Resource accounts at 31 december 2017

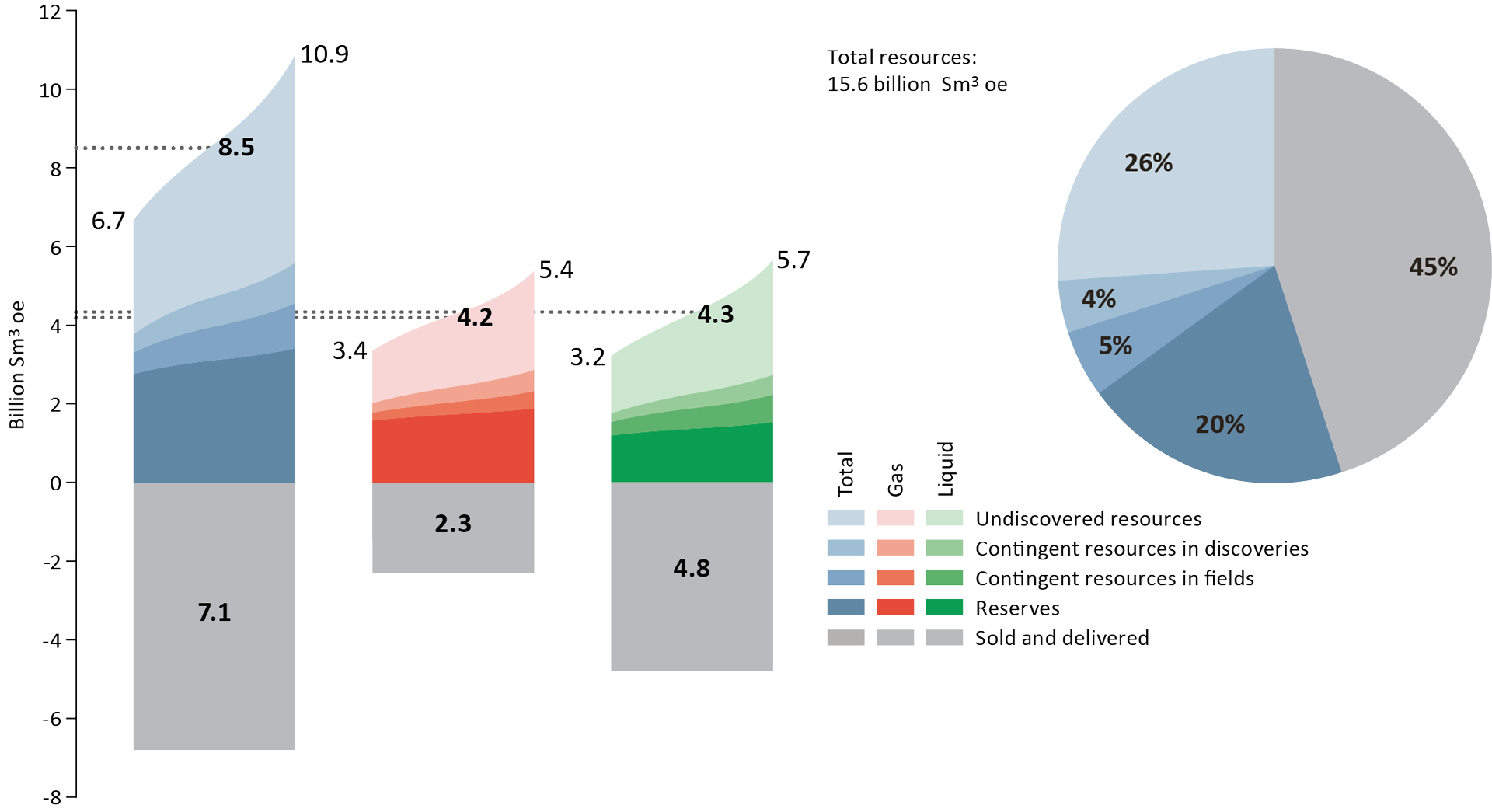

The Norwegian Petroleum Directorate’s (NPD’s) estimate for total proven and unproven petroleum resources on the Norwegian continental shelf is about 15.6 billion standard cubic metres of oil equivalents.

