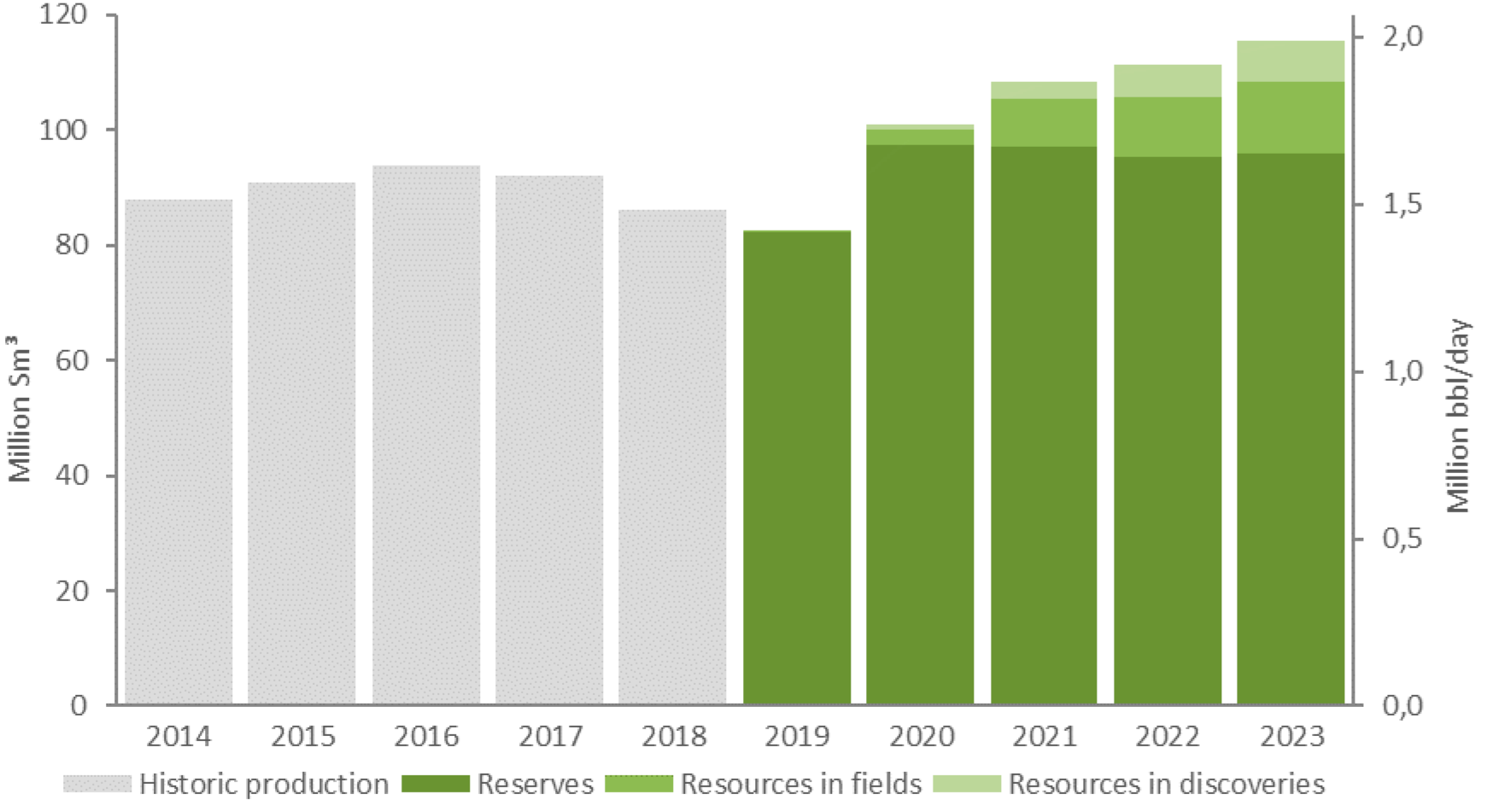

Production from operating fields and approved projects accounts for 90 per cent of expected production in the five-year period 2019-2023 (Figure 2-3). The remaining ten per cent are primarily expected to come from improved recovery measures on the fields. Wells that have not yet been approved and optimisation of recovery strategies are the main contributing factors. Towards the end of the five year period, production is also expected from discoveries which do not yet have a firm development decision.

