Facts and figures

Investments

Significant activity in the industry, a weakened Norwegian currency and growth in costs have resulted in higher projected costs and investments for 2023 and 2024 in particular, compared with what was presented in The Shelf in 2022. Projected investments have also changed for ongoing developments. Several fields report extended lifetimes, which will require increased investments to maintain the facilities' technical integrity. An expectation of increased exploration activity moving forward contributes to growth in exploration investments from 2024.

New investment decisions will be necessary to maintain activity leading up to 2030.

Exploration

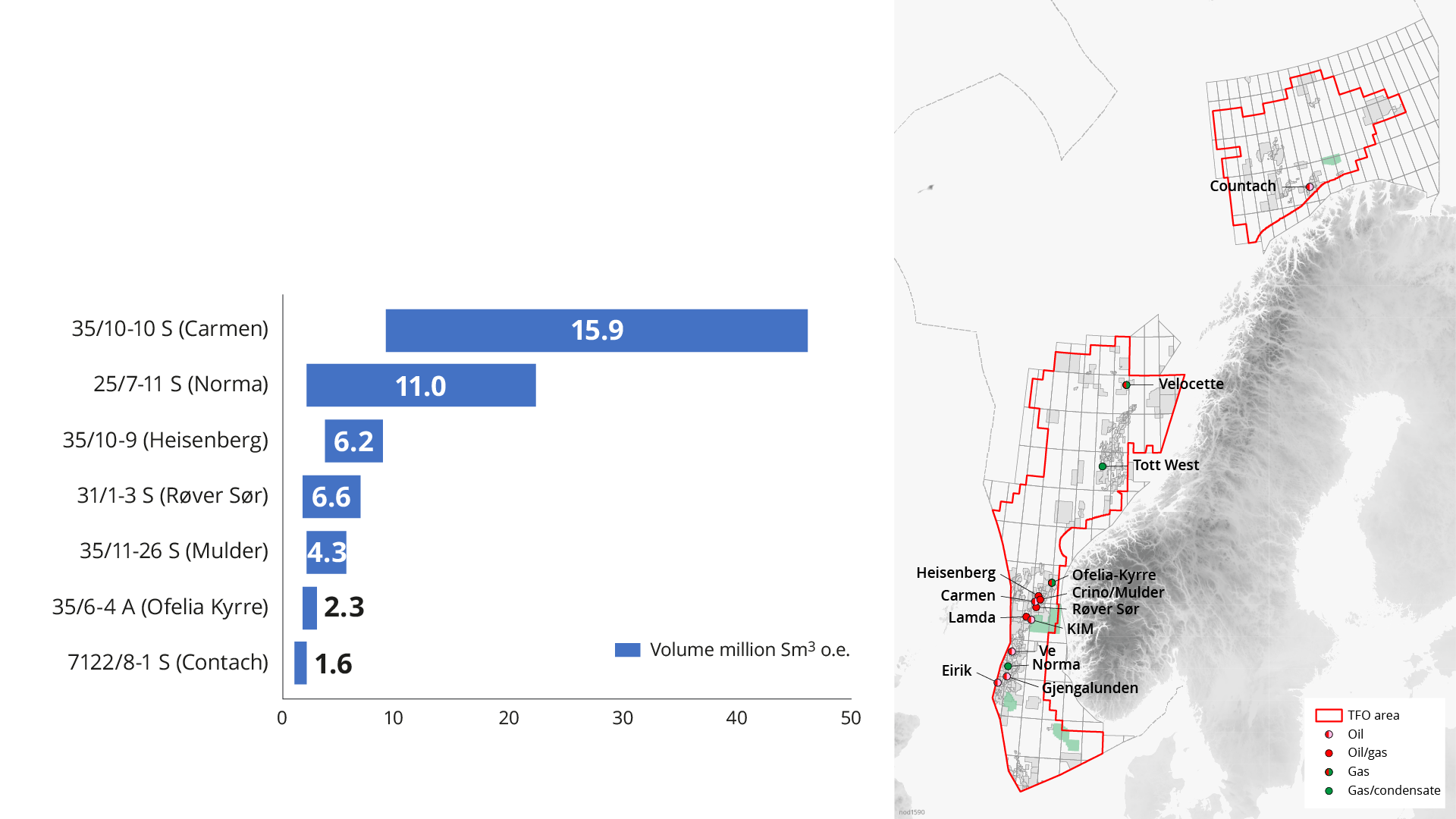

34 exploration wells were spudded in 2023, which is on par with recent years. 14 discoveries were made; 11 in the North Sea, two in the Norwegian Sea and one in the Barents Sea. The largest discovery is 35/10-10 S (Carmen) in production licence 1148. This discovery may contain between 9 and 46 million standard cubic metres (Sm3) of oil. The resource growth from discoveries made in 2023 is about 50 million standard cubic metres of oil equivalent (Sm3 o.e.).