This is 1.3 billion more than at 31 December 2016. Of this, 45 per cent has been sold and delivered. About 47 per cent of the remaining resources have not been proven.

The article also includes a summary of the NPD’s resource accounts according to the UNFC classification.

Resources is a general term for all oil and gas that can be recovered. The resources are classified according to their maturity in relation to their progress in the planning process leading up to the decision to develop and produce. The main classifications are reserves, contingent resources and unproven resources.

Total resources

The Norwegian Petroleum Directorate’s basic estimate for total proven and unproven petroleum resources on the Norwegian continental shelf is about 15.6 billion standard cubic metres of oil equivalents (Sm3 o.e.). Of this, 7.1 billion Sm3 o.e., or 45 per cent, have been sold and delivered. It is an increase in unproven resources of 1.3 billion Sm3 o.e. compared with the previous year. The reason for this is that, in 2016/2017, the Norwegian Petroleum Directorate mapped acreage that has yet to be opened for petroleum activities in the northeastern part of the Barents Sea.

The remaining resources to be produced are expected to total 8.5 billion Sm3 o.e. Of this, 4.5 billion Sm3 o.e. are proven resources. The estimate for unproven resources is 4.0 billion Sm3 o.e. About 47 per cent of the remaining resources have yet to be proven.

Download: all tables that are part of the resource accounts for the Norwegian shelf as of 31 December 2017.

Petroleum resources and estimate uncertainty per 31 Dec 2017

Download: Table (Excel)

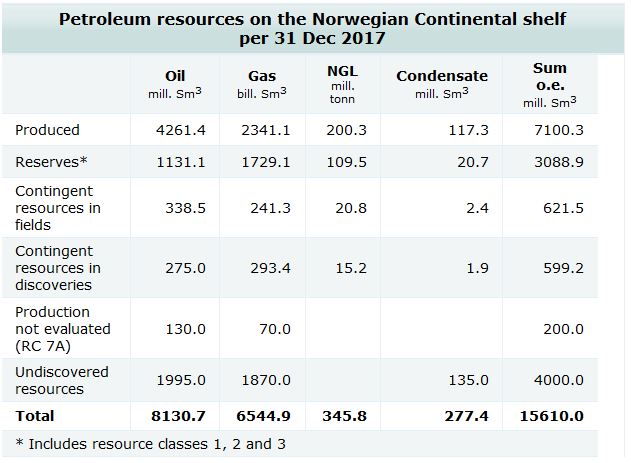

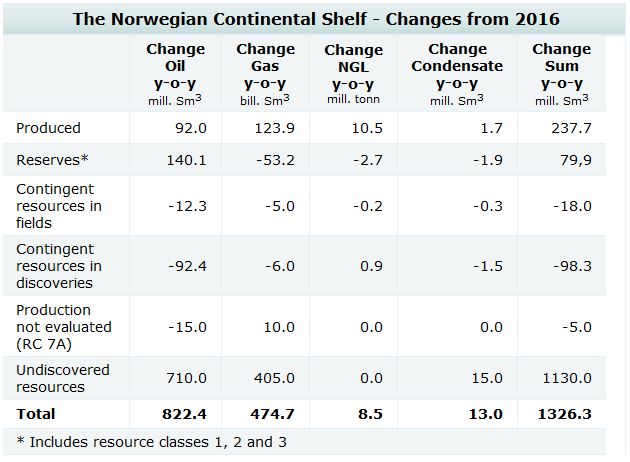

Total petroleum resources on the Norwegian Continental Shelf at 31 December 2017

Oil and condensate – are stated in million standard cubic meters. NGL is stated in million tonnes, and gas is stated in billion standard cubic metres. The conversion factor for NGL in tonnes to Sm3 is 1.9. Total oil equivalents are stated in million Sm3 o.e.

