Production, operating fields and investments

Investment levels remain high on the shelf

Gas production reached a new record in 2024, and the investment level remains high. Several new development plans are expected over the next few years. Most will be small developments tied back to existing infrastructure.

Read about:

- Record-high gas production

- Investments remain high

- Awards in pre-defined areas (APA)

- Several projects and developments are expected

- Production start-up and continuation

- Emissions are coming down

Record-high gas production

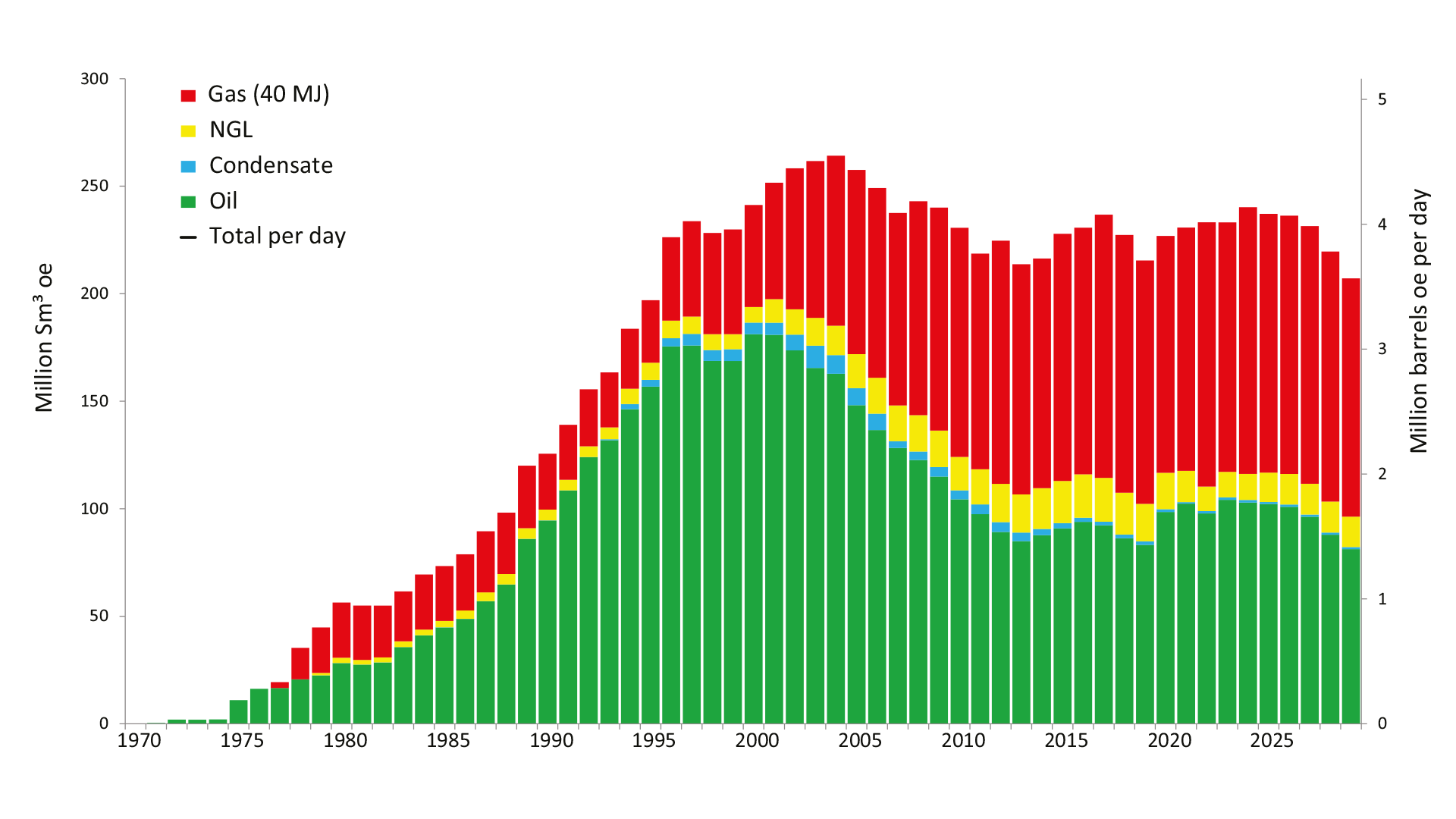

Gas production from the NCS reached a record-high level in 2024. A total of 124 billion standard cubic metres (Sm3) was sold. In comparison, the previous record of 122.8 billion Sm3 of gas was set in 2022. The high production in 2024 was caused by high regularity on the fields and increased capacity following upgrades in 2023.