Discovery 2023

|

Ocean area |

Prospect name |

Wellbore |

Production licence |

Operator |

Content |

Size, |

|---|---|---|---|---|---|---|

|

North Sea |

Ve |

919 |

Aker BP |

Oil |

0,5-0,8 |

|

|

North Sea |

Eirik |

817 |

OMV |

Oil |

0,95–5,55 |

|

|

North Sea |

Gjengalunden |

867 B |

Aker BP |

Oil |

0,5-1,4 |

|

|

North Sea |

Lambda |

053 |

Equinor |

Oil and gas |

0,2-0,4/ |

|

|

North Sea |

Crino/Mulder |

090 |

Equinor |

Oil and gas |

1,5-5,5 |

|

|

North Sea |

Heisenberg |

827 S |

Equinor |

Oil and gas |

3,8-13,3 |

|

|

North Sea |

Carmen |

1148 |

Wellesley |

Oil |

9-46 |

|

|

North Sea |

Røver Sør |

923 |

Equinor |

Oil and gas |

2,7-7,4 |

|

|

North Sea |

Norma |

984 |

DNO |

Gas and condensate |

2-21 |

|

|

Norwegian Sea |

Velocette |

1016 |

OMV |

Gas |

0,2-1,8 |

|

|

Norwegian Sea |

Tott West |

255 B |

Equinor |

Gas and condensate |

0,2-1,1 |

|

|

Barents Sea |

Countach |

229 |

Vår Energi |

Oil |

0,5-2,1 |

|

|

North Sea |

Kim |

055 |

Okea |

Oil |

0,2-0,5 |

|

|

North Sea |

Ofelia - Kyrre |

929 |

Neptune |

Gas |

1,8-3 |

*Discoveries were made in two formations, the Eiriksson Formation and the Cook Formation

Exploration results

Discovery rate

Awards in pre-defined areas (APA)

In January 2023, 25 companies were offered ownership interests in a total of 47 production licences in pre-defined areas (APA) 2022.

When the application deadline for APA 2023 expired on 23 August 2023, the authorities had received applications from 25 companies. Offers of ownership interests in new production licences are expected to be made early this year.

Geophysical and scientific surveys

99 commercial geophysical surveys were conducted on the Norwegian shelf in 2023. Eight reported surveys were cancelled.

Six geophysical surveys were conducted in the Barents Sea, three of which were drilling site surveys, two subsurface surveys and one ordinary seismic survey.

19 geophysical surveys were conducted in the Norwegian Sea, 13 of which were drilling site surveys, two subsurface surveys and four ordinary seismic surveys.

74 geophysical surveys were conducted in the North Sea. 68 of these took place under the petroleum regulations, while six took place under the CCS regulations. 38 were drilling site surveys, 15 were subsurface surveys, 16 were seabed seismic surveys and five were ordinary seismic surveys.

33 scientific survey licences were issued, 16 of which to Norwegian institutions.

Production

At year-end 2023-2024, there were 92 fields in operation on the Norwegian shelf. Atla, Flyndre, Heimdal, Skirne and Vale shut down over the course of last year, while Bauge, Breidablikk, Fenja and Tommeliten A came on stream.

Production remains at a high level and will peak in 2025. Johan Castberg is expected to come on stream toward the end of 2024, which will yield significant production growth for 2025.

Oil and gas production is expected to remain stable over the next few years as a result of robust development activity on the shelf. Without new fields or major investments in existing fields, production from the Norwegian shelf will decline. Over the short term, the new fields that come on stream will offset lower production from ageing fields.

A total of approx. 233 million Sm³ of o.e. was produced in 2023 – the equivalent of about four million barrels of o.e. per day, which is around the same level as in 2022 .

Gas pro duction in 2023 came to a somewhat lower level than we expected one year ago. This is primarily caused by unplanned and extended maintenance shutdowns at several onshore facilities and fields. Another part of the explanation is delayed well deliveries and multiple wells not yielding the anticipated production.

The Norwegian Offshore Directorate publishes preliminary production figures on a monthly basis.

