6 - Completion of the spreadsheet – “Profil_1-15 (=profile collections)”

6.1. Definitions, reporting requirements and the need for comments

6.1.1 Definitions, reporting requirements and the need for comments

Profile: All yearly or monthly data under one heading (i.e., column) in the spreadsheet is a Profile.

Profile collection: All data in the different spreadsheets, Profil_1, Profil_2, are Profile collections.

Time horizon: The operator should report complete profiles for the projects, assumed profitable operations beyond the expiry of the license. Relevant columns for costs and emissions, because of the production, shall be filled inn. If profitability is dependent on other projects, e.g., when reporting an uneconomic tail production, this should be stated in a comment for this project.

Norwegian part: If the ownership of a field or discovery is shared with another country, only the Norwegian part shall be reported in the profiles, except for environmental data which shall be reported 100 per cent if the emissions take place in Norway.

NOK-values: Costs and income for the previous calendar year shall be reported in actual NOK values for that year. No price increase/decrease calculation shall be made on cost numbers for previous years. All future costs and income shall be reported in real NOK. Year of reference for real NOK shall be current calendar year.

Costs: To the extent possible, reported operating costs should be distributed among the various cost components and correspond with the operating period. For next year, the RNB reporting should be in accordance with the proposed license budget per 1.10. Any discrepancies between reported estimate and the operator’s proposed investment budget shall be commented in cell AE28 in the relevant profile sheets.

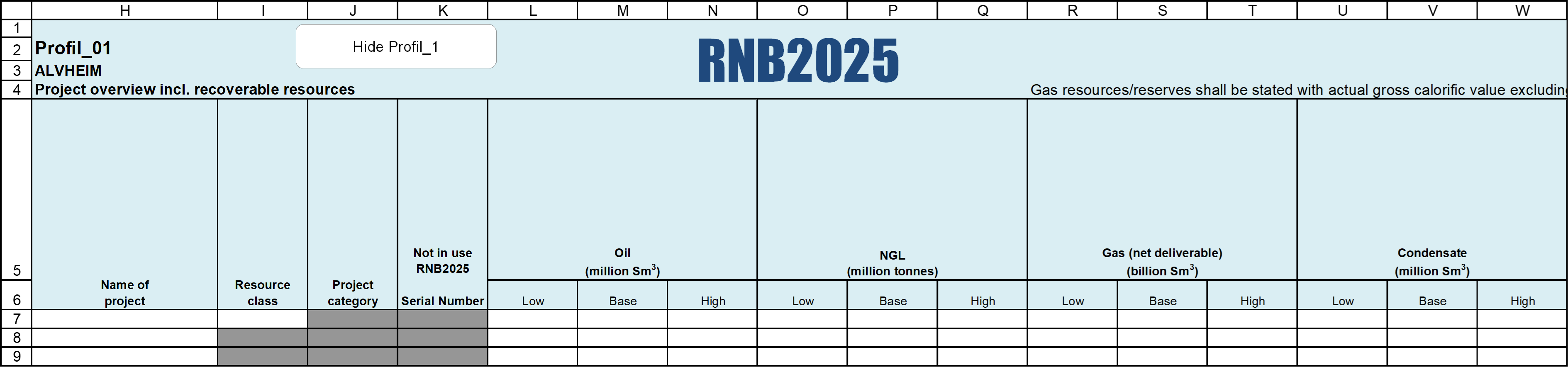

6.1.2 Type of profiles – overview

For fields, discoveries and TUF in RC0, 0+1, 1, 2, 3, 4 and 5, data on a yearly basis should be reported.

Monthly sales quantities for 2025, actual profiles shall be reported in a separate spreadsheet, see chapter 8 – Completion of the spreadsheet “Månedsdata”.

Types of data included in the profile collections:

- Project overview incl. recoverable resources and project attributes

- Uncertainty on production start/DG4 should be reported

- Production and injection data

- Sale of petroleum and other revenues

- Physical rich gas/dry gas deliveries

- Costs, (investments, operating costs, tariffs and other costs)

- Environmental data

The scope of the reporting depends on the type of project (field versus pipeline/land facility) and resource class.

There is an area under each profile collection for the consistency checks of data entered in the profile collection, see chapter 9.2 Consistency checks.

6.1.3 Comment boxes – explanation of changes from last year’s reporting

Each profile collection includes comment boxes placed above the production and sales data, investment data, operating costs, and environmental data. These boxes shall be used to provide brief information about the profiles. For example, if gas is bought for injection, please state the source field in the information cell “Please name sources of gas purchase”.

Furthermore, the comment boxes are to be filled in if there are significant changes compared with the previous RNB reporting, such as:

- Changes of more than 5 per cent in the total recoverable resource estimates.

- Changes in one (or more) years in the next ten-year period that is greater than 10 per cent or more than 1 million Sm3 o.e.

- Changes in total investment of more than 5 per cent Changes of more than NOK 500 million in a single year.

- Changes in operating costs amounting to more than NOK 300 million per year.

- As regards “Disposal costs and Other income”, changes in the total estimate greater than NOK 300 million must be explained.

The comment boxes can be used to explain large variations in the series of number reported this year. For projects that are reported with operating costs in basis profile, the comment box in this profile sheet is used to explain nonconformities. For other projects, the nonconformity explanation is provided in the comment box in the profile sheet, ref. chapter 6.7.

6.2 Project overview

The table at the top of each profile sheet must be completed with information about the projects included in the profile collection: project name, resource class and project category. Please notice that resource class and category only shall be entered into row 7, automatic filled in if multiple projects. Serial number will not be in use RNB2025. Recoverable volumes shall be stated with uncertainty. Fields and discoveries shall specify which deposit the recovery comes from. The drop-down lists retrieve information from Table 2a in the spreadsheet “Generell info og kommentarer”.

The main project should always be reported in Profil_1. Further profile sheets should be used according to maturation and dependencies. For example, a project depending on implementation of another project should be reported in a profile sheet with a higher number. Note that the resource class is independent on the numbering of profile sheets.

In each profile sheet, multiple projects with the same resource class can be included. The projects reported in the same sheet should have a common project type and decision timeline. Larger projects, where PDO or an application for PDO exemption will be delivered, must be reported in a separate profile sheet. Furthermore, the projects in the resource classes 3, 4 and 5 require information ("prosjektattributter") about the projects, this is described in chapter 6.10 Project Attributes.

6.3 Annual profiles for petroleum – production, sale, transport and injection

This chapter includes a description of the reporting of liquid and gas profiles. Please note the following:

- Reporting is requested for the sales product, for example condensate sold as oil should be reported as oil

- For individual profiles negative rates can occur in some years, for example, a profile for a project that entails acceleration of the oil production or increased gas injection, however the sum of all profiles for a field or discovery should be positive

- Reporting of commercial agreements involving swaps/borrowing/deferral of volumes are described in chapter 6.3.5.

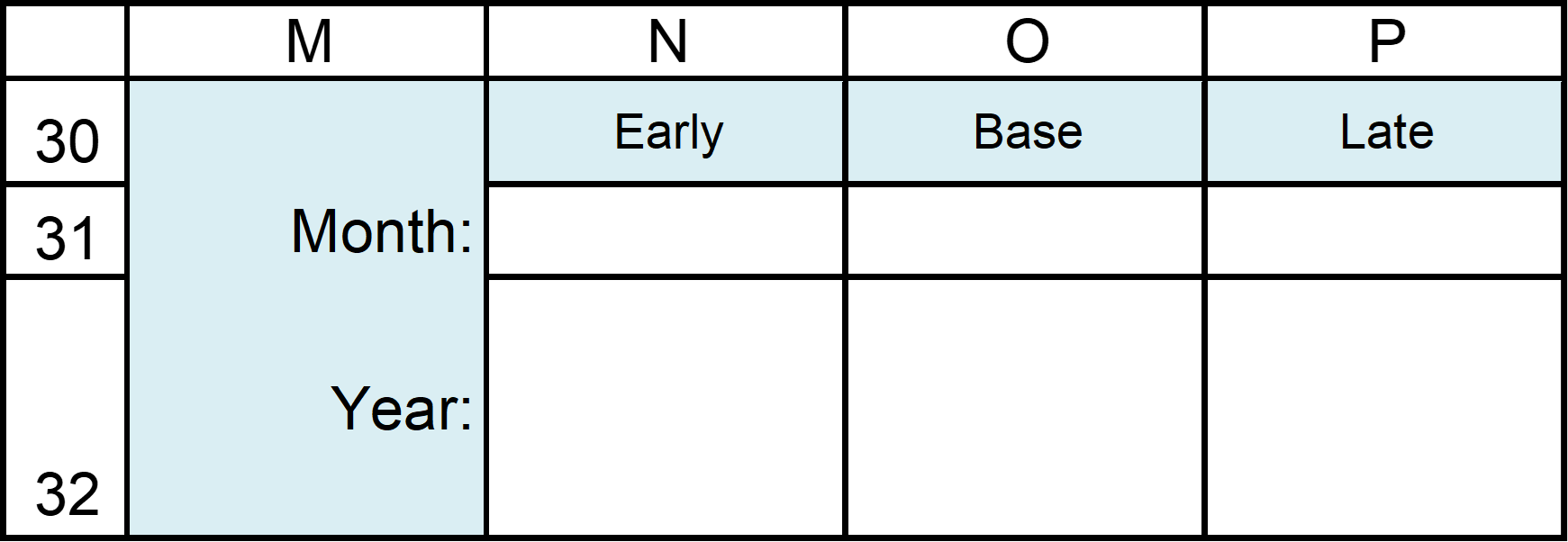

Generally, for all profile sheets reported in RC 2-5 we request information on assumed start-up (DG 4) of projects.

Year and month when production from a project or operation of an infrastructure project will start:

- DG4 (Base) reflects the expected start-up date

- DG4 (Early) could reflect an ambition start-up date

- DG4 (Late) reflects possible delays that could occur to the project, delaying start-up

The DG years should be consistent with the resource class for the profile. Example: volumes from wells classified as reserves according to 3.3.1 in the Guidelines, shall have DG1-DG3 when these criteria are met even though DG3 (drilling plan) for individual wells are not yet approved.