Gas constitutes more than half of all production on the shelf. Most of the oil and gas is exported to Europe.

Overall production will remain at a high and stable level. In 2024, it reached about 240 million standard cubic metres of oil equivalent (MSm3 o.e.). This is the highest level since 2009. Production from the Troll and Johan Sverdrup fields in the North Sea contributes about 37 per cent of overall production from the NCS.

High and stable total production

Production on the shelf is expected to remain at a stable, high level over the next two-to-three years, and will then gradually decline towards the end of the 2020s.

At year-end 2024, there were 94 fields in operation on the Norwegian shelf. The Hanz and Tyrving fields in the North Sea came on stream, and no fields were shut down over the previous year.

The Castberg field in the Barents Sea is expected to come on stream in the first quarter. This will be important for oil production and further development of the Barents Sea as a petroleum province. Several new fields are expected to come on stream over the next few years, but many will also shut down.

Some previously shut-down fields are now being considered for redevelopment with a simpler development solution.

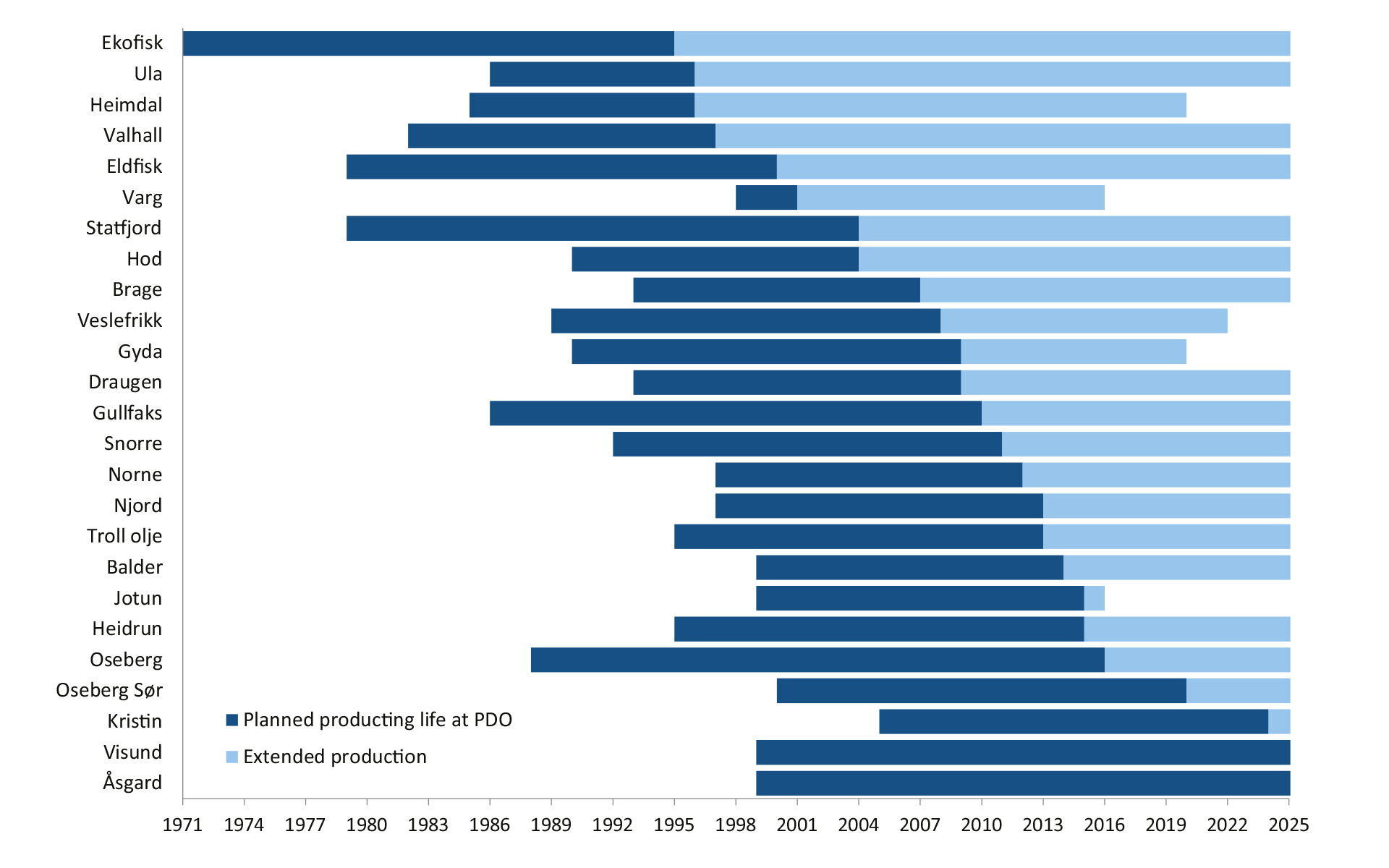

One important reason why production remains at such high levels is that the fields are producing for longer than originally planned. New and improved technology has allowed us to continuously improve our understanding of the subsurface. This has enabled the industry to further develop the fields. New development projects, more production wells and exploration in the surrounding area have helped extend the lifetimes of most fields.

The figure below shows a number of fields that are producing between 10 and 30 years longer than originally planned. Several of these fields will continue to produce until 2030, and some even to 2040. This provides a significant contribution to production and value creation on the shelf.

The Norwegian Offshore Directorate publishes preliminary production figures on a monthly basis.