The new Regulations relating to fiscal measurement in the petroleum activities (Measurement Regulations) entered into force in May 2023. It replaces Regulation No. 1234 of 1 November 2001 relating to measurement of petroleum for fiscal purposes and for calculation of CO2 tax.

Consent to commencement and continuation

Consent to commencement and continuation for facilities is governed by Section 30a of the Petroleum Regulations. The consent system was delegated to the Norwegian Petroleum Directorate by the Ministry of Petroleum and Energy (now the Norwegian Offshore Directorate and the Ministry of Energy) via a letter of 27 November 2006.

Consents to commencement and continuation issued in 2023

| Field | Consent to | Commencement |

|---|---|---|

| Eldfisk Nord | commencement and continuation – Eldfisk Nord facilities |

Not started |

| Gina Krog | commencement and continuation – Gina Krog power from shore |

Planned for January 2024 |

| Sleipner | commencement and continuation – Gina Krog power from shore | Planned for January 2024 |

| Breidablikk | commencement for Breidablikk | 20 October 2023 |

| Frosk | utilise the installation on Frosk | 13 May 2023 |

| Fenja | commencement for Fenja | 28 April 2023 |

| Tommeliten A | utilise Tommeliten A facilities | 13 October 2023 |

| Hasselmus | commencement and continuation for facilities on Hasselmus | 1 October 2023 |

| Statfjord Øst | commencement and continuation – Statfjord Øst gas lift project | 25 August 2023 |

| Gekko og Kobra | utilise facilities on Gekko and Kobra | 26 October 2023 |

| Bauge | commencement and operation of facilities | 8 April 2023 |

Projects/developments

15/5-2 Eirin was the only plan for development and operation (PDO) submitted in 2023 following the wave of PDOs in 2022. 15/5-2 Eirin is a subsea development in the central part of the North Sea. Resources in 15/5-2 Eirin are estimated at 4.5 million Sm3 of o.e.

The authorities received two applications for PDO exemptions in 2023, for the Brage Cook project on the Brage field and Solan and Ludvig on the Gullfaks Sør field. Both are slated to be developed with wells from existing infrastructure, and both are located in the northern part of the North Sea. Resources in the two projects are estimated at 0.1 and 0.3 million Sm3 of o.e., respectively.

In 2022, the authorities received plans for 13 new developments (PDOs) as well as several plans for projects to improve recovery near existing fields or to secure extended lifetimes. Major investment decisions were also made on existing fields. These plans were approved in 2023.

Plans for development and operation (PDOs)/installation and operation (PIOs) submitted in 2022 and approved in 2023

| Name | Resources, million Sm3 o.e. | Investments stated in PDO/PIO, million 2022-NOK | Commencement stated in PDO/PIO | Development solution |

|---|---|---|---|---|

| Tyrving | 4,1 | 5569 | 2025 | Subsea template |

| Eldfisk Nord | 10,8 | 10272 | 2024 | Subsea template |

| Yggdrasil | 103,1 | 115063 | 2027 | Platform and plants |

| Fenris | 25,4 | 30900 | 2027 | Platform |

| Valhall PWP | 11,1 | 19500 | 2027 | Platform |

| Symra | 5,8 | 9122 | 2027 | Subsea template |

| Halten Øst | 15,2 | 9089 | 2025 | Subsea template |

| Irpa | 21,5 | 14822 | 2026 | Subsea template |

| Maria Fase 2 | 3,4 | 4106 | 2025 | Well |

| Ørn | 9,5 | 6494 | 2027 | Subsea template |

| Alve Nord | 6,8 | 6253 | 2025 | Subsea template |

| Idun Nord | 3,4 | 3839 | 2024 | Subsea template |

| Verdande | 5,7 | 4732 | 2025 | Subsea template |

| Dvalin Nord | 14,3 | 7683 | 2026 | Subsea template |

| Berling | 7,5 | 9054 | 2028 | Subsea template |

| KFL Draugen/Njord | x | 7300 | 2027 | Plants |

| Snøhvit Future Phases 2 | x | 13157 | 2028 | Plants |

Carbon capture and storage (CCS)

Three licences were issued in 2023 pursuant to the Regulations relating to exploitation of subsea reservoirs on the continental shelf for storage of CO2 and relating to transportation of CO2 on the continental shelf. A total of seven licences have been awarded; one exploitation licence and six exploration licences.

Twelve companies are licensees in these licences, nine of which also carry out petroleum activities.