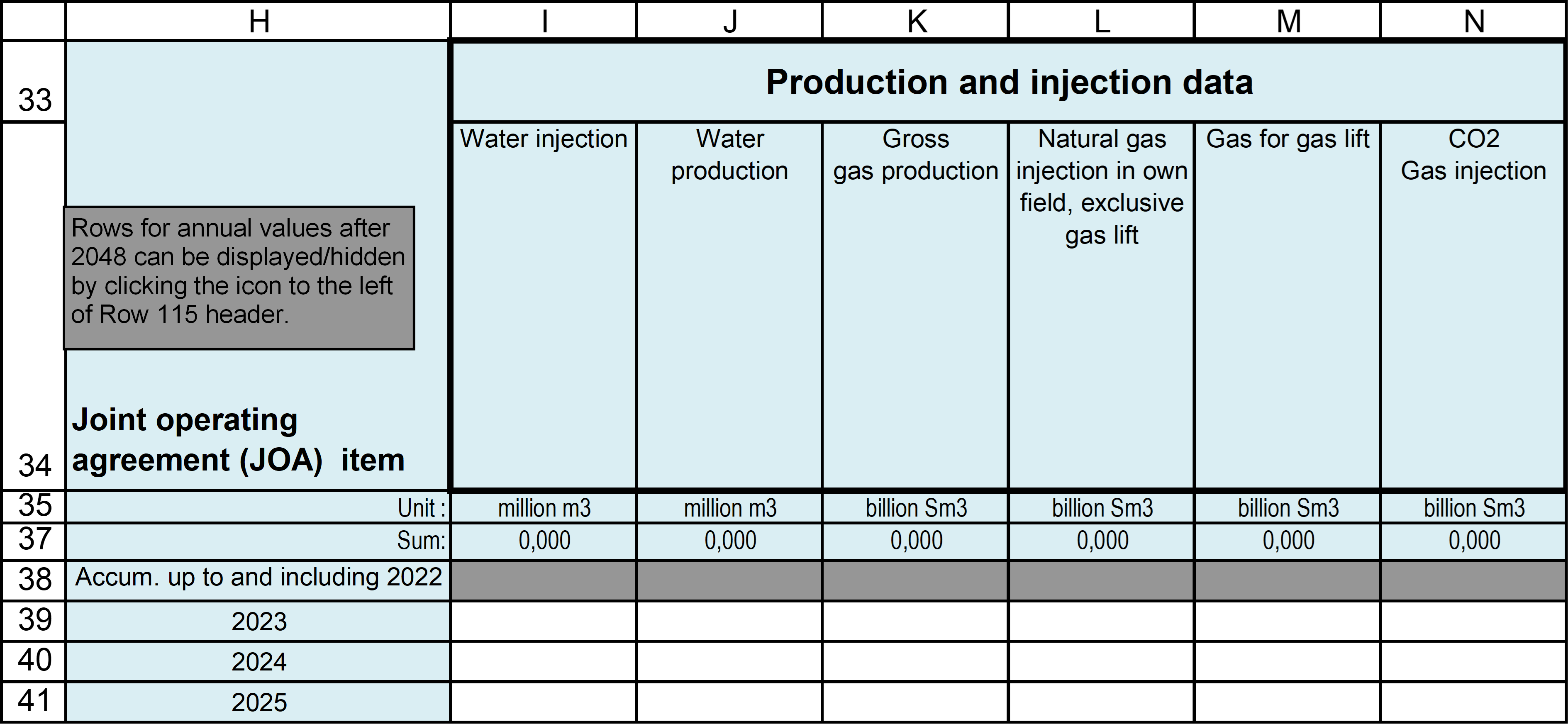

6.3.1 Production and injection data

The profiles under the heading "Production and injection data" relate to volumes that are produced and injected in the deposits in the same field, not injection in other fields.

The following profiles are to be reported:

- Water injection (million m³) in own field

- Water production (million m³) from own field

- Gross gas production (billion Sm³)

- Gross gas production (billion Sm³)

Gross gas production shall be equivalent to the lifting of gas from the reservoir in the relevant field/discovery. Gross gas production shall not include gas from other fields/discoveries that is merely processed and/or transported on the field/discovery that is the subject of the report. Nor should this profile include gas lift rates. For fields that are in production, gross gas production shall be reported in volumes equivalent to those reported to the Directorate (DISKOS – Allocated Production), in connection with the monthly production reporting. The measuring point is otherwise left to the discretion of the individual operator (state applicable assumptions). - Natural gas injection in own field excluding gas lift and CO2 (billion Sm³) reported in separate columns. Injection gas purchased (bought or borrowed) from another field shall be included in this column by the recipient (not the provider)

- Gas for gas lift (billion Sm³)

- CO2 injection (billion Sm³) for enhanced recovery in own field.

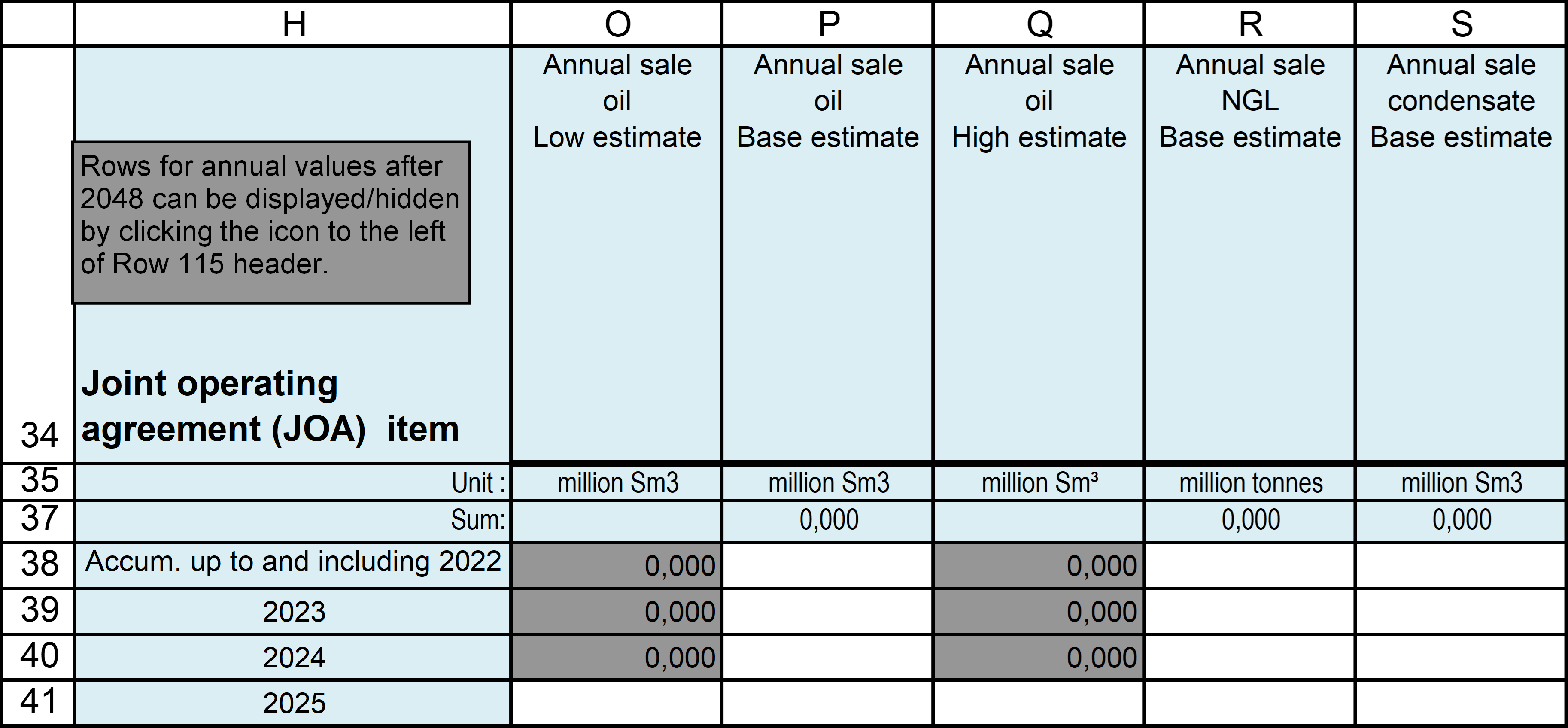

6.3.2 Profiles for sale of oil, NGL and condensate

For oil, annual base (expected) estimates must be reported with uncertainty estimates if the project is in RC(0+1) - 4. For NGL and condensate, only annual base (expected) estimates are to be reported.

The high and low estimates must describe the sample space for the relevant calendar year including both general reservoir uncertainty and operational uncertainty. Operational uncertainty shall reflect the progress in well drilling, the productivity of the wells, production capacity in processing facilities, etc.

The total of low estimates for annual production will normally be lower than the low estimate for the resource estimate (chapter 6.2), as uncertainty in annual volume shall include uncertainties that are not correlated from year to year (for example regularity). It is also improbable that the low estimate will occur all years. Correspondingly, the total of annual high estimates will normally be higher than the high estimate in the resource overview.

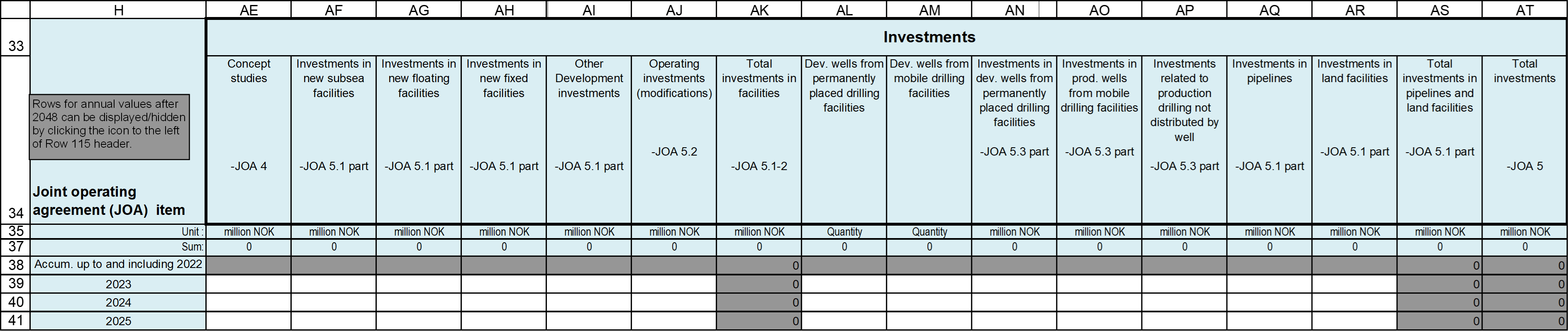

6.3.3 Transport, sale and purchase of gas

Transport and sale of gas shall be reported independently of the given production permit. If the expectation is higher than the production permit, this must be stated.