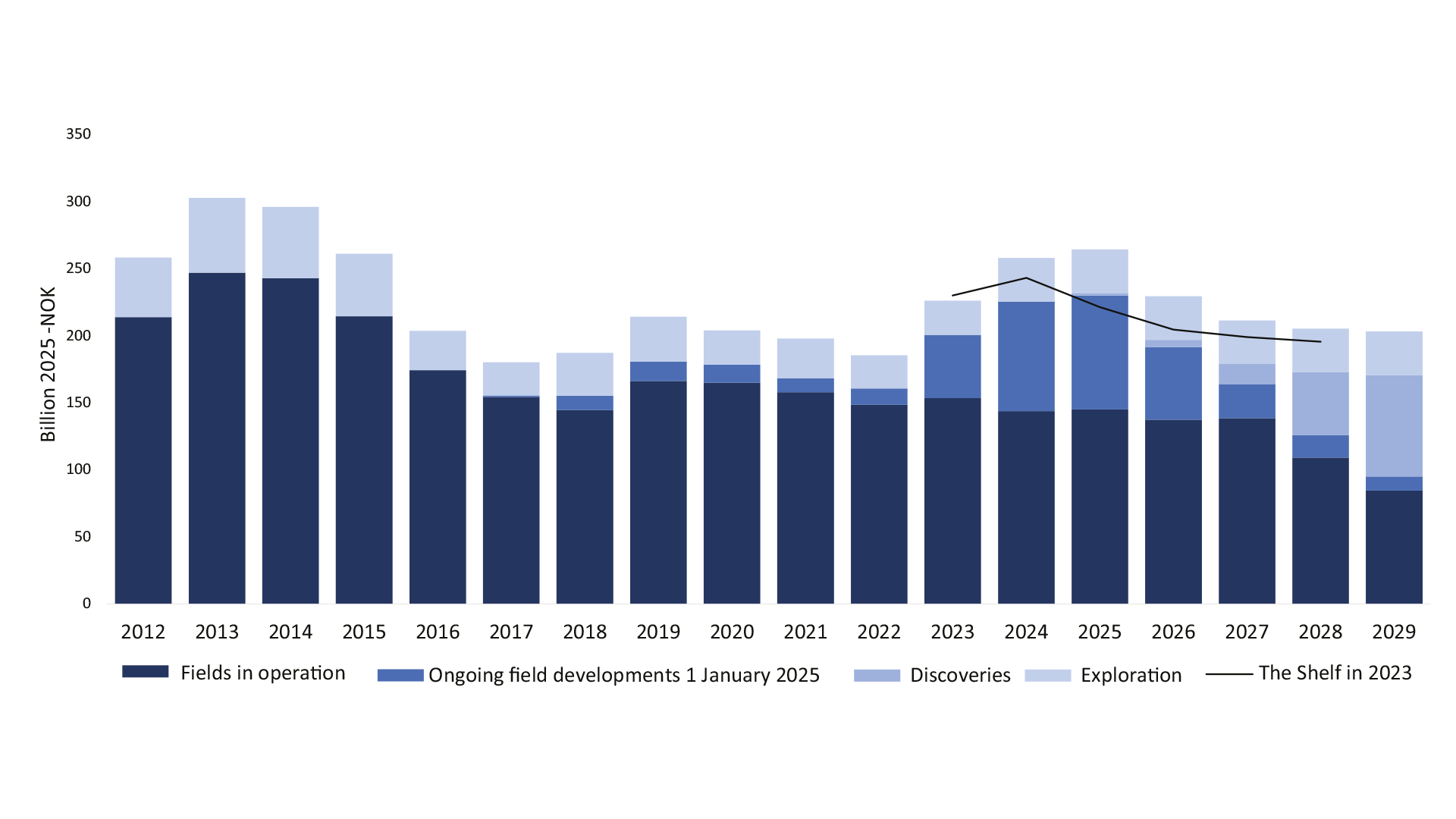

Investments remain high

In 2025, the Norwegian Offshore Directorate is expecting investments on the NCS totalling NOK 264 billion. This is an increase of 2.5 per cent from the previous year.

Significant activity and scarce capacity in parts of the supplier industry, a weakened Norwegian currency and growth in costs have led to higher cost and investment projections for 2024–2026 in particular, compared with what was presented at the end of 2023. Higher drilling costs per development well also contributes to a higher level of investment.

Projected investments for certain ongoing developments have also increased (Norwegian only) (Prop. 1 S, 2024 –2025, pdf).

We expect exploration activity and exploration costs to remain about the same as in 2024.

Measures to reduce emissions and discharges from petroleum activities on the NCS account for a substantial share of the investments leading up to 2030.

Despite the high level of activity in the industry, new investment decisions will be necessary to maintain activity in the future.

Awards in pre-defined areas (APA)

In January 2024, 24 companies were offered ownership interests in a total of 62 production licences in the Awards in pre-defined areas (APA) 2023.

When the application deadline expired on 3 September, the authorities had received applications from 21 companies. In other words, all current licensees on the NCS have applied. This shows that the shelf remains an attractive province for exploration and long-term production. Offers of ownership interests in new production licences are expected to be made early this year.

Several projects and developments are expected

The Plan for development and operation (PDO) for the Eirin field, which is located in the Sleipner area in the North Sea, was submitted in 2023 and approved in 2024. Investments in the project are estimated at about 4.2 billion 2024-NOK.