Figure 2-3

Oil production 2014-2023 distributed by maturity

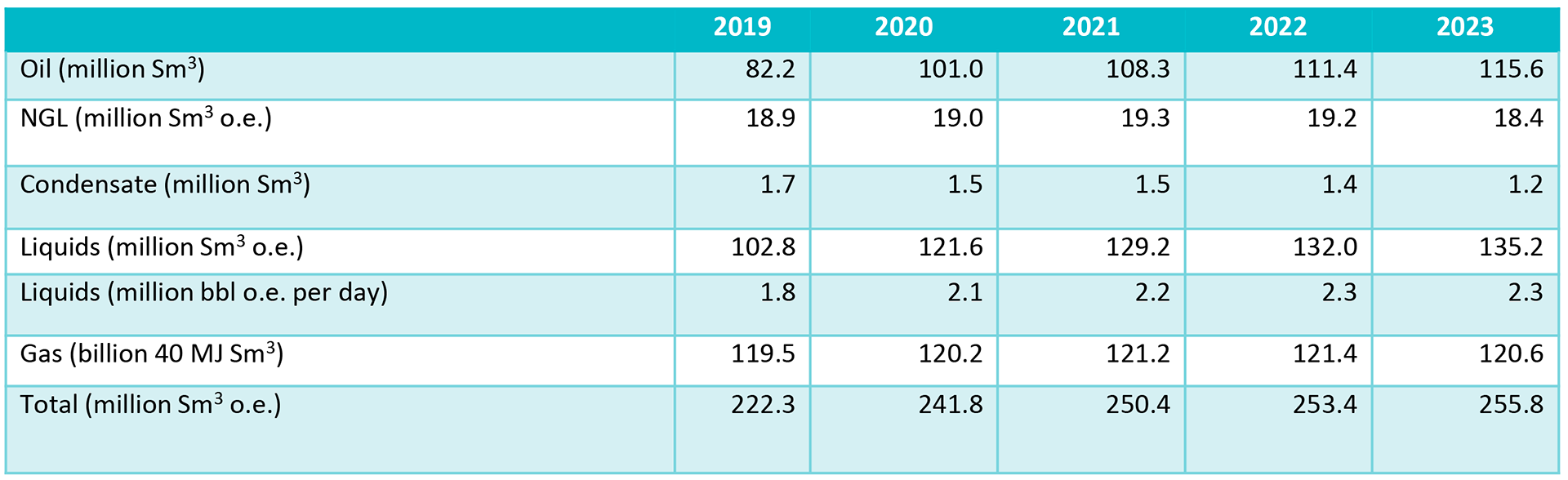

Table 2-1

Production forecast distributed by the various products for the next five years

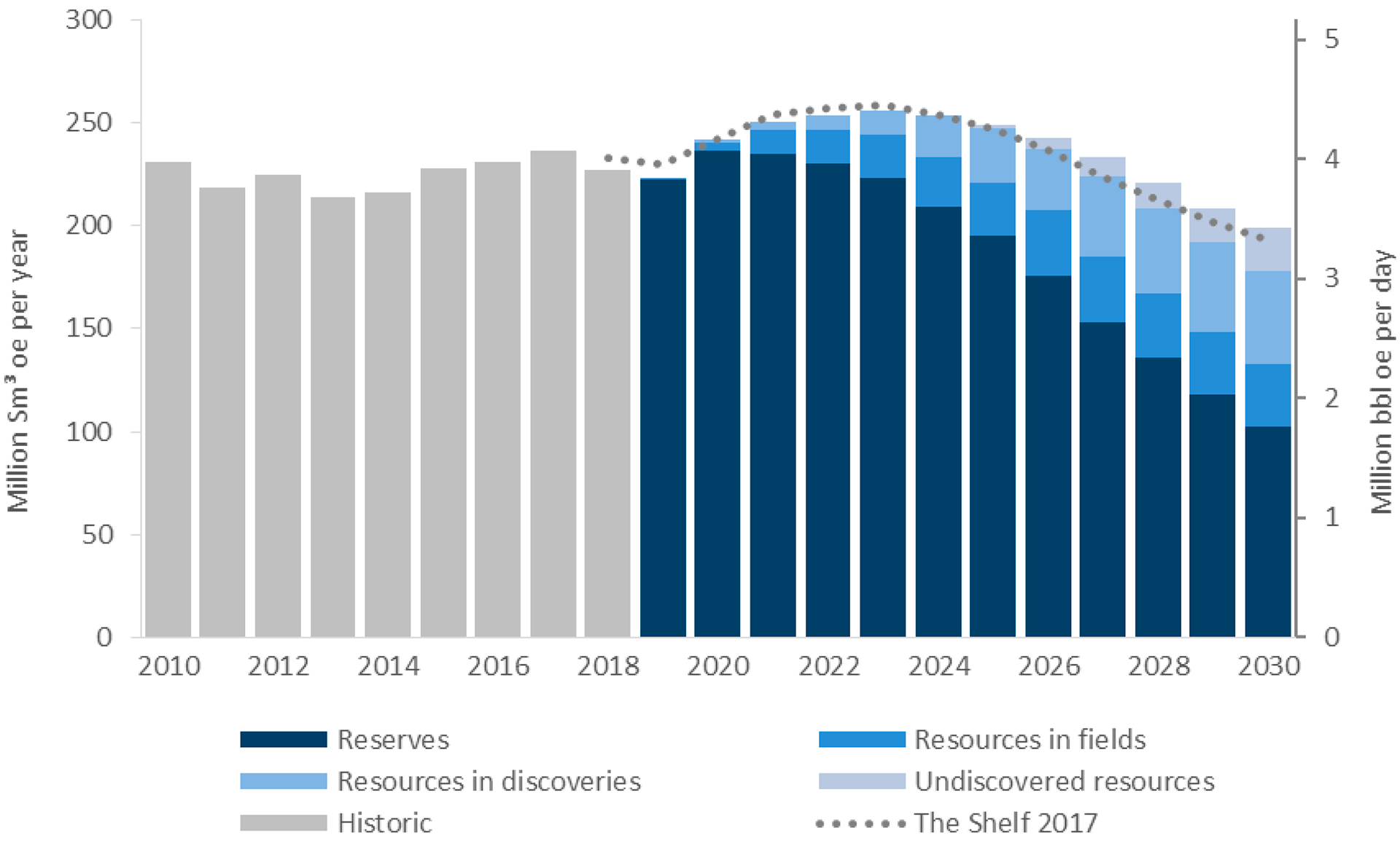

2.3 Total production up to 2030

Production will remain relatively high over the next decade and going forward to 2030, production from undiscovered resources is expected to have increasing significance.

Figure 2-4 shows the most recent production forecast compared with what was presented one year ago, in The Shelf in 2017. The forecast reveals a relatively flat production development up to 2020. As from that time, it is assumed that all projects currently under development will contribute to a considerable production increase up to 2023.

The production level is somewhat lower in 2019, compared with the previous forecast; approximately unchanged in the period from 2020-2025 and somewhat higher going forward to 2030. The increase in the estimate up to 2030 compared with last year’s forecast, is due in part to the fact that more new measures have been identified on the fields; mainly more wells included in the forecasts.