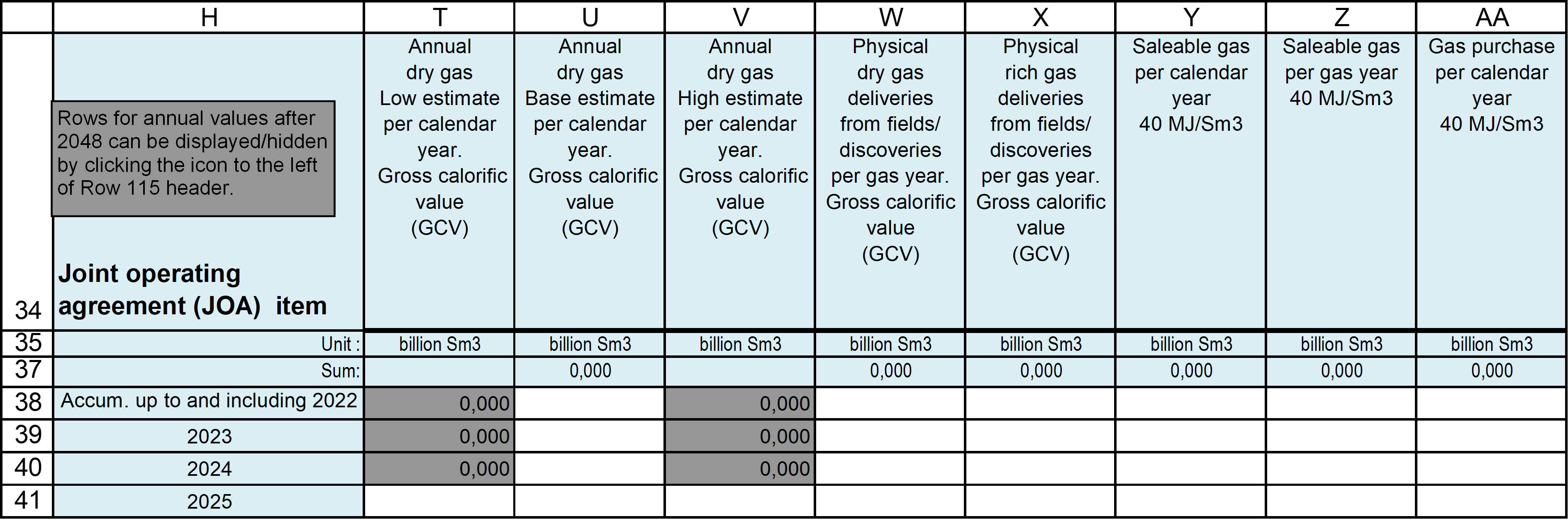

Note that some of the gas data is to be reported according to calendar year (1 January – 31 December), while other data is to be reported according to gas year. The gas year (n) runs from 1 October in year (n) to 1 October in year (n+1). If it is difficult to convert between gas year and calendar year, please contact the Directorate.

We are cooperating with Gassco on the reporting. The sheets used to report to the GMDC are included in the reporting file. The RNB data is transferred into the "Gassco sheets" using formulas. The operators will receive a separate request from Gassco.

Transport of gas:

The profile in column W (Physical dry gas delivery) shall be completed for all fields and discoveries that physically deliver gas. Fields that deliver rich gas shall report the expected volumes of dry gas at sales point after processing. For fields transporting unstable liquids ashore, the profile W shall not contain dry gas that is separated from the liquids at the terminal.

The data (column W) shall be reported with gross calorific value per gas year. This profile (W) is also used in the enclosed Gassco forms in the RNB file. For fields/discoveries that are expected to deliver dry gas to Gassled, the gas is reported to Gassled Area D (dry gas) (”Entry point” = Gassco Area D). All gas that the licensees may seek transport rights for in Gassled, shall be included in the Gassco part of the reporting.

The profile in column X (Physical rich gas delivery) shall be completed for fields/discoveries that are expected to deliver rich gas. The profile is stated per gas year with actual gross calorific value at the sales point. The profile is also used in the enclosed Gassco forms in the RNB file. Fields that export rich gas to another fields for processing before further transport as dry gas, are not required to report rich gas in column X.

For fields/discoveries that are expected to deliver rich gas to Gassled, the rich gas (column X) is reported to Gassled Area A (Statpipe), Area B (Åsgard), Area E (Kollsnes), Area K (Haltenpipe), Area L (Utsira High Gas Pipeline) and/or other areas such as the Barents (Gassco: “Entry points”). All gas that the licensees may seek transport rights for in these transport systems or areas, shall be included in the Gassco part of the reporting.

Sale of gas:

The profile in column Z (saleable gas per gas year) is derived from the profile in column W. For fields transporting unstable liquids ashore, this profile (column Z) should also contain dry gas that is separated from the liquids at the terminal and sold.

The profile in column Y (saleable gas per calendar year) is derived from the profile in column Z, only converted into calendar years.

The profile in column AA includes both historical and future expected purchases. Gas received as compensation for services (such as storage, treatment, and transport), is not defined as purchase. All physical received gas to the field / discovery (bought, compensation, in kind, etc.) shall be reported in column BY (Receipt of gas), see chapter 6.9.1.

Sale of gas – low and high estimates:

Sale of gas – low and high estimates:

The profile in column U should be identical with the profile "Saleable gas per calendar year 40 MJ/Sm³” in column Y but stated in gross calorific value. For reporting of uncertainty and production start-up, the same principles as for oil are used as a basis (see chapter 6.3.2).

The table below summarizes the reporting of different gas types.

Table 6 1 The reporting of different gas types

6.3.4 Reporting of gas blow-down

Blow-down of gas caps on the fields should be reported in a separate profile collection. This will apply to projects that describe a change in production strategy for gas (compression, blow-down, etc.).

The reason for this, is the uncertainty of when these projects start. It is therefore useful to receive separate profiles so this can be taken into consideration when the Directorate’s aggregated prognoses are prepared. Therefore, the blow-down projects included in RC0 +1, and previously included in the main profile, should be reported separately.

For these projects, it is desirable to get gas and associated liquid profiles and investment profiles in a separate profile collection. Operating costs and environmental profiles can still be reported in the main project unless the project involves new power-generating equipment.

6.3.5 Reporting of resources and profiles for commercial agreements

Gas bought from other fields (for injection purposes), which later will be exported, shall not be included in the resource base of the buyer. These volumes should be shown in a separate row in the resource overview with negative numbers. The gas import profile is given in column AA (gas purchase) by the buyer, and the payment is given in column BJ (Cost purchase of gas).

If gas is delivered to another field/discovery for injection or other use, please name the actual field/discovery. If the gas is given away as payment for a service or if the gas is sold, this should be explained in the comment box 2C in the worksheet “Generell info og kommentarer”.

When products are delivered in kind to other fields, the recipient should show the volumes in a separate row in the resource overview, if these volumes will be sold.

When commercial agreements involve swaps/borrowing/deferral of volumes between fields, a new “commercial” profile, Profil_15 can be added.

The complexity in reporting of commercial agreements varies, and in some situations sufficient reporting might be possible without the introduction of Profil_15.

Reporting of commercial agreements should apply the following practise:

- Commercial agreements between fields/discoveries should be reported in the RNB file.

- The effects of commercial agreements should be reported in Profil_15. If there are several field agreements, please use the adjacent profiles in descending order (Profil_14, Profil_13 etc)

- To avoid unnecessary feedback in the consistency checks, you should choose “Kommersiell avtale” as project type in the attribute area AB7:AB25 regardless of resource class.

- To avoid unnecessary feedback in the consistency checks, you should choose “Kommersiell avtale” as project type in the attribute area AB7:AB25 regardless of resource class.

- If a commercial agreement is expected, the commercial effects should be reported. When to report depends on what information the discovery/field holds at the time of reporting; this is not related to a decision gate (DG) for the discovery. Please state if all parties have agreed to the commercial agreement or if it is in progress, use the comment box in cell H28.

- If only one party considers that there will be a need for commercial agreements this must be reported. Comment box in cell H28 must be used to explain the preconditions for the agreement and the expected host field.

- For bookkeeping it is crucial that the different parties report the same effect of the commercial agreement, i.e., the total effect should be zero. If the agreements are not ready for RNB reporting, the Directorate can ask for the commercial effects in a separate Excel file. Please comment (cell H28) on whether the other field/discovery is expected to report.

- The gas columns in Profil_15 should be based on the same definitions as in chapter 6.3.3

- The sum of all profiles (including Profil_15) should give the correct total income profiles corresponding to the total resources in the project resource overviews (Sheet “Ressursoversikt” row 315).

- The project resource overview should correspond to the sum of the sales profiles for all products in each profile collection.

- The project resource overview should correspond to the sum of the sales profiles for all products in each profile collection.

- In total the field/discovery should not report negative total resources in the project resource overviews. If the expectation is that a development of a discovery reduces total saleable products, please report physical products separate from the total effect. Total saleable can then be corrected in Profile_15.

- In total the field/discovery should not report negative total resources in the project resource overviews. If the expectation is that a development of a discovery reduces total saleable products, please report physical products separate from the total effect. Total saleable can then be corrected in Profile_15.

- The comment area should be used to describe commercial set-ups and assumptions (cell H28)

- Bilateral agreements between individual companies (e.g., shipper agreements) are not to be reported in the RNB file.

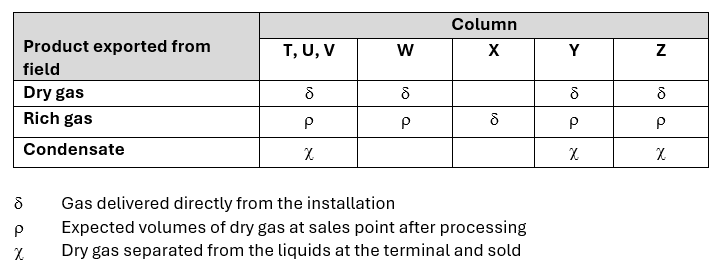

6.4 Costs and income –the Joint Operating Agreement and exceptions therefrom

The Joint Operating Agreement (JOA), which is an appendix to the License Agreement, specifies which cost items the licensees are obliged to report in their budgets, work programs etc. The JOA consists of 9 main items with sub-items (and sub-sub-items).

The reporting to the Directorate shall mainly be in accordance with the item structure in the JOA.

In some cases, the operators are asked to submit more detailed reporting than what is specified in the JOA. In other cases, the operator is requested to report more aggregated data. This applies to both investment costs and operating costs.

6.4.1 Operating income, Concept studies (JOA, items 7 and 4), Price increases

Concept studies (JOA, item 4)

For further definition of what is included in “Concept studies”, please refer to the JOA.

Operating income (JOA, item 7)

Tariff income shall be reported in the spreadsheet “Tariffinntekter” (see chapter 7 for details). Tariffs from this spreadsheet are copied automatically to Profile 1 only.

”Other income” beyond tariff income should be reported directly in column AC under “Other income” in the profile sheets.

General price increase

«General price increase» is the operator’s general assumption for converting nominal NOK to real NOK. For RNB2025 the reference year is 2024. The “General price increase” should therefore be used to convert nominal figures for 2025 and onwards from nominal value to 2024-value. Figures for year 2023 should be reported in nominal values.