Seabed minerals

The Seabed Minerals Act entered into force on 1 July 2019. This law facilitates exploration for and extraction of mineral deposits on the Norwegian shelf.

The Storting (parliament) is scheduled to make a decision on opening for mineral activities on the Norwegian shelf in early January 2024.

The administrative responsibility for seabed minerals on the Norwegian shelf is assigned to the Ministry of Energy (MoE). The Norwegian Offshore Directorate has assisted the Ministry in conducting the impact assessment and coordinating the academic study efforts.

The Norwegian Petroleum Directorate, now the Norwegian Offshore Directorate, has prepared a resource assessment for the seabed minerals on the Norwegian shelf. The report, which was submitted in January 2023, concludes that there are substantial resources in place.

The Norwegian Petroleum Directorate has been gathering data in deepwater areas in the Norwegian Sea and Greenland Sea along with the University of Bergen and University of Tromsø since 2011. We have also organised several of our own expeditions since 2018.

In 2023, we carried out one expedition on our own, where we mapped areas along the southern part of the Knipovich Ridge in the northern part of the Norwegian Sea with an autonomous underwater vehicle (AUV). We also participated in a joint expedition with the University of Bergen, where we mapped parts of the same area with a remotely operated vehicle (ROV).

In addition, we participated in a joint expedition with the University of Tromsø, where multiple seismic lines were collected over a sulphide deposit on the Knipovich Ridge.

The Storting's potential resolution to open areas for seabed minerals will mean that the licensing authorities will initiate a process to announce and award permits pursuant to the Seabed Minerals Act.

At the same time, we expect the mapping of seabed minerals to continue, which will take place in parallel with potential commercial players. The authorities want a stepwise development and a cautionary approach to the activity, and additional knowledge will be acquired as regards natural and environmental factors.