The Plan for development and operation (PDO) for the Bestla field, which is located in the Oseberg area, was approved in November 2024. Total projected investments are NOK 6.3 billion.

Several new development plans are expected over the upcoming years. Most of these are relatively small discoveries that are being developed with subsea templates or wells from existing subsea templates and tied back to existing infrastructure.

22 development projects or field developments with approved development plans were under way on the NCS at year-end (Norwegian only) (Prop. 1 S, 2024 –2025, pdf). Nine of the projects are in the North Sea, 11 in the Norwegian Sea and 2 in the Barents Sea. These projects will help keep the investment level high and slow the underlying decline in production over the next decade. Additional development projects will also help extend lifetimes and thereby lead to improved recovery from existing fields.

The largest undeveloped discoveries are 7324/8-1 (Wisting) in the Barents Sea, 6406/9-1 (Linnorm) in the Norwegian Sea and 35/2-1 (Peon) in the North Sea. (see chapter "Resources and challenges in discoveries"). These discoveries are all being considered for development and could contribute considerable resources and values over the next few decades.

Production start-up and continuation

The consent system (pdf) is how the authorities follow up to ensure that licensees conduct their activities in line with the regulations and previous decisions. The consent entails a verification to the effect that assumptions in the Plan for development and operation (PDO), Plan for installation and operation (PIO) and disposal decisions are fulfilled.

The table below shows consents for start up and continuation issued in 2024.