Please note that if the general price increase is assumed to be constant with time from 2024 and onwards, this shall be reported as a percentage in the cell AC28 in profile sheet 1 (Profil_1). We expect the same general price increase (for instance the consumer price index) to be used for all projects reported by the same operator, and we recommend that the price increase percentage value is entered into cell AC28 by a coordinator before internal distribution to the projects. If the general price increase varies, please state the percentages in the “Cost control” spreadsheet range C19:C41, see chapter 9.3.

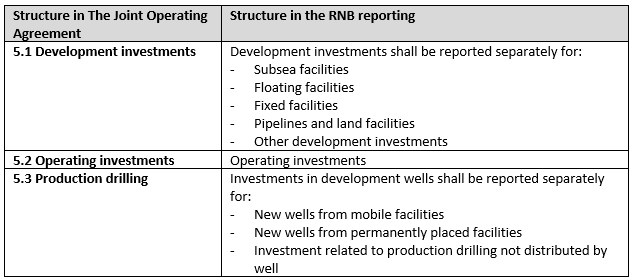

6.4.2 Investments (JOA, item 5)

Investments begin when a decision on implementation of a development project has been made.

Reporting to the RNB regarding investment costs differ on certain items from the structure in the JOA.

The table below shows where this is applicable.

Table 6-2 Investment costs

The following table shows the reporting requirements for development and operating investments, ref. Items 5.1, 5.2 and 5.3 of the JOA.

6.4.3 Development investments (JOA, item 5.1)

The JOA: ”Development investments concern the development of new resources. There will always be concept studies before such an investment is made. The budget for the project is sanctioned by an approved PDO/PIO. Some projects are exempted from the PDO requirement.”

“Other development investments” is a miscellaneous column that includes all other development investments.

Please control the accordance between type of development investment and development solution reported in the project attribute area for RC3-5 projects

The following definitions apply:

Subsea facilities are facilities on the seabed. They are to be reported excluding pipelines.

Floating facilities comprise all facilities that do not rest on the seabed, such as semi-submersible platforms, tension leg platforms (TLP), production ships, and other floating facilities. If in doubt, please contact the Directorate.

Fixed facilities comprise all facilities that are located on the seabed (excluding subsea facilities and pipelines), and that are above sea level. Fixed facilities also include mobile facilities which during the field’s lifetime are regarded as permanent for the field (e.g. jack-up rigs, owned or rented as production facility).

Pipelines shall comprise investments in the pipeline system. However, investments related to non-pipeline facilities offshore, such as Draupner, should be reported as investments in columns AF to AJ. Internal pipeline costs for fields and discoveries shall be included here, in addition to export pipelines. Costs related to umbilical are included with pipelines.

The pipeline system includes the actual pipeline downstream of the connection point on the production facility and upstream of the connection point for

- receiving production or process facility

- receiving pipeline with different ownership than the joint venture/equivalent or

- receiver on land

Land facilities include facilities owned by the joint venture, or equivalent that are located on land downstream of the pipeline. Investments on land that are transferred free of charge to another joint venture shall be included in the investment estimate.

Other development investments comprise development investments that would not naturally be included in the other categories, including special modifications or additional equipment on existing facilities. CAPEX for a discovery under evaluation, related to modification on a future host installation, should also be included. This category also covers investments in specific equipment on leased production facilities.

6.4.4 Operating investments (JOA, item 5.2)

We refer to the JOA which states what to be included in point 5.2.

6.4.5 Development wells (JOA, item 5.3) – investments and number of wells

Development wells (JOA, item 5.3)

The reporting regarding development wells must differentiate between wells drilled from fixed and mobile facilities.

Please note that the Directorate uses the term Development wells instead of Production wells (and Development Drilling, not Production drilling).

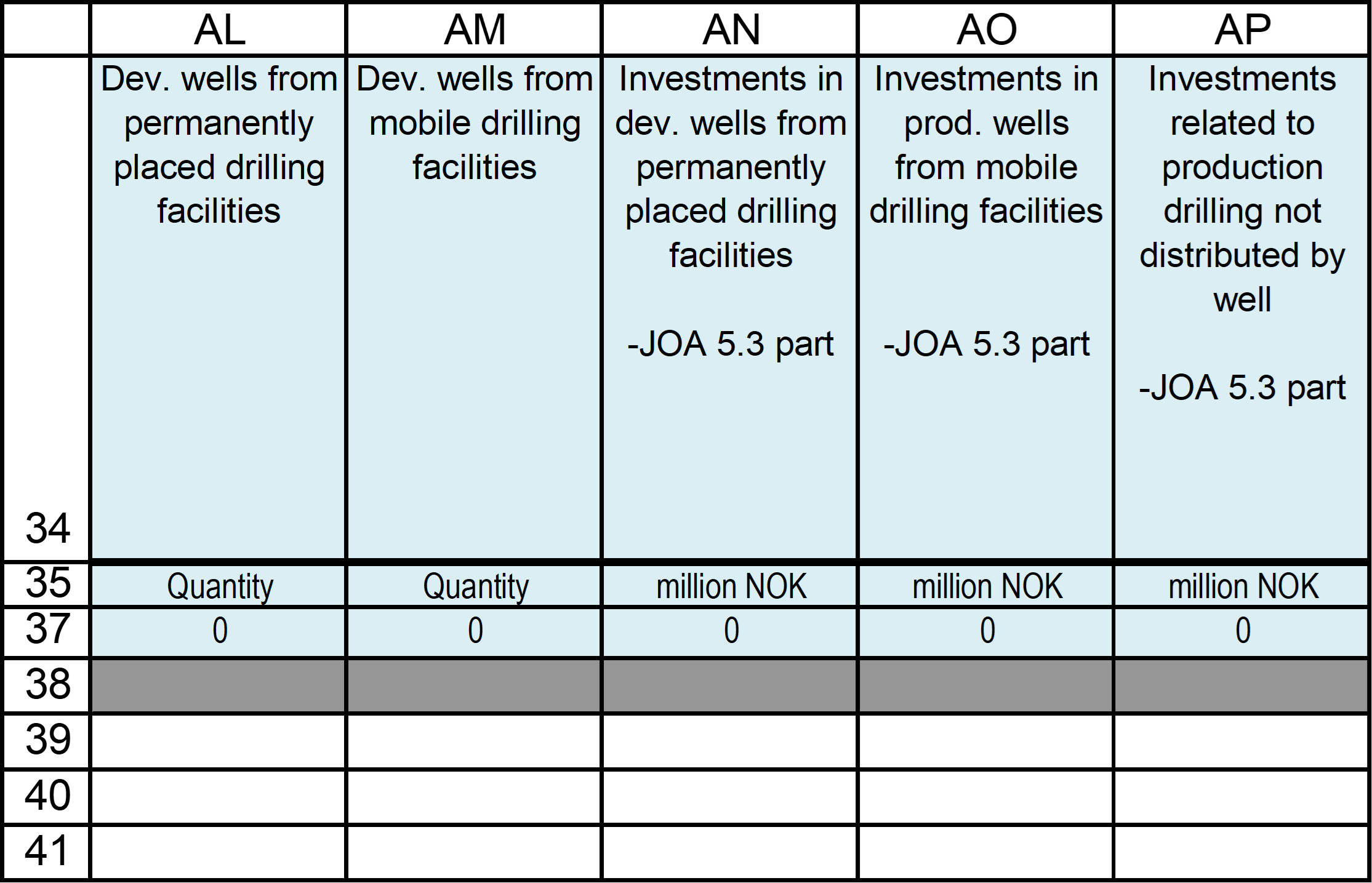

The table below shows reporting requirements for investments in development wells, ref. Item 5.3 in the JOA.

For more details, we refer to the JOA.

Please note that investments in development drilling that cannot be attributed to wells, such as seismic and associated activities mentioned above, shall be kept separate and reported separately.

Number of development wells

New wells include all wellbores that receive their own designation in accordance with the Directorate’s rules for naming wells and wellbores: Designation of wells and wellbores. Please note that a side-track and each branch in a multilateral well shall count as a separate wellbore.

The number of development wells is to be reported:

- Both production and injection wells shall be included in number of development wells and costs.

- Pilots and observation wells drilled to establish an efficient wellbore, should not be reported under the number of development wells. However, costs related to these wells must be reported. Calculations of an average well cost will then reflect the total cost of getting one functional well.

- Changes to the purpose of a well may occur. This however will not count as a new well, hence the number of wells is not changed. The costs related to conversion must be reported.

- Exploration wells (wildcat and appraisal wells) shall NOT be included in number of development wells nor in well costs.

- Disposal wells shall be included in number of development wells and costs.

The number of development wells from mobile and permanently placed facilities shall be reported.

The number of development wells from mobile and permanently placed facilities shall be reported.

The following definition applies:

- A mobile drilling facility means a drilling facility that is intended to be used on multiple fields.

- A permanently placed drilling facility means a drilling facility that is permanently placed on a field, including drilling facilities that physically can be moved, but are intended to be permanently placed during the production period. This means that wells drilled from floating facilities and jack-up rigs with drilling and processing equipment are drilled from a permanently placed facility.

The division is thus not determined by whether the facility can physically be moved or not.

Well costs

Costs associated with development wells, disposal wells and costs related to pilot and observation wells shall be reported.

The number of wells from fixed and mobile drilling facilities shall correspond per year with costs associated with development wells. The number of wells may be reported as a decimal figure (e.g.,3.2) if the wells are not completed within the calendar year.

As part of the quality assurance, a graph in the spreadsheet “Cost Control” shows yearly investments per well, distributed on different drilling facilities, calculated from the spreadsheet “Profil_Total”.

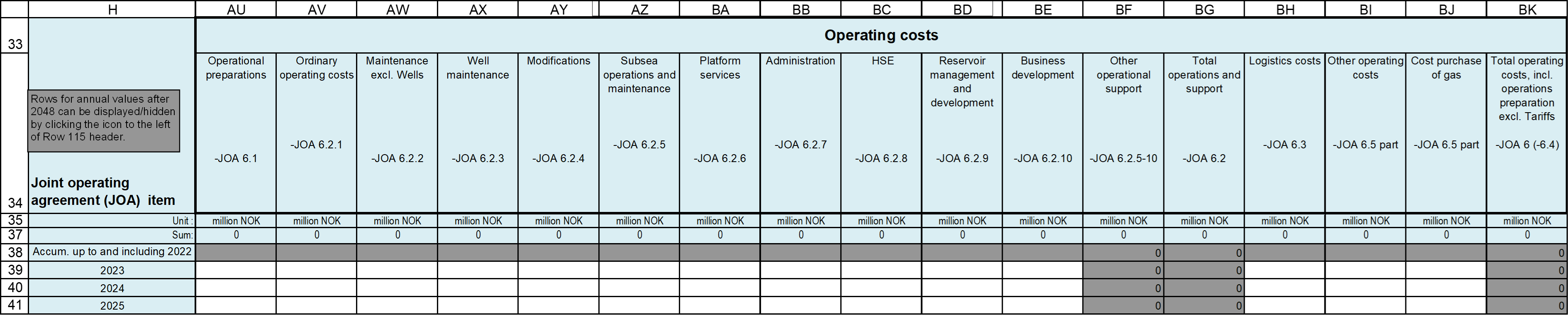

6.5 Operating costs, (JOA, item 6)

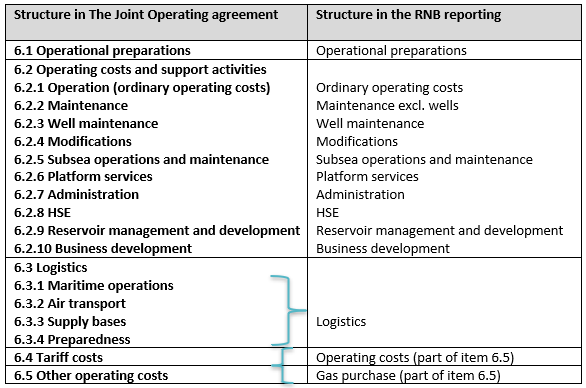

The reporting to the RNB regarding operating costs differs on certain items from the structure in the JOA. The table below shows where this is applicable.