Offshore wind

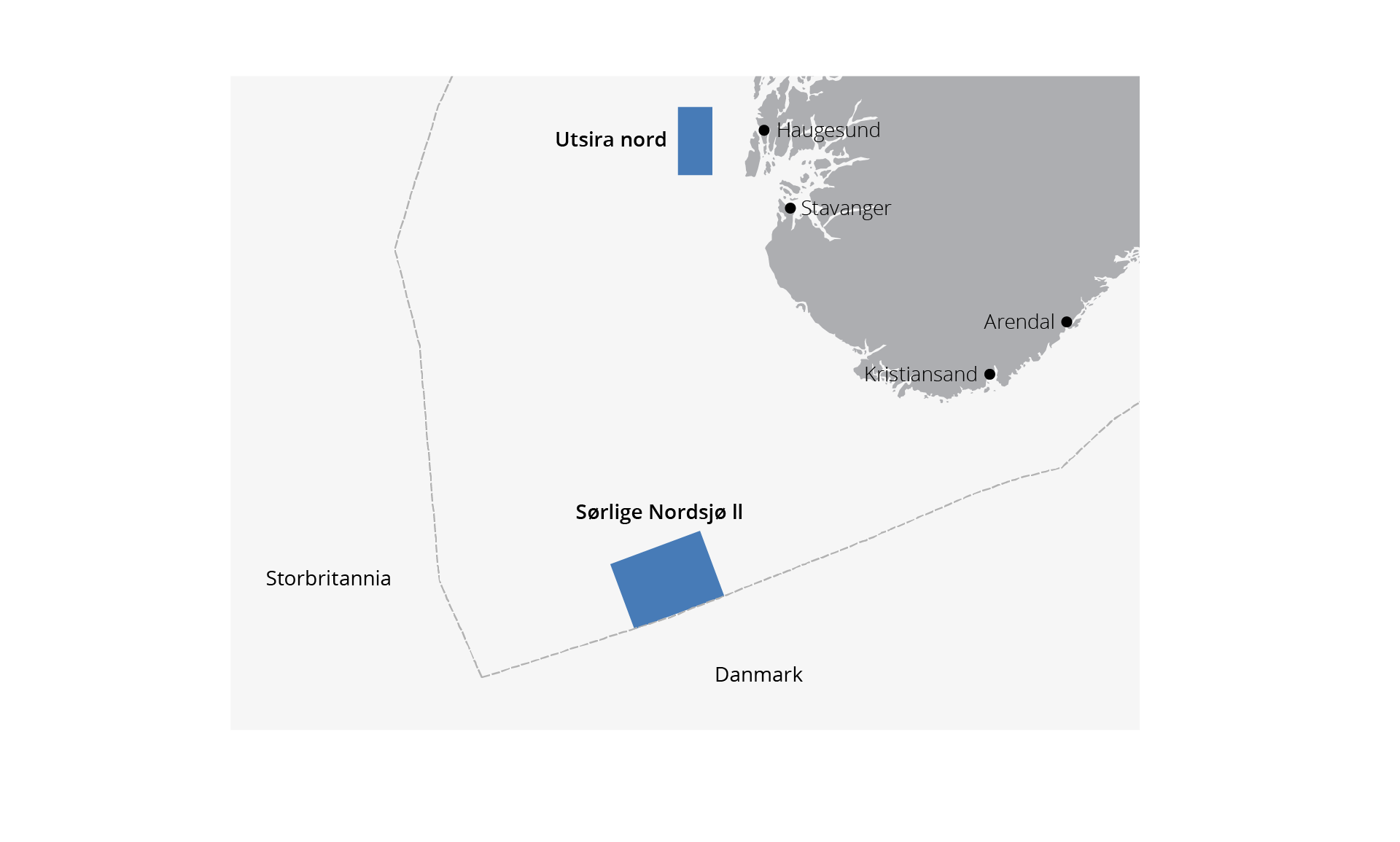

In 2022, the Norwegian Petroleum Directorate was tasked with conducting subsurface surveys in the Utsira Nord and Sørlige Nordsjø II areas, which have been opened for applications for renewable energy generation. The objective is to find the most suitable locations for placing wind turbines.

Seven different measurements are carried out: MBES (multibeam echo sounders) provides key datasets for bathymetry, acoustic backscatter and water column data. We also collect 2D high resolution seismic, sub-bottom profiler (SBP), side scan sonar (SSS), as well as magnetometer data.

The subsurface surveys are set to continue in 2024.

The Norwegian Offshore Directorate has started a process to make this data available to the industry.

We have conducted subsurface surveys in the areas of Utsira Nord and Sørlige Nordsjø II.

In 2023, a broadly composed group established by the Directorate identified 20 areas on the Norwegian shelf that could be technically suitable for further development of offshore wind, and where the activity is expected to be suitable for coexistence with other industries.

The NPD has provided technical contributions in this process, which has been spearheaded by the Norwegian Water Resources and Energy Directorate (NVE).

Data management

The Norwegian Offshore Directorate is responsible for collecting, storing and publishing data from the Norwegian shelf.

n 2023, the consultancy Menon Economics assessed the gains derived from the Norwegian Petroleum Directorate's data sharing activities, and concluded that the data sharing contributes to annual gains in time and resources saved for licensees in the order of NOK 1.5 billion.

Section 85 of the Petroleum Regulations was amended as of 1 January 2023. These Regulations govern the duration of confidentiality for geological, technical reservoir and production/injection aspects in reports or other materials submitted to the public authorities.

The duration of confidentiality for interpreted data has been shortened from 20 to 5 years (this will apply in full as of 2028). Interpreted data from relinquished areas/licences can be released after one year. This change has resulted in about 6000 data sets being released in 2023. The vast majority of this data is available in Diskos.

Diskos 2.0 was launched in April 2023. Diskos is the national data repository for exploration and production-related information from the Norwegian shelf. All seismic, well and production data reported to the Norwegian Petroleum Directorate is uploaded to Diskos.

Diskos is now in the cloud. Several automated processes and API integration allow for new opportunities and ways to use Diskos data.

Technology

Our technology strategy places particular emphasis on technology areas we believe will be crucial for the Norwegian shelf moving forward. It also deals with measures to be implemented.

Our primary focus is on technologies that can contribute to discovering more, producing more and reducing emissions, and that licensees in the production licences make them a high priority. We believe we can see the impact of our initiatives in three distinct areas; electrical subsea systems, a pilot for injecting low salinity water, and we're generally seeing more companies focusing on potentials in tight formations.

This strategy was the basis for the topics at the NPD's 2023 Technology Day, which was primarily aimed at companies engaged in activities associated with oil and gas on the Norwegian shelf. The 2024 Technology Day will be held in June.

Emissions

Emissions from petroleum activities come from the combustion of natural gas and diesel in turbines, motors and boilers, from safety flaring of natural gas, venting and fugitive emissions of gas, as well as from the storage and loading of crude oil.

Emissions from the sector are expected to decline somewhat per produced unit over the next few years. This is due to the companies' emission-reducing projects, which are mainly transitioning from local power supply to power from shore.

Updated: 15/01/2024