Reserves

Reserves are recoverable petroleum volumes that have not been produced, but where a production decision has been made. This applies for both resources where the authorities have approved a Plan for Development and Operation (PDO) and the resources that the licensees, companies in the production licence, have decided to produce, but where they do not yet have the required permits from the authorities.

Reserves totalled 3089 million Sm3 o.e at the end of 2017. 56 per cent of this is gas. Gross reserves, or the estimate before production is deducted, increased by 318 million Sm3 o.e. The reason for this solid increase is reserve growth on a number of producing fields and the submission of several Plans for Development and Operation (PDOs). Production in 2017 was 238 million Sm3 o.e. This entails a net resource growth of 80 million Sm3 o.e., or about 3 per cent, in 2017.

Contingent resources

Contingent resources are proven oil and gas for which a production decision has not yet been made. Petroleum volumes in potential improved recovery projects are included in this category. At the end of 2017, the contingent resources totalled 1421 million Sm3 o.e. Resources that are not considered commercial are not included in the accounts.

Decisions will be made every year to develop some of the contingent resources, and then they will be transferred to the reserves category. Growth in the contingent resources category comes from both exploration activity, changed projections and new opportunities in fields and discoveries.

In 2017, the exploration activity resulted in a resource growth estimated at 33 million Sm3 o.e. Twenty-three exploration wells were completed, and 11 discoveries were made; six in

the Barents Sea, three in the Norwegian Sea and two in the North Sea. Many of the discoveries have not been fully evaluated, and the estimates are therefore very uncertain.

Contingent resources in fields constitute 822 million Sm3 o.e. or 18 per cent of the remaining proven resources. In 2017, contingent resources in fields were reduced by 23 million Sm3 o.e. compared with the accounts in 2016. The reduction can e.g. be explained by the maturation of the project to further develop Snorre and the project to develop Ærfugl in Skarv into reserves. Resources in discoveries were reduced by 98 million Sm3 o.e., to 599 million Sm3 o.e., as a result of submission of PDOs for discoveries 25/1-11 R Skogul, 6407/8-6 Bauge, 6407/12-3 S Fenja and 7220/8-1 Johan Castberg. A PDO exemption has been granted for the 6706/12-2 Snefrid Nord discovery, and the discovery has been incorporated into the Aasta Hansteen field. The resources in these discoveries are now classified as reserves. In addition, five of the discoveries in the accounts from last year were not found suitable for development. They are therefore not included in the accounts.

Unproven resources

Unproven resources comprises oil and gas that probably exists and can be produced, but that have not yet been proven through drilling.

The resource estimate for unproven resources was updated in 2017. This update takes place every two years. Unproven resources were estimated at 4000 million Sm3 o.e. This is an increase of 1130 million Sm3 o.e. compared with the resource accounts for 2016. This large increase is caused by the re-evaluation of the northern Barents Sea, as well as the fact that, following the agreement on the demarcation line between Norway and Russia, the area in the northeastern Barents Sea is now included in the estimate. Unproven resources constitute about 47 per cent of the total resources that remain on the Norwegian shelf.

UNFC classification

The United Nations Framework Classification System 2009 (UNFC 2009) is a classification system that was made in order to compare resource estimates across various classification systems.

Since 2014, the NPD has also classified the Norwegian petroleum resources according to UNFC 2009.

The resources in each of the approximately 700 Norwegian projects that are included in the resource accounts are sorted along three axes; the E, F and G axis. These represent varying degrees of socio-economic attractiveness, technical maturity and uncertainty.

The Norwegian resource accounts as of 31 December 2017, converted to UNFC, can be summarised as shown in the table with the resource accounts under the “UNFC” tab.

An explanation of the method used to convert from the Norwegian system to UNFC 2009 can be found in this publication from 2014.