| Field | Consent to | Commencement |

| Troll | Commencement power from shore to Troll Vest | 7 September 2024 |

| Åsgard | Commencement Smørbukk Nord | 28 November 2024 |

| Hanz | Commencement/utilise Hanz facilities | 20 April 2024 |

| Kristin | Commencement and continuation of Kristin Sør | 7 July 2024 |

| Tyrving | Commencement and operations | 2 September 2024 |

| Johan Castberg | Commencement and continuation | First quarter 2025 |

Emissions are coming down

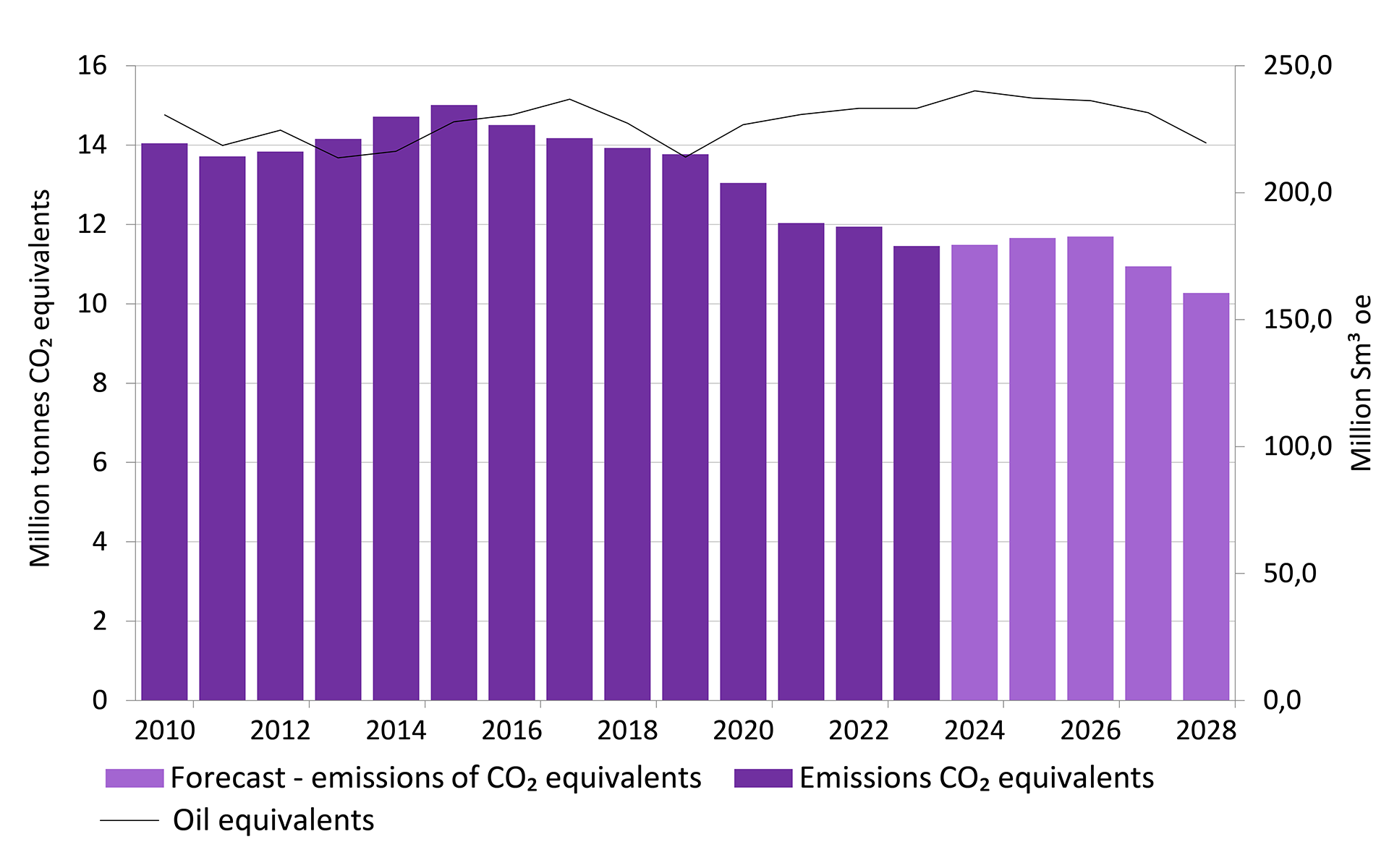

CO2 emissions from petroleum activities on the NCS have been on the decline since 2015, despite relatively stable production. This is mainly caused by transitioning power solutions to power from shore.

Three projects were under development in 2024 leading up to a potential decision on power from shore. These projects cover the Tampen area and the Balder and Grane fields in the North Sea, as well as the Halten area in the Norwegian Sea, where Heidrun will serve as a hub for multiple platforms.

Emissions per produced unit are expected to decline somewhat over the next few years, despite the slight increase in production over the short term.

The emissions are derived from the combustion of natural gas and diesel in turbines, motors and boilers, from safety flaring of natural gas, venting and fugitive emissions of gas, as well as from the storage and loading of crude oil.

The figure below is based on data from the national budget 2015.

Download: Background data (Excel)