Table 6‑3 Operational costs

The table below shows our requirements concerning operating costs. For more details, we refer to the JOA.

As part of the quality assurance, a graph in the spreadsheet “Cost Control” shows yearly unit costs calculated from the spreadsheet “Profil_Total”.

6.6 Shared facilities (Costs)

Some fields or development projects share common facilities to achieve a cost-efficient resource management. Examples might be

- development of deposits in different production licences sharing common facilities

- power from shore projects involving different fields

For this kind of projects, all investments and operating costs should be reported by the operator of the shared facilities. Other fields or discoveries paying for the shared facilities should only report its investment share or operating cost share as Cost sharing CAPEX or Cost sharing OPEX in the spreadsheet (columns BR and BQ). For RC1 and RC2 the shared costs are to be reported by the operator of the shared facilities in sheet “Tariffinntekter”.

When different projects at a specific field share new common facilities, all investments and operating costs regarding new common facilities should only be reported in one profile collection. No cost sharing should be reported.

6.7 Distribution of a field’s total operating costs on an individual project

Projects that result in significant changes in operating costs cannot be reported in the basis profile.

- Examples of this include new facilities, new expensive equipment/drainage strategy and cost reduction project.

It is not necessary to report separate operating costs for a project on a field if no significant changes are expected in the operating costs on the facility.

- Examples of this include Wells/well work, optimizations within reservoir management, upgrades, etc.

If some of these projects result in extended lifetime for the field, the total operating costs must also be extended.

6.8 Shut-down and removal (JOA, item 8) and General costs (JOA, item 9)

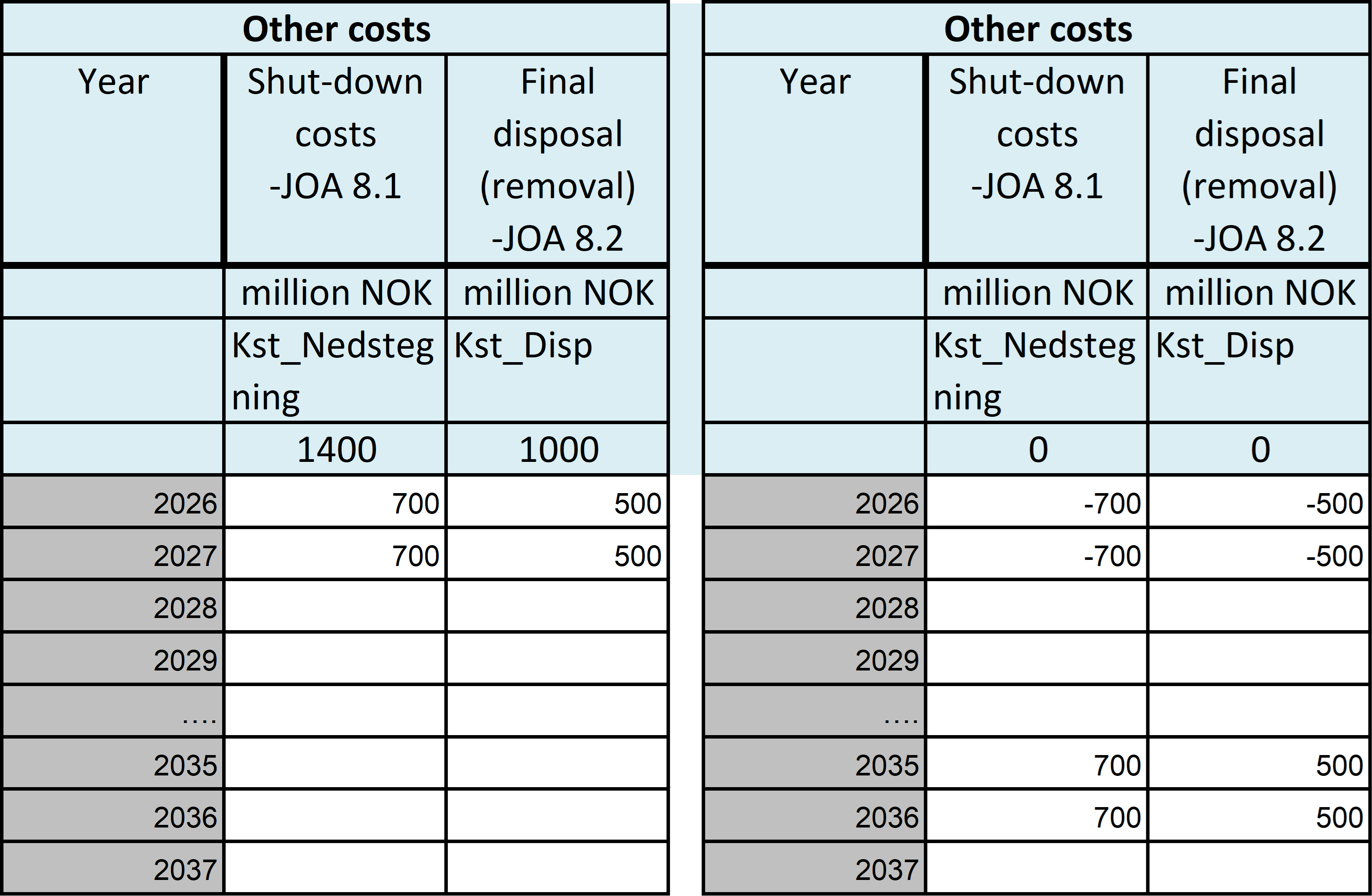

Shut-down and final disposal costs

Costs associated with shutdown and final disposal shall be reported. The time schedule for the activity must be practically possible to carry out. In a supplementary project that can extend the lifetime of the same field, costs related to shut down and removal/disposal may be postponed. Shutdown- and final disposal costs are then subtracted from the profile sheet for the supplementary project and added to the year(s) the removal/disposal of facility is taking place. An example is given below.

Example: A project in RC1 is shown in the left table. The right table illustrates a supplementary project in RC5 that can extend the lifetime of the field, thereby delaying shutdown and final disposal costs.

6.9 Environmental data and assumptions for discharges/emissions

The environmental forecasts comprise the physical volumes that are flowing in the production facilities on the respective fields, both from and to own fields and connected fields, and entailing emissions to air and/or discharges to sea.

Alternative power projects related to existing infrastructure shall be reported with costs and emissions when passed or expected to pass DG0 current year. The reporting shall be in a separate profile with emissions reduction both on the main field and associated fields. Termination of separate reporting shall be decided in the process with the project list.

Main principles:

- For reserves, RC1-3, environmental data are reported for fields, transport systems and land facilities where the emissions/discharges physically occur. This means that some fields (such as fields that only have seabed installations) do not need to report other environmental data than drilling related emissions. The forecasts shall reflect emissions/discharges based on the use of current technology and the effect of emission/discharge reduction measures adopted by the license.

- A different principle is employed for RC4 and 5. Environmental emissions/discharges, as well as the assumptions used, are to be reported for the respective field/discovery. Future emissions/discharges from the development shall be reported. In the comment space, it should be stated which existing field that are planned to be used. The forecasts should be based on the current plans. Measures under consideration that could lead to emission/discharge reductions, beyond what can be achieved using current technology, shall be described in the comments space for environmental data.

- The border fields/discoveries whose facilities are placed entirely on the Norwegian shelf, shall report emissions/discharges.