Resources according to sea area

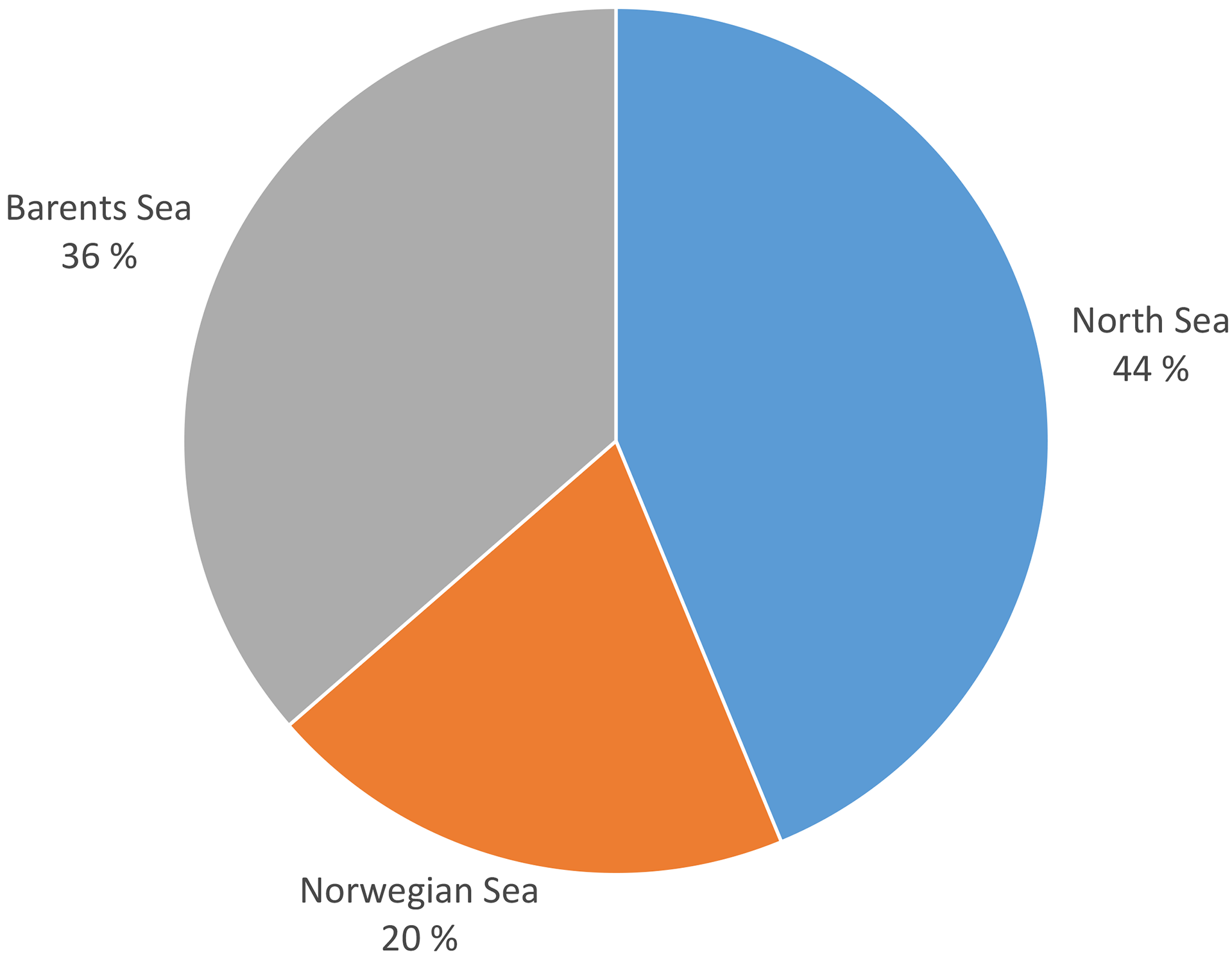

The North Sea contains about 44 per cent of the remaining resources. The distribution of the rest of the resources shows that there is 36 per cent left in the Barents Sea and 20 per cent left in the Norwegian Sea. A large portion of the expected resources that remain in the Barents Sea have not yet been proven.

The North Sea is the powerhouse in the Norwegian petroleum activities, with 66 producing fields at the end of 2017. Four new fields, Gina Krog, Flyndre, Sindre and Byrding, started producing in 2017.

There are 17 producing fields in the Norwegian Sea. One new field, Maria, started producing in 2017. There are two producing fields in the Barents Sea.