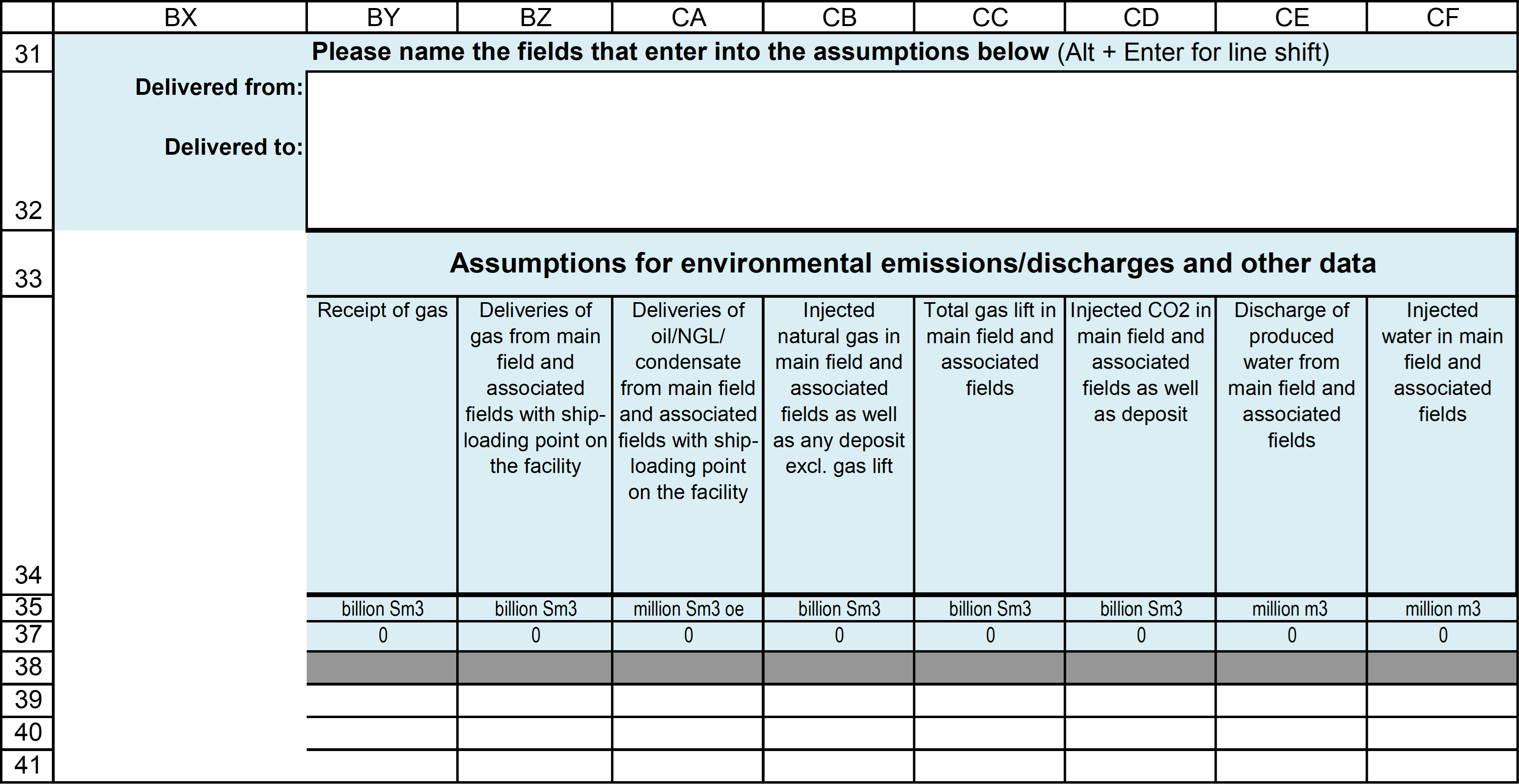

6.9.1 Assumptions for environmental data

Fields included in the environmental reporting

Associated fields that are included in the assumptions for environmental emissions/discharges should be listed in the cell above (BY32). Please distinguish between fields that you are receiving products from and fields that are recipients from your field (for instance by using two lines in cell BY32; Alt+Return to make a new line).

Gas received (column BY) shall include all gas received or purchased for fuel, injection, resale, or storage. It is insignificant whether the gas is actually used for this purpose, or whether it substitutes for gas produced from the reporting field/discovery.

Deliveries of gas (column BZ) shall be reported at actual calorific value. The column shall contain all gas, including gas from associated fields treated for further transport, as well as any NGL volumes that follow the gas stream. The volumes shall refer to the metering point (fiscal) for shipping/export of gas on the facility. Gas directly injected in associated fields shall not be included in this profile.

Deliveries of oil/NGL/condensate (column CA) are sales of oil/NGL/condensate (including oil/NGL/condensate that is treated from associated fields) converted into Sm³ oil equivalents (1 tonne NGL = 1.9 Sm³ oil). NGL that follows the oil stream shall be reported here. The volumes shall be referred to the metering point (fiscal) for shipping/export of gas on the facility.

Injected natural gas (column CB) is the total volume of compressed natural gas for injection as pressure support and/or disposal in own or third-party fields. Gas that is delivered for further compression and injection and/or disposal in a neighbouring field, should be included in “Deliveries of gas” (BZ). The gas is reported at actual calorific value. Gas volumes used as gas lift shall not be included in this column, nor CO2 gas for disposal or pressure support.

Gas lift (column CC) is the volume of gas compressed on the field for use as gas lift in own or associated fields.

Injected CO2 (column CD) is the volume of CO2-gas that is injected from the field for improved recovery or for disposal in own or associated fields.

Discharge of produced water (column CE) is the total volume of produced water discharged from the field, i.e., the water that comes from own field and other associated fields.

Injected water (column CF) is the total volume of water (seawater and/or produced water) injected for pressure support or disposal. If a field delivers water to an installation on another field, the injection is to be reported where the pumping work takes place.

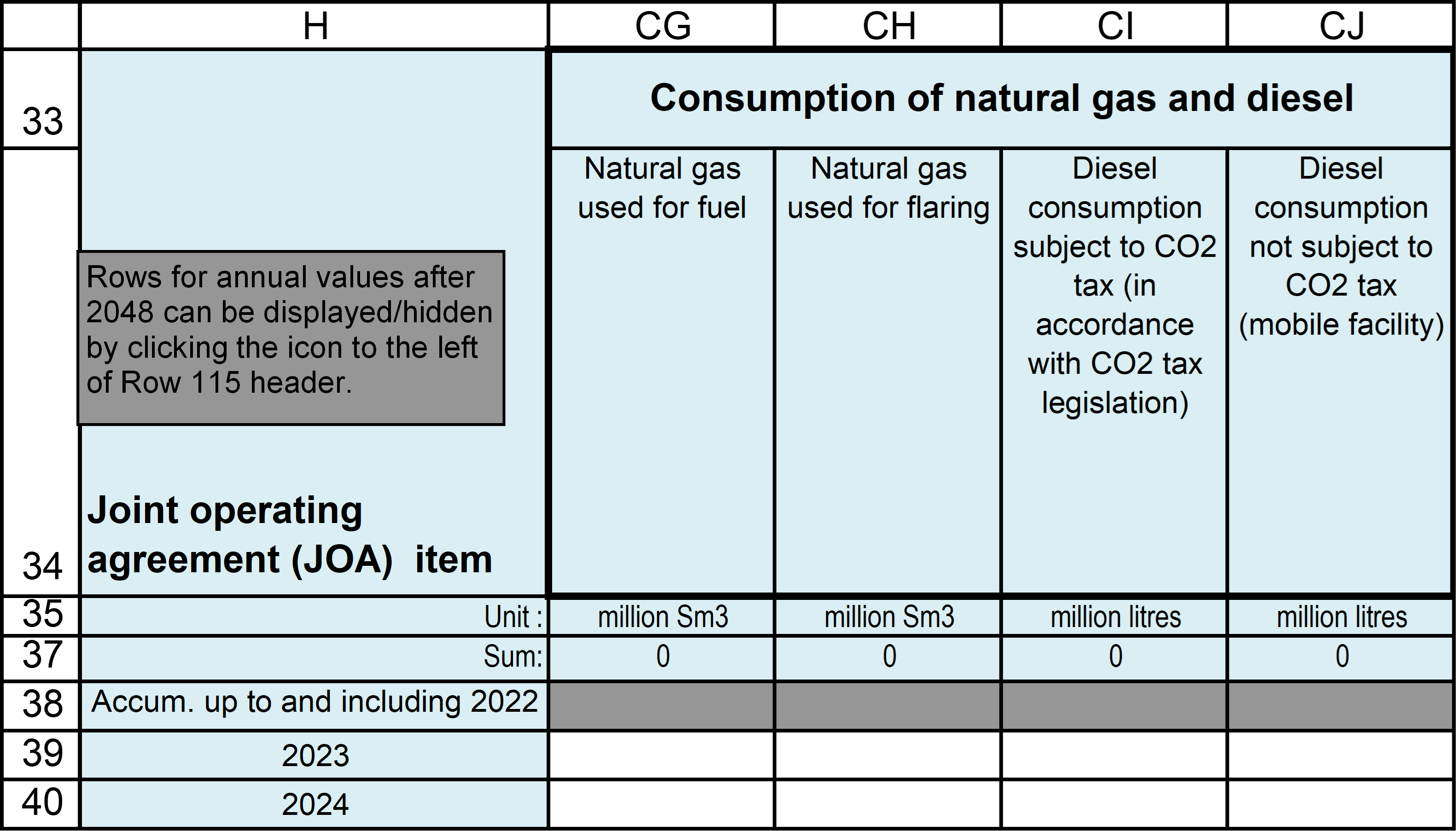

Natural gas for fuel (column CG) is gas consumption to generate power.

Natural gas for flaring (column CH) is the gas volume that is flared.

Diesel (column CI) is diesel consumption from permanently placed facilities and mobile facilities that are tied in to a permanently placed facility in production (activity that is subject to the CO2 tax) regardless the status of the reporting object.

Diesel consumption (column CJ) that is not subject to the CO2 tax under the CO2 Tax Act shall be reported in a separate column and shall include mainly diesel consumption on mobile facilities that are involved in petroleum activity. This entry includes activities before start-up and after cease of production.

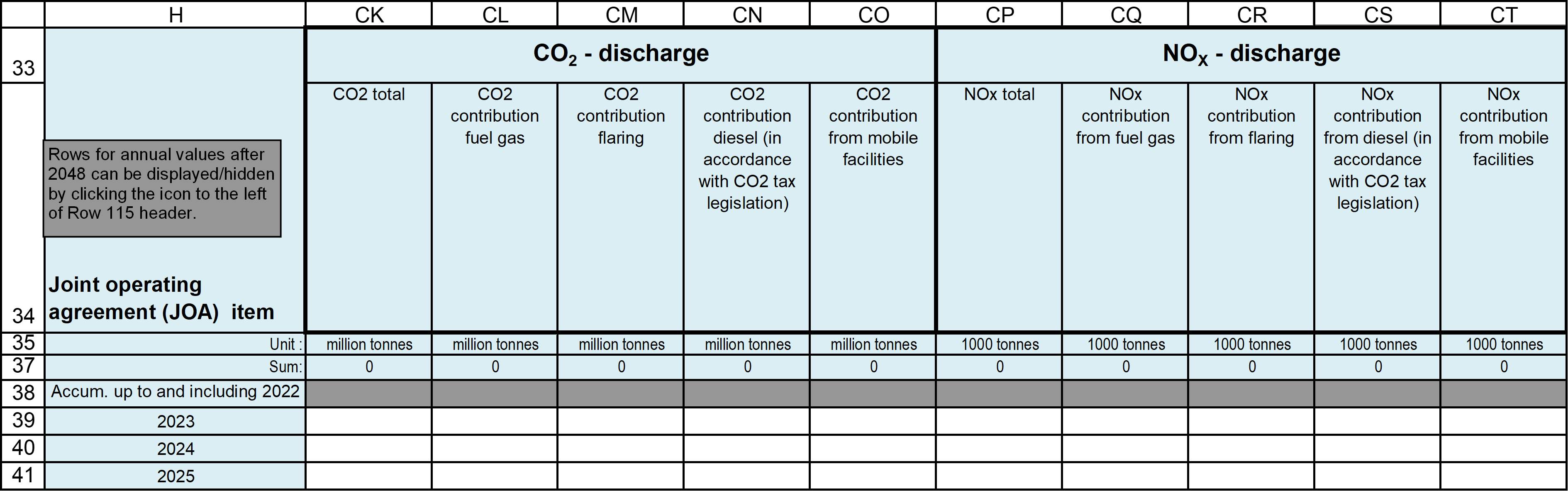

6.9.2 Emissions

Emissions of CO2 and NOx from fuel gas, flaring and diesel include emissions from permanent facilities, mobile facilities linked to a permanent facility in production (activities subject to the CO2 tax) and facilities that are not covered under the CO2 Tax Act.

Emissions of CO2 as a consequence of e.g. venting from CO2 separation plants shall be reported under the column ”CO2 contribution flare”, and shall also be addressed under comments. In some cases, this will lead to a lack of consistency between the columns “natural gas to flare” and ”CO2 contribution flare”. This must be explained in the comments box.

For reserves (RC1-3), the total CO2 and NOx emissions shall be divided between the contributions from fuel gas, flaring, diesel, and activity from mobile facilities.

For RC4 and 5 it is required to report the total prognosis for emissions of CO2 and NOx, respectively. When possible, please specify these emissions according to contributions from fuel, flare, diesel, and activity from mobile facilities.

Activity related to exploration wells shall not be reported.

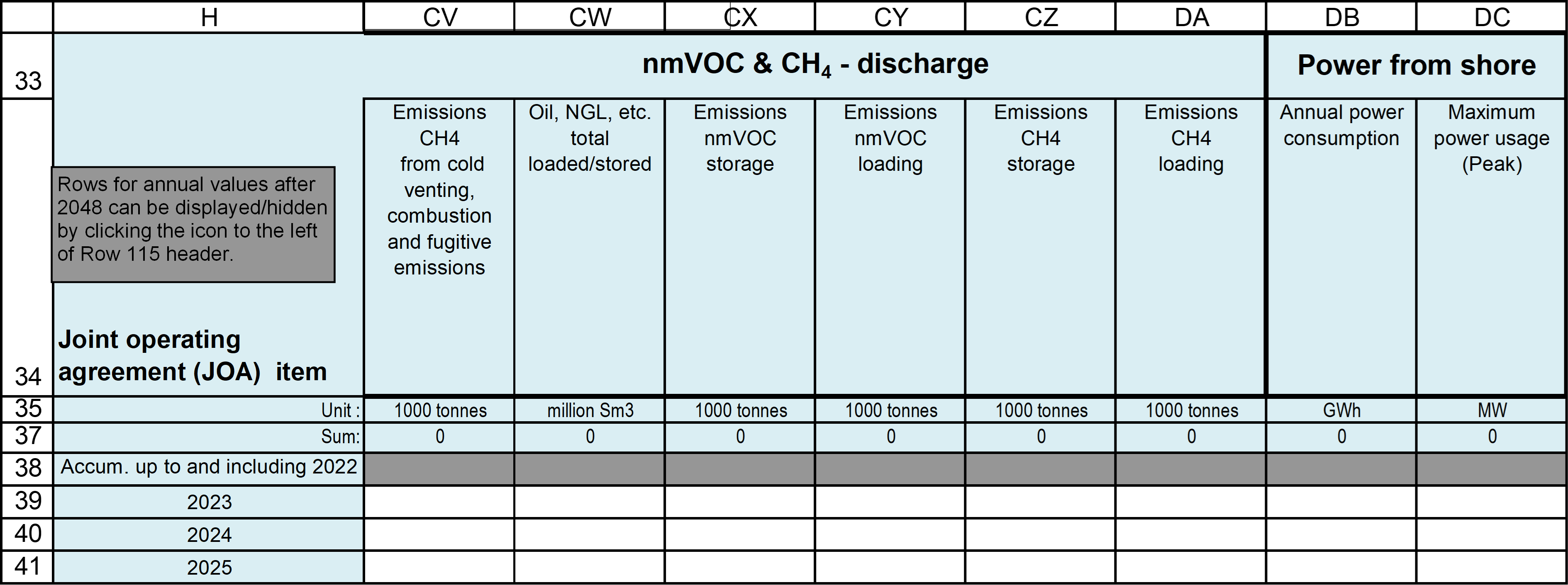

Emi ssions of nmVOC and CH4

ssions of nmVOC and CH4

Total emissions of nmVOC and CH4 from diffuse emission sources, and cold venting and from combustions (vent, turbines, motors, boilers, furnace, well tests, well cleaning or others) shall be reported. The sources of these emissions will be facility specific. Emissions of natural gas from all systems that handle hydrocarbons shall be included. Total emissions reported in columns CU and CV should be sum of all sources, except for storage and loading, reported yearly to Footprint.

Emissions associated with storing and loading of oil/NGL/condensate shall be reported in accordance with adopted measures or as the operator has planned (in those cases where a final decision has not yet been made).

For facilities that carry out storage and loading for other fields, these volumes and their associated emissions shall also be included (applies to reserves).

Energy demand for power from shore

Use of power from shore in the petroleum industry will have consequences for the whole power system onshore. Information regarding both energy requirements and power demand (GWh and MW) from the sector of the petroleum industry that gets power from shore is necessary, both to secure an effective operation of the power system onshore, and to help plan for prudent development over time.

It is important when planning to have the best possible overview and knowledge of both energy consumption and power demand. Power demand from the onshore grid, measured as maximum load during a year, from the installations that get power from shore will vary over time. This applies to both facilities that receive power from shore via subsea cables and land facilities that are directly connected to the domestic power grid. It is the power demand that regulates the dimensioning requirement of the transmission capacity in the power grid.

Report

- Forecasts for power (electricity) consumption in GWh/year in column DB

- Maximum peak load/effect in MW that is expected for one hour, for each year in column DC

6.10 Project attributes

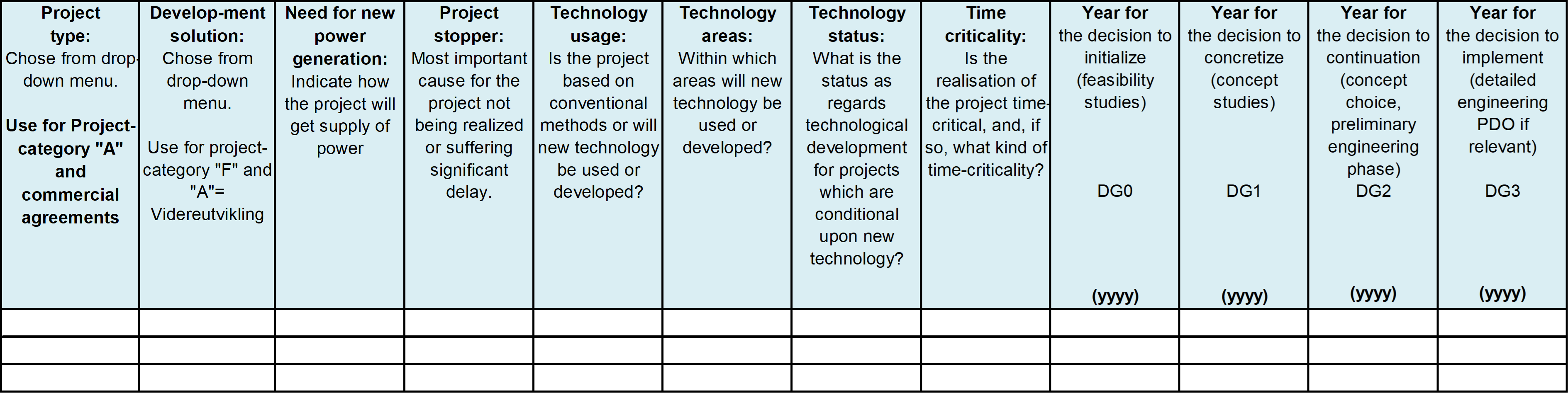

For all projects/discoveries in RC3-5, project-specific information shall be provided under the collective heading "project attributes" in the table at the top of each profile collection in the reporting file. Please note that the project attributes are identical to the categories used in Scope RNB-Collabor8. The spelling in Collabor8 is not reflected in descriptions below. It is possible to copy and paste information from other Excel-files, like exports from Collabor8. Project attributes for projects/discoveries in RC2 may be entered - but this is optional.

This information will be used in various analyses the authorities perform regarding the offshore activity. To ensure a uniform basis for the analysis, the project attributes are based on lists with pre-defined selections (drop-down lists). Therefore, only one value can be selected in each cell. The selections shall be reflected in the profile collection below.

For pipelines and land facilities the name of the various projects must be entered in H7 in the profile collection.

When none of the options fit

In some cases, none of the options in the respective lists will be appropriate for the specific project. The parameter that comes closest shall nevertheless be selected. An explanation can be entered in the comments space to the right in the project attributes, or a more suitable parameter can be given. The same applies if several of the choices are equally relevant; select one parameter and, if applicable, list the others in the comments space.

The comments space can also be used to provide information e.g., that realization of the project is contingent on specific assumptions, more detailed information about the use of new technology, or technology development needs, and explanations for the decision plan.

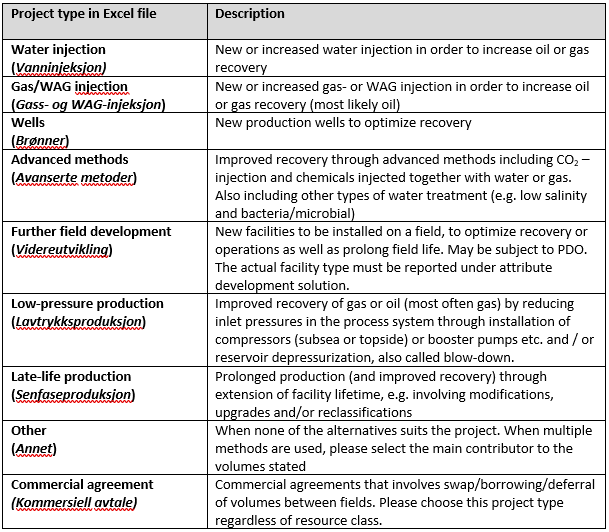

Project type

Use this attribute to describe the main method applied to recover the additional volumes reported with project attribute A. A drop-down list has been assigned to this column.

The table below shows available options for project category A.

Table 6‑4 Options for project category A

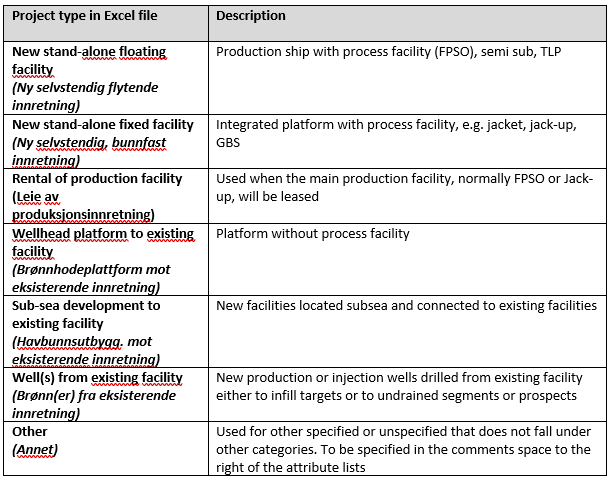

Development solution –use this attribute to describe the planned solution for development of resources with project category F. If multiple facilities are possible, pick the most relevant solution in the table below. This attribute also applies for project category A when the attribute, “further development” is selected.

More detailed information about assumed development concept can also be described using free text in the comments space in cell H28.

The table below shows the available options corresponding to project category F:

Table 6‑5 Options for project category F

Power solution

Many projects will be of such a character that there will be no need to install new power intensive equipment, and installed capacity must be used. This applies to both field- and development projects.