Download: all tables that are part of the resource accounts for the Norwegian shelf as of 31 December 2017.

Remaining petroleum resources distributed by sea area at 31 December 2017

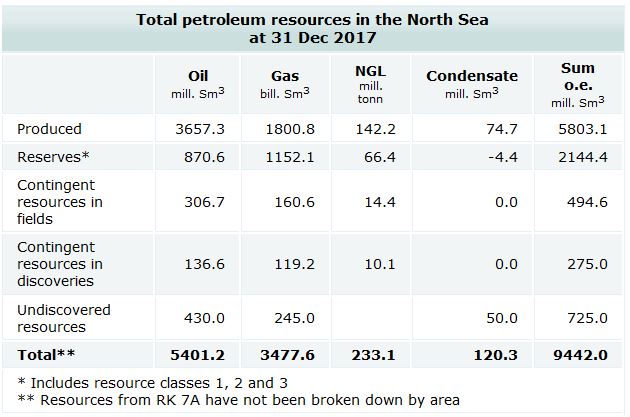

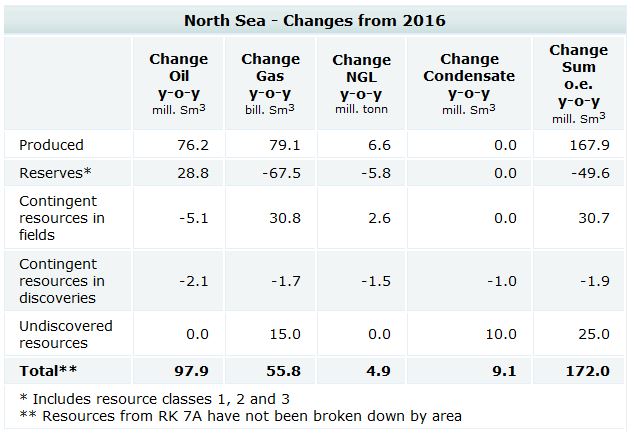

North Sea

North Sea

The resource accounts for the North Sea show that 168 million Sm3 o.e. were sold and delivered from this part of the Norwegian shelf over the past year. Gross reserves increased by 118 million Sm3 o.e, before deducting production. This means that the reserves that remain in the North Sea were reduced by 50 million Sm3 o.e. in 2017.

The increase in gross reserves can be explained by the fact that PDOs were submitted for 25/1-11 R Skogul, the Snorre Expansion Project, Valhall West Flank and Yme. Reserves also increased on a number of fields, such as Johan Sverdrup and Balder.

Contingent resources in fields increased by 31 million Sm3 o.e. in 2017 due to the identification of additional recoverable resources in fields. There are also plans in place to redevelop the Frigg, Northeast Frigg and Odin fields. Contingent resources in discoveries have been reduced by 2 million Sm3 o.e. compared with last year's accounts, because the resources in 25/1-11 R Skogul have been transferred to reserves. Five of the discoveries in last year's accounts are also considered not to be commercial, and are therefore not included in the accounts. Two new discoveries were made in the North Sea in 2017, and resource growth from these discoveries totals about 4 million Sm3 o.e.

The resource estimate for the unproven resources was updated in 2017. The expected value is estimated at 725 million Sm3 o.e., which represents an increase of 25 million Sm3 o.e. compared with last year's accounts.

Download: Table (Excel)

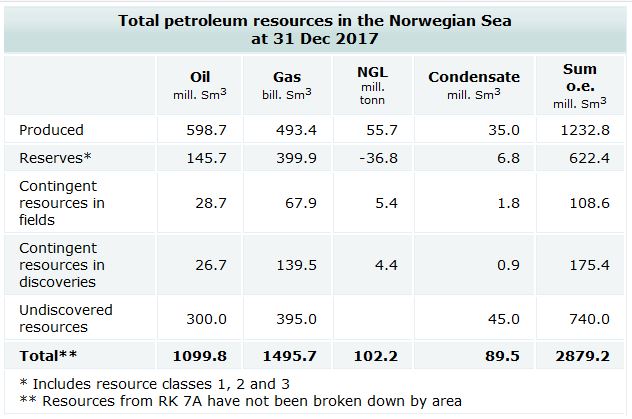

Norwegian Sea

The resource accounts for the Norwegian Sea show that 60 million Sm3 o.e. were sold and delivered from this part of the Norwegian shelf over the past year. At the same time, gross reserves increased by 109 million Sm3 o.e, before deducting production. This entails an increase in remaining reserves in the Norwegian Sea of 48 million Sm3 o.e. in 2017.