In the environmental part, independent data should be reported. We ask you to state what will be the most likely requirement at project implementation.

These choices are possible;

- Use of existing equipment (Bruk av eksisterende):

- There will be no need to install new power generating equipment on the field/ host field/ power plant, installed capacity is sufficient

- New power generating equipment (Nytt kraftgenererende utstyr).

- Power from shore (Kraft fra land)

- Wind turbines (Vindturbiner)

- Alternative fuels (Alternative brennstoff)

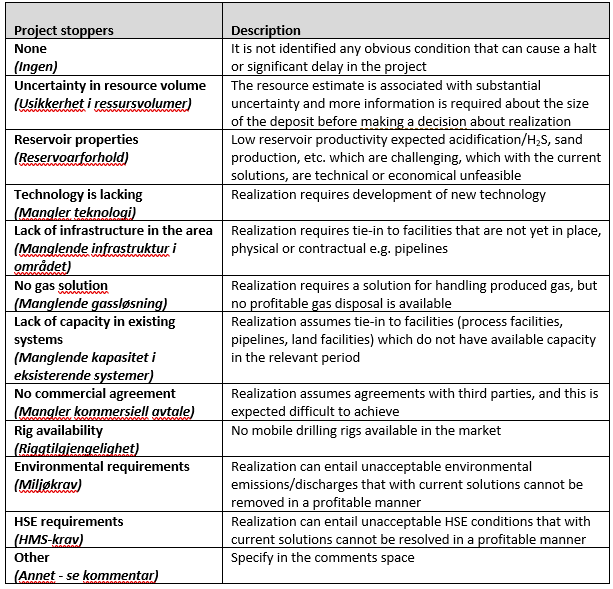

Project stoppers

We ask for an identification of the most obvious condition that may hinder project implementation as reported. For projects with resources in RC4-5 the most important cause for the project not being realized or suffering significant delay is to be chosen. The table below shows the available options:

Table 6‑6 Project stoppers

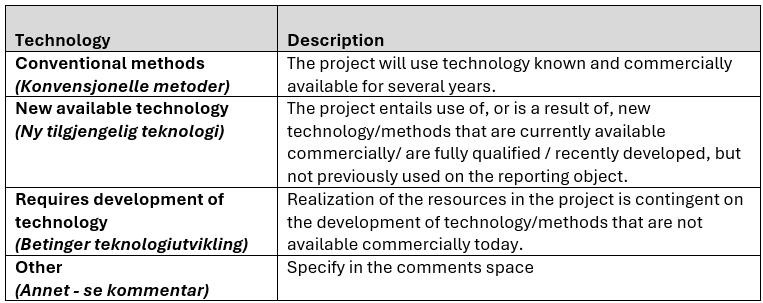

Technology

Is the project based on conventional methods or will new technology be used or developed?

The table below shows the available options:

Table 6‑7 Technology options

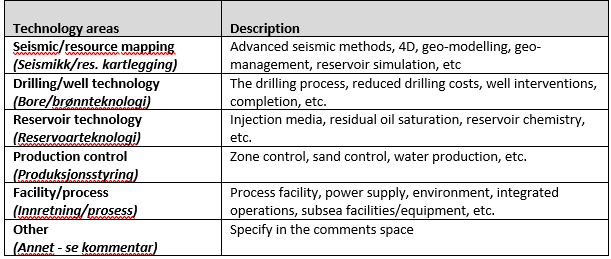

Technology areas

Within which areas will new technology be used or developed? Provide detailed comments in the comments space, e.g., if the project includes technology development within several areas. The table below shows the available options:

Table 6‑8 Technology areas

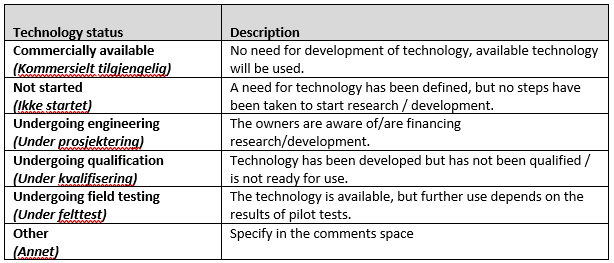

Technology status

What is the status regarding technology development for projects that are contingent on new technology? The table below shows the available options:

Table 6‑9 Technology status

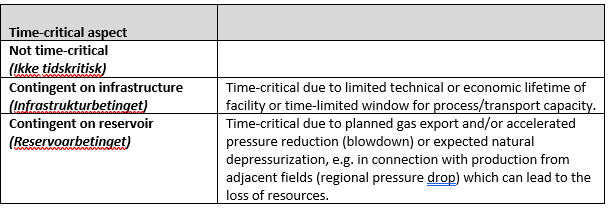

Time-critical aspect

Is realization of the project time-critical, and if so, what is the time-criticality. The table below shows the available options:

Table 6‑10 Time-critical aspect

Decision plan

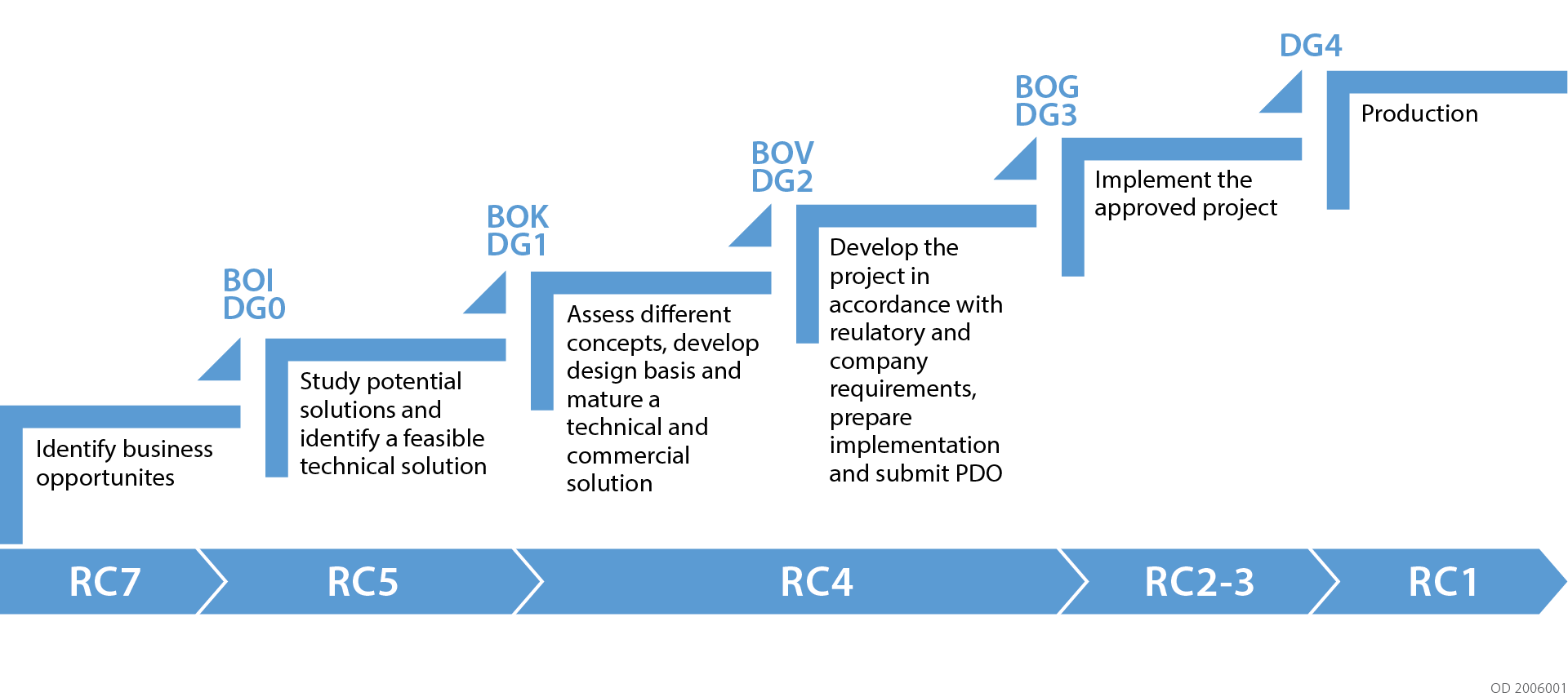

To ensure that the maturation of projects and discoveries can be followed, the authorities want an overview of the past and expected project decisions in the production licences. What kind of decisions will be made next, indicates how far the project has progressed in terms of studies/evaluations. The figure below illustrates the decision model used by the authorities for larger projects and developments, and that represents some of the possible selections in the list.

Figure 6-1 The connection between project maturation and resource classes

Decision year

-

The expected/planned years for future decisions must be indicated. Even if, for example, initiation of the project lies quite far into the future, the operator must nevertheless indicate a year that represents the best estimate. The year selected should be realistic, and not just an ambition. Decision milestones that have already been passed shall also be stated, including the year.

-

Decision on project initiation, BOI (DG 0)

- Equivalent to start-up of feasibility studies. The project is a potential, but evaluation has not yet been started. -

Decision on concretization, BOK (DG 1)

Equivalent to start-up of concept studies. The project is initiated, and feasibility studies are underway. Work is proceeding towards a reduced list of concept options. The following activities are normally carried out in the feasibility study phase up to a decision on concretization:-

The concept or resource base for the project is reviewed, evaluated, and described.

-

The market for the proposed products is evaluated.

- Based on technical studies, potential feasible technical solutions are outlined for the field development, transport system, treatment facility, etc.

- HSE consequences are evaluated.

- A cost estimate is prepared for the project; this will normally satisfy +/- 40 per cent.

- The probable profitability of the business concept will be documented.

- An evaluation is made of the uncertainty associated with the project, including resource base, market, technical solution, HSE, feasibility, supplier market, cost estimate and profitability.

-

-

Decision to continue, BOV (DG 2)

- Equivalent to start-up of pre-engineering and concept selection. A cost estimate with reduced uncertainty will be prepared. - Decision to implement, BOG (DG 3)

- The project is in the engineering phase and final approval by the licensees and submission of PDO (if applicable) is planned. The year will mark when the resources are expected to become reserves. This applies regardless of whether the final decision is submission of a PDO, or whether the decision is made in some other manner. The selected year should be realistic, and not merely reflect ambition. Even if the project is in an early study phase, a year must be entered as the best estimate, given certain assumptions. For discoveries/projects that will be phased into a (parent) facility when capacity becomes available, this field can remain blank, if necessary, but a notation should be made in the comments space.

The DG years should be consistent with the resource class for the profile. Example: volumes from wells classified as reserves according to 3.3.1 in the Guidelines, shall have DG1-DG3 when these criteria are met even though DG3 (drilling plan) for individual wells are not yet approved.

Updated: 30/08/2024