The increase in gross reserves is e.g. due to the fact that PDOs have been submitted for 6406/12-3S (Fenja), Bauge and t Ærfugl in Skarv, and that the resources slated for development have been transferred to reserves. A PDO exemption has also been granted for 6706/12-2 Snefrid Nord, which is now part of the reserve base on the Aasta Hansteen field. Reserves also increased on several fields, such as Åsgard, Ormen Lange and Heidrun.

Contingent resources in fields were reduced by 46 million Sm3 o.e. in 2017. The reason for this is e.g. that a decision has been made to develop Ærfugl in Skarv. The estimate for contingent resources in discoveries was reduced by seven million Sm3 o.e. compared with last year’s accounts. The most important reasons for this are the submissions of development plans for 6406/12-3 S (Fenja), 6407/8-6 Snilehorn (now the Bauge field) and 6706/12-2 Snefrid Nord.

Three new discoveries were made in the Norwegian Sea in 2017. The discoveries are minor, and total resource growth is about six million Sm3 o.e. The estimate for unproven resources is 740 million Sm3 o.e., which constitutes a reduction of 35 million Sm3 o.e. from 2016.

Download: Table (Excel)

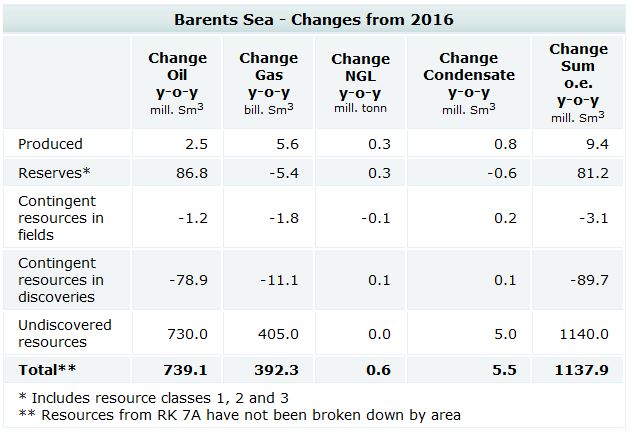

Barents Sea

The resource accounts for the Barents Sea show that 9 million Sm3 o.e. were sold and delivered from this part of the Norwegian shelf over the past year. At the same time, gross reserves increased by 90 million Sm3 o.e, before deducting production. This entails an increase in remaining reserves in the Barents Sea of 81 million Sm3 o.e. in 2017.

The increase in gross reserves is due to the fact that a PDO has been submitted for 7220/8-1 Johan Castberg.

Contingent resources in fields have been reduced by 3 million Sm3 o.e. compared with last year’s accounts. The estimate for contingent resources in discoveries has been reduced by 90 million Sm3 o.e. The reason for this is that a PDO has been submitted for 7220/8-1 Johan Castberg.

Six new discoveries were made in the Barents Sea in 2017. Resource growth is about 23 million Sm3 o.e. Three of the discoveries are considered not to be commercial for development, and are therefore not included in the accounts.

The unproven resources in the Barents Sea include volumes in the southern, southeastern and northern Barents Sea. The new area in the northeastern Barents Sea following the demarcation line agreement between Norway and Russia is included for the first time this year. The 2017 estimate for unproven resources is 2535 million Sm3 o.e. This is an increase of 1140 million Sm3 o.e. compared with 2016. The reason for this considerable change from 2016 is the new evaluation of the northern Barents Sea.

Download: Table (Excel)

Updated: 14/